Unlock Digital Due Diligence: Boost M&A Success

Published: April 29, 2025Why Digital Due Diligence Transforms Modern M&A

In the complex world of mergers and acquisitions, relying solely on traditional financial due diligence is no longer sufficient. While financials are still important, they don’t tell the whole story. To truly understand a target company’s value and potential risks, digital due diligence is essential.

Digital due diligence expands the assessment beyond financial statements to include a company’s digital presence and infrastructure. This includes websites, social media, technology systems, cybersecurity practices, and data privacy protocols. It provides a more holistic view of the target company’s digital health.

For instance, consider acquiring an e-commerce company with seemingly healthy financials. Traditional due diligence might show strong revenue and a large customer base. However, digital due diligence could reveal hidden vulnerabilities, such as outdated software with security flaws, insufficient data protection measures, or declining social media engagement.

These overlooked digital risks can significantly impact the acquisition’s value. Conversely, digital due diligence can also uncover hidden opportunities. A strong digital marketing strategy, a loyal online community, or proprietary software can represent significant untapped value.

Why Digital Due Diligence Matters

Identifying these digital assets allows for a more accurate valuation and informs post-acquisition integration. A Deloitte report from 2022 found that companies performing thorough digital due diligence experienced an average revenue uplift of 15% post-transaction. This underscores the importance of assessing a company’s digital assets, cybersecurity, and digital strategy during M&A. You can find more statistics on the impact of digital due diligence here.

Ultimately, digital due diligence transforms modern M&A by:

- Uncovering Hidden Risks: Identifying cybersecurity vulnerabilities, data privacy issues, and technology infrastructure weaknesses often missed by traditional due diligence.

- Identifying Untapped Value: Recognizing digital assets and capabilities that can fuel growth and increase profitability.

- Improving Negotiation Leverage: Providing a comprehensive understanding of the target company to help acquirers negotiate better deal terms.

- Facilitating Smooth Integration: Enabling a more strategic integration process by offering a clear picture of the target company’s digital landscape.

This proactive approach avoids costly surprises after the acquisition and sets the stage for long-term success. Integrating digital due diligence into the M&A process allows businesses to gain a competitive advantage and maximize the value of their transactions.

The Six Pillars of Effective Digital Due Diligence

Smart acquirers are going beyond simple technical checks. They’re using a strong system to assess a company’s digital health during digital due diligence. This involves a thorough examination of six essential parts. These parts work together to present a full view of the target company’s digital strengths and weaknesses.

This goes deeper than just knowing what technologies a company uses. It’s about knowing how those technologies are managed, secured, and used to generate value. Simply having an e-commerce platform isn’t enough. Understanding its architecture, security, and performance is crucial. A comprehensive evaluation also looks at the target company’s digital marketing success, data privacy methods, and the team leading its digital operations. This detailed approach helps avoid costly surprises after an acquisition.

Technology Infrastructure Evaluation

This pillar looks at the core technology a business runs on. It checks the stability, scalability, and how easy it is to maintain the target company’s systems. This involves assessing the hardware, software, network structure, and any cloud services used.

For instance, an acquirer might check the age and efficiency of servers, how much the company depends on older systems, and how adaptable the technology is to future market needs.

Cybersecurity Posture Assessment

Solid cybersecurity is critical. This assessment finds vulnerabilities and risks within the target company’s digital world. It involves examining security procedures, plans for responding to incidents, and data protection actions.

It’s crucial to grasp how well the company protects sensitive information and defends against cyberattacks. This often includes penetration testing and vulnerability scans to find weak points.

Digital Marketing Effectiveness Analysis

This pillar looks closely at how well digital marketing performs. It analyzes website traffic, search engine optimization (SEO) methods, social media engagement, and the overall return on investment (ROI) of marketing.

A strong digital marketing presence can significantly add to a company’s value, while a weak one might need substantial investment after acquisition.

Data Privacy Compliance Review

Data privacy is a major concern for businesses and consumers. This review ensures the target company follows data privacy rules. This covers regulations like GDPR, CCPA, and other laws.

Failing to comply can result in hefty fines and damage a company’s reputation. This is a key area of focus. Digital due diligence now includes several assessments, such as cybersecurity practices, digital marketing, data privacy compliance, and technology infrastructure. According to industry analyses, over 70% of investors and acquirers see comprehensive digital due diligence as essential in deals, showing how important digital assets are in valuing a business. Find more information about digital due diligence statistics here.

Software and IT Systems Auditing

This audit goes deep into the target company’s software licenses, IT systems, and development methods. It confirms the company owns the right licenses and follows best practices for software development and maintenance.

It also looks at technical debt, how well systems are documented, and how scalable the IT setup is for future growth.

Digital Talent Capability Assessment

This final pillar evaluates the digital team’s skills and expertise. It assesses the abilities of developers, designers, marketers, and other digital professionals. A company’s digital success relies on its people.

This involves studying the team’s structure, experience, and capacity to innovate and adapt.

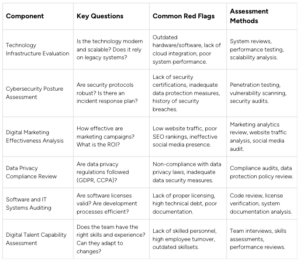

To summarize the key areas evaluated during digital due diligence, let’s examine the table below:

Core Components of Digital Due Diligence

A comprehensive overview of the key areas to evaluate during digital due diligence processes

This table provides a framework for assessing a company’s digital maturity and potential risks. Addressing these components effectively can significantly reduce post-acquisition challenges and ensure a smooth transition.

Navigating the Regulatory Maze in Digital Assessments

Successfully navigating regulatory requirements is a crucial part of effective digital due diligence. This means understanding relevant data protection laws, cybersecurity requirements, and any industry-specific regulations. Overlooking these areas can expose companies to significant risks, including financial penalties and damage to their reputation. A proactive approach to compliance is not just a best practice; it’s essential for protecting investments and achieving long-term success.

Key Regulatory Areas in Digital Due Diligence

Several key regulatory areas require careful examination during digital due diligence.

- Data Privacy: Regulations like the GDPR and CCPA set strict rules for how personal data is collected, processed, and stored. Failure to comply can result in substantial fines and legal battles. Verifying adherence to these regulations is critical during due diligence. This involves reviewing data governance policies, security measures, and consent protocols.

- Cybersecurity: A strong cybersecurity posture is vital for protecting sensitive information and ensuring business operations can continue uninterrupted. Frameworks like the NIST Cybersecurity Framework and ISO 27001 offer guidelines for establishing effective security controls. Digital due diligence should evaluate the target company’s cybersecurity framework, incident response plans, and how they manage vulnerabilities.

- Industry-Specific Regulations: Certain industries face unique regulatory requirements. Financial institutions, for instance, must comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Healthcare organizations must adhere to HIPAA regulations regarding patient health information. Digital due diligence must be adjusted to account for these industry-specific obligations.

Identifying and Addressing Compliance Gaps

Digital due diligence aims to uncover potential compliance gaps early in the acquisition process. These gaps can range from inadequate data security to using outdated software that no longer meets regulatory standards. After identifying these gaps, it’s vital to assess the financial implications. Remediation might require significant investments in technology upgrades, staff training, or process improvements. These costs must be included in the deal valuation.

The European Union’s Corporate Sustainability Due Diligence Directive (CSDDD), adopted in May 2024, represents a significant regulatory shift. It will reshape how large corporations globally approach sustainability due diligence. Businesses subject to the CSDDD will need to use digital tools and data analytics to track and manage risks. Learn more about the impact of CSDDD on due diligence here.

Turning Regulatory Challenges into Opportunities

While regulatory compliance may appear challenging, it also presents opportunities. By proactively addressing compliance issues, acquirers can reduce risks, build trust with stakeholders, and potentially achieve a competitive edge. Demonstrating a solid commitment to data privacy can strengthen a brand’s reputation and attract customers. Implementing strong cybersecurity measures protects against costly data breaches and interruptions to business operations. This means regulatory compliance can be a significant driver of long-term value creation. By integrating regulatory considerations into each phase of digital due diligence, companies can not only protect their investments but also position themselves for continued success in a dynamic regulatory environment.

The Digital Due Diligence Tech Stack That Actually Works

Evaluating a company’s digital health during an acquisition goes beyond basic spreadsheets and checklists. It demands the right digital due diligence tech stack. This section explores the essential tools successful acquirers use to gain efficient and effective digital insights. These tools span from specific cybersecurity platforms to sophisticated data analytics, dramatically reducing the time and effort needed for a thorough analysis.

Cybersecurity Assessment Platforms

Cybersecurity vulnerabilities present significant financial and reputational risks. Specialized cybersecurity assessment platforms automate vulnerability scanning, penetration testing, and security audits. These often integrate with current security information and event management (SIEM) systems for comprehensive threat analysis.

These platforms pinpoint weaknesses in network security, application security, and data protection, allowing for proactive remediation. This helps address vulnerabilities before they can be exploited.

Some tools specialize in finding specific vulnerabilities. For example, some identify SQL injection vulnerabilities, while others focus on cross-site scripting (XSS) flaws). Choosing the right tool depends on the specific industry and the target company’s technology.

Data Analytics Tools for Marketing and Sales

Understanding a target company’s digital marketing effectiveness is crucial for valuing its future potential. Data analytics tools provide valuable insights into website traffic, SEO performance, social media engagement, and marketing campaign effectiveness.

This data helps determine the true return on investment (ROI) of marketing spending and identify areas for improvement. Analytics platforms can also track conversion rates, customer lifetime value, and the most profitable marketing channels. This data-driven method provides clarity beyond basic metrics.

Compliance Scanning Technologies

Maintaining compliance with evolving data privacy and cybersecurity regulations is a significant undertaking. Compliance scanning technologies automate the process of checking for compliance with regulations like GDPR and CCPA. These tools scan websites, applications, and data storage for potential violations.

This automation saves time and reduces the risk of costly fines. These tools also provide real-time monitoring and alerts. This ensures ongoing compliance even as regulations change, particularly important in sectors like finance and healthcare.

Infrastructure Evaluation Solutions

Evaluating a company’s IT infrastructure is crucial for finding potential technical debt and scalability problems. Infrastructure evaluation solutions analyze network architecture, server performance, cloud usage, and software dependencies.

These solutions can pinpoint outdated systems, potential bottlenecks, and modernization opportunities. For example, if a target company uses legacy systems, these might be difficult and costly to integrate and maintain after the acquisition. Infrastructure evaluations reveal such issues early in the due diligence process.

Cost-Benefit Tradeoffs and Human Expertise

While these tools offer powerful features, expert analysis is still essential. Experienced professionals should interpret the findings, consider specific factors, and investigate further when needed. There are always cost-benefit tradeoffs. Not every tool is necessary for every transaction.

The chosen tools should align with the deal size, the industry, and the target company’s digital operations. By combining the right technology with expert analysis, acquirers can efficiently evaluate the digital health of target companies. This leads to informed decisions that protect investments and maximize deal value. Solutions like Blackbird, offered at blackbrd.co, help financial firms manage compliance, automating due diligence and improving collaboration.

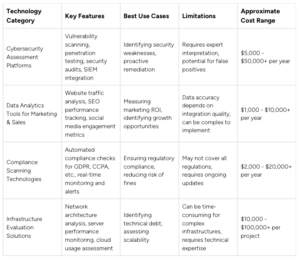

Before diving into the table below, remember it provides a snapshot of key digital due diligence tools currently available. It aims to guide your selection process based on common use cases and cost considerations.

This table highlights the diverse range of tools available, each catering to specific due diligence needs. While cost is a factor, selecting the right tool based on its features and your specific use case is crucial. Remember, the most expensive tool isn’t always the best fit. Consider your specific needs and budget to make the most informed decision.

Building Your Digital Due Diligence Playbook

Moving away from ad-hoc digital assessments is crucial for successful Mergers and Acquisitions (M&A). This section provides a framework for building a customized digital due diligence playbook to deliver reliable results. By learning from seasoned M&A professionals, we’ll examine proven strategies for assembling the right technical experts, developing detailed checklists, setting clear evaluation standards, and integrating digital findings with the broader deal process.

Assembling the Right Team

Effective digital due diligence demands specialized skills. Building a team with expertise in cybersecurity, data analysis, software engineering, and legal compliance is essential. This team must not only possess technical knowledge but also understand the business implications of their discoveries. It’s similar to assembling a specialized surgical team – each member plays a vital, specific role.

- Cybersecurity Experts: Identify and evaluate security vulnerabilities.

- Data Analysts: Examine website traffic, marketing data, and customer behavior.

- Software Engineers: Assess code quality, technical debt, and system architecture.

- Legal Counsel: Address data privacy, compliance, and intellectual property matters.

Developing Comprehensive Checklists

Checklists ensure a systematic approach to digital due diligence, preventing crucial areas from being overlooked. These checklists should be tailored to the specific industry and the target company’s business model. For example, a checklist for a Software as a Service (SaaS) company will differ significantly from that of a manufacturing company. A comprehensive checklist should consider:

- Technology Infrastructure: Evaluate the age and scalability of systems.

- Cybersecurity: Assess security protocols, incident response plans, and data protection measures.

- Data Privacy: Verify compliance with the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and other pertinent regulations.

- Digital Marketing: Analyze website traffic, Search Engine Optimization (SEO) performance, and social media presence.

Establishing Clear Evaluation Criteria

Define specific criteria for evaluating the results of the digital due diligence process. This includes setting thresholds for acceptable risk levels and defining metrics for measuring the value of digital assets. For example, a company may define an acceptable level of technical debt or a target for website traffic growth. These criteria help facilitate informed decisions about the acquisition.

This step clarifies what constitutes a significant risk and helps prioritize areas requiring further investigation or negotiation. It’s akin to establishing a budget – you set clear limits to guide your spending choices.

Integrating Digital Findings with Other Workstreams

Digital due diligence should not operate in isolation. It’s essential to integrate the findings with other due diligence workstreams, such as financial and legal due diligence. This holistic perspective provides a more complete picture of the target company.

For example, digital marketing findings can be integrated with financial projections for more accurate valuation. Similarly, cybersecurity vulnerabilities can inform legal negotiations related to risk allocation. This interconnected approach enhances the overall due diligence process.

Timelines, Resources, and Communication

Create a realistic timeline for the digital due diligence process, accounting for the deal size and complexity. Allocate sufficient resources to ensure a thorough assessment. Finally, establish transparent communication protocols to keep stakeholders informed throughout the process.

Communicating technical findings effectively with non-technical stakeholders requires clear and concise language. Translating intricate concepts into actionable business insights ensures everyone grasps the implications of the digital due diligence findings. Streamlining this process makes digital due diligence a key instrument for M&A success. Tools like Blackbird offer solutions to streamline due diligence, automating compliance workflows and improving collaboration for financial firms, leading to a more efficient and insightful process.

Digital Due Diligence Success Stories and Horror Tales

Theory and frameworks provide a solid foundation, but real-world examples truly illuminate the importance of digital due diligence. This section explores anonymized case studies, showcasing both the successes and the failures of digital assessments in Mergers and Acquisitions (M&A). These narratives, spanning various industries from Software as a Service (SaaS) to manufacturing to retail, offer practical lessons applicable across any sector.

A Cybersecurity Victory

In one instance, an acquirer was evaluating a promising SaaS company. Traditional due diligence presented a positive outlook, with healthy financials and a growing customer base. However, the digital due diligence process, conducted by cybersecurity experts using specialized assessment platforms, revealed a critical vulnerability. This vulnerability existed within the target company’s data encryption protocols and was missed by traditional methods. The discovery saved the acquirer millions in potential liability from future data breaches. Moreover, addressing the vulnerability pre-acquisition strengthened the company’s security posture and fostered customer trust.

This case highlights the crucial role of a robust cybersecurity assessment, a cornerstone of effective digital due diligence. Tools like Blackbird automate compliance workflows, which can significantly improve due diligence efficiency.

The Hidden Marketing Fraud

Another case involved a retail company acquisition. The target company boasted impressive online sales figures and a strong digital marketing strategy. However, a thorough examination of their marketing analytics during digital due diligence uncovered a significant problem. A large portion of their online traffic was generated fraudulently, artificially inflating their performance metrics. This discovery significantly impacted the acquisition valuation and prevented the acquirer from a costly overpayment.

This emphasizes the critical role of data analytics tools in uncovering hidden issues within digital marketing data. Relying solely on reported figures would have led the acquirer to a drastically different post-acquisition outcome.

Missed Opportunities in Manufacturing

Not all stories are about averted disasters. In one instance, an acquirer overlooked the digital transformation potential of a manufacturing company. By focusing primarily on traditional financial metrics, they underestimated the value of the target company’s developing Industrial Internet of Things (IIoT) initiatives. A competitor, recognizing this untapped digital value through comprehensive digital due diligence, acquired the company. They capitalized on the IIoT opportunity and gained a significant competitive advantage.

This case demonstrates that digital due diligence not only uncovers hidden risks but also reveals hidden opportunities. A comprehensive assessment, encompassing all aspects of digital due diligence, is vital for maximizing deal value.

Key Takeaways From These Tales

These stories offer valuable lessons:

- Thoroughness is Key: Superficial digital assessments can overlook crucial details that significantly affect deal value.

- Specialized Expertise Matters: Employing experts in cybersecurity, data analysis, and other digital disciplines is essential.

- Integrate Findings: Connect digital insights with other due diligence streams for a comprehensive overview.

- Technology Enhances but Doesn’t Replace Human Expertise: While tools can automate aspects of digital due diligence, expert interpretation and analysis remain crucial.

These real-world examples emphasize the practical impact of digital due diligence. By learning from both successes and failures, businesses can refine their own approaches and make more informed decisions in the complex world of M&A. For more insights on streamlining due diligence processes, explore the solutions offered by Blackbird.

The Future of Digital Due Diligence: Stay Ahead of the Curve

While some organizations still focus on current digital assessment practices, forward-thinking acquirers are already looking ahead. This section explores emerging trends reshaping digital due diligence, from AI-powered assessments to evaluating the resilience of digital business models. We’ll examine how top firms incorporate digital sustainability metrics, adapt to evolving cybersecurity threats, and assess the potential for digital transformation.

AI-Powered Automation: The Next Frontier

Artificial intelligence (AI) is changing the face of digital due diligence. AI-powered tools can automate time-consuming tasks like document review and data extraction. This allows human analysts to focus on higher-level insights and strategic decision-making.

For example, AI algorithms can scan thousands of contracts to identify key clauses and potential risks much faster than any manual review. This increased efficiency leads to quicker deal closures and more informed investment decisions.

Additionally, AI can analyze large datasets to identify patterns and anomalies that human analysts might miss. This is particularly helpful in areas like marketing analytics and cybersecurity, where enormous amounts of data require analysis. This capability empowers businesses to make data-driven decisions, minimizing risks and maximizing deal value.

Digital Sustainability: A Growing Priority

As environmental, social, and governance (ESG) concerns become more important, digital sustainability is becoming a key factor in digital due diligence. Investors are increasingly examining a company’s environmental impact, including its data center energy consumption.

For example, the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) now requires companies to assess and mitigate sustainability risks across their value chains. This new regulatory landscape requires companies to incorporate digital sustainability metrics into their due diligence procedures. Leading firms are already adapting by developing frameworks for measuring and managing their digital sustainability performance.

This trend underscores the importance of incorporating sustainability considerations into investment decisions. Companies with strong digital sustainability profiles are more attractive to investors and better positioned for long-term success.

Cybersecurity in a Dynamic Threat Landscape

Cybersecurity threats are constantly changing, and companies must adapt their due diligence strategies accordingly. As cyberattacks become more complex, thorough assessments of a target company’s security posture are crucial. This includes evaluating incident response plans, data protection measures, and overall system resilience.

For example, businesses should assess a target company’s ability to withstand ransomware attacks and recover from data breaches. This proactive approach is vital for mitigating the risk of costly cyber incidents and protecting sensitive information. Companies must stay informed about emerging threats to protect their investments and their reputation.

Building Adaptable Frameworks for the Future

The rapid pace of technological advancement requires adaptable digital due diligence frameworks. These frameworks should be designed to accommodate new technologies and assessment methodologies.

For instance, as new data privacy regulations emerge, due diligence checklists should be updated. This continuous improvement ensures that the process remains relevant and effective. Building adaptable frameworks is essential for long-term success in digital due diligence, allowing companies to remain agile and responsive to future changes.

Blackbird transforms KYC and investor onboarding, automating compliance workflows and reducing manual effort. Our solution accelerates due diligence with seamless data collection, automated document verification, and AI-driven classification. Learn more about how Blackbird can enhance your digital due diligence at https://blackbrd.co.