Transform Your Regulatory Change Management Process

Last Revised: May 6, 2025Why Effective Regulatory Change Management Matters Now

Regulatory compliance is no longer optional but a core business requirement. Many organizations, especially in finance, healthcare, and education, find it challenging to keep pace with the constantly evolving regulatory landscape. This difficulty often arises from reactive compliance approaches—treating it as a checklist instead of a strategic process. This reactive approach can leave organizations scrambling, creating vulnerabilities and exposing them to substantial risks.

However, forward-thinking organizations are turning this challenge into a strategic opportunity through robust regulatory change management processes.

A proactive regulatory change management process is essential for a successful compliance program. This means anticipating and preparing for regulatory changes before they affect operations. The importance of regulatory change management (RCM) is particularly apparent in sectors like finance, healthcare, and education.

As of March 2025, these industries are increasingly prioritizing proactive RCM to quickly address new compliance obligations. Explore this topic further This shift is driven by the severe consequences of non-compliance, including significant financial penalties and lasting reputational damage. For instance, financial institutions have faced billions of dollars in fines for non-compliance, a stark reminder of the cost of falling behind. Effective RCM involves tracking regulatory updates, assessing their impact, and implementing necessary changes to policies and systems. Crucially, it also means incorporating change management best practices for improved outcomes.

The Real Cost of Non-Compliance

The costs of non-compliance go far beyond financial penalties. Reputational damage, erosion of customer trust, operational disruptions, and legal battles can severely impact an organization. Furthermore, the resources needed to address compliance failures can strain budgets and divert focus from core business goals. For example, a data breach resulting from insufficient security measures (a compliance failure) can lead to regulatory fines and substantial costs related to data recovery, customer notifications, and public relations efforts to rebuild trust.

Turning Compliance Into a Competitive Edge

Leading organizations are recognizing that effective regulatory change management isn’t just about minimizing risk—it’s about gaining a competitive advantage. By proactively addressing compliance, these organizations can achieve several benefits:

- Enter New Markets Faster: Streamlined compliance processes enable quicker adaptation to new regulatory environments, allowing for faster entry into new markets.

- Develop Compliant Products More Efficiently: Integrating compliance into product development from the start avoids costly rework and delays down the line.

- Build Trust with Regulators: Proactive engagement with regulators fosters positive relationships, which can be invaluable when navigating complex regulatory landscapes.

This proactive approach positions compliance as a driver of innovation and efficiency, not an obstacle. By building a robust regulatory change management process, organizations not only protect themselves from the downsides of non-compliance but also unlock significant strategic advantages. This requires shifting from a reactive “check-the-box” mindset to a proactive, integrated approach that sees compliance as a fundamental part of business strategy. In the next section, we’ll explore the specific steps involved in building an effective regulatory change management process.

Breaking Down the Regulatory Change Management Process

What sets apart organizations that effortlessly navigate regulatory changes from those constantly struggling to keep up? The answer lies in a robust regulatory change management (RCM) process. This structured framework provides a roadmap for handling the complexities of ever-shifting compliance requirements. It’s a proactive strategy that minimizes disruptions and creates opportunities for improvement.

Identifying Emerging Regulations

The first crucial step in effective RCM is horizon scanning. This involves continuously monitoring regulatory agencies, industry publications, and other relevant sources to identify emerging regulations. It’s like having a dedicated radar system, constantly scanning the environment for potential changes. This early awareness gives organizations a head start in preparing for upcoming requirements.

Impact Analysis: Beyond the Surface

Once a potential regulatory change is identified, a comprehensive impact analysis is essential. This assessment goes beyond a surface-level review, delving into the specific operational, financial, and technological implications for the organization. For instance, a change in data privacy regulations might require updates to data storage systems and new employee training programs. This thorough analysis helps organizations fully grasp the scope of necessary adjustments.

Bridging the Gap: Gap Analysis

Following the impact analysis is the gap analysis. This process compares the organization’s current compliance status with the requirements of the new regulation, highlighting any gaps or shortcomings. This comparison helps prioritize areas needing immediate attention and resource allocation. Effectively addressing these gaps is paramount for successful implementation.

Developing a Robust Implementation Plan

With a clear understanding of the impact and identified gaps, the next step is creating a detailed implementation plan. This plan outlines specific actions, timelines, and resources needed to bring the organization into compliance with the new regulation. Think of it as a project roadmap, guiding the implementation process and ensuring every necessary step is taken. This structured approach minimizes the chance of overlooking critical components.

Implementation and Beyond

The implementation phase brings the plan to life, involving clear communication, interdepartmental coordination, and diligent progress tracking. This stage is where the theoretical becomes practical. But the journey doesn’t end with implementation.

Continuous Monitoring and Improvement

Ongoing monitoring and evaluation are crucial for maintaining long-term compliance. This involves tracking key performance indicators (KPIs), gathering feedback, and making necessary adjustments. This continuous improvement loop ensures the RCM process remains effective and adaptable to future regulatory changes. Learn more about regulatory change management here: Regulatory Change Management By embracing this dynamic approach, organizations can not only stay compliant but also leverage regulatory changes to gain a strategic advantage. A structured RCM process also includes assigning clear roles and responsibilities, encouraging cross-functional collaboration, adopting a risk-based approach, keeping employees informed, and implementing continuous monitoring processes. By utilizing technology like regulatory compliance software, organizations can automate tasks, improve efficiency, and maintain compliance with ever-evolving regulations. This proactive approach minimizes compliance risks and facilitates continuous regulatory updates. Integrating organizational change management (OCM) principles into RCM can lead to even better outcomes. OCM focuses on preparing employees for changes, reducing resistance, and boosting engagement.

Building Your Dream RCM Team That Actually Works

Even with the most carefully planned approach, regulatory change management (RCM) can falter without the right team. Building a successful RCM team takes more than just assembling a group; it requires thoughtful planning, clearly defined roles, and a strong collaborative environment. This means creating a cross-functional team capable of handling the many facets of regulatory change, leading to consistent implementation across your organization.

Breaking Down Silos: The Cross-Functional Approach

Effective RCM teams break down departmental barriers. This involves bringing together representatives from key areas like Legal, IT, Operations, and Compliance. Each department brings unique expertise: Legal provides regulatory interpretation, IT handles system updates, and Operations manages the implementation of process changes. This integrated approach minimizes miscommunication and ensures all relevant viewpoints are considered.

Defining Roles and Responsibilities

Clearly defined roles and responsibilities are essential for a smooth RCM process. Every team member needs to understand their specific contributions. This clarity avoids duplicated efforts and promotes accountability, ensuring everyone knows their role and who is responsible for what.

Fostering Genuine Collaboration

True collaboration is more than just having representatives from different departments in the same room. It means fostering open communication, shared objectives, and mutual respect. Creating opportunities for team members to connect and learn from each other strengthens relationships and improves teamwork. This collaborative spirit is key to navigating the complex world of regulatory change.

Overcoming Common Team Challenges

Building a strong RCM team isn’t always easy. Challenges such as conflicting priorities, limited resources, and communication breakdowns can hinder progress. Addressing these challenges proactively is essential for success. For example, establishing clear communication channels and procedures for escalating issues can help resolve problems quickly.

Building Your Winning Team: Roles & Contributions

The foundation of a successful RCM team lies in the right mix of skills and perspectives. The following table details key roles and how they contribute to the regulatory change management process.

To understand how each role contributes to successful RCM, we’ve outlined their key responsibilities and contributions below.

This table highlights the interconnectedness of each role within the RCM process. Each member plays a vital part in ensuring regulatory changes are managed effectively and efficiently.

By investing in a strong RCM team, organizations can shift their perspective on regulatory change. Instead of a burden, it can become a source of strategic advantage. This proactive approach not only minimizes risk but also allows organizations to adapt quickly to the ever-changing regulatory environment.

Transforming Compliance into Competitive Advantage

Robust regulatory change management is more than just avoiding penalties. It’s a powerful tool for gaining a competitive edge. This means shifting the perspective on compliance from a cost center to a strategic asset that generates business value. Leading organizations are showing how this can be done, using their regulatory agility to outperform the competition.

How Compliance Creates Opportunity

This shift hinges on recognizing that regulatory changes aren’t just obstacles, but opportunities to innovate and improve. Companies with established regulatory change management processes, for example, can enter new markets faster. Their ability to quickly adapt to new regulations gives them a significant advantage.

In addition, these organizations can develop compliant products more efficiently. By integrating compliance into the product development lifecycle from the beginning, they avoid expensive rework and delays. This proactive approach builds trust with regulators, fostering open communication and potentially leading to more collaborative market opportunities.

This contrasts sharply with organizations struggling with reactive compliance. These companies are often behind, constantly playing catch-up with the latest regulations. This reactive stance not only increases their non-compliance risk but also limits their ability to innovate and seize new opportunities.

A well-structured regulatory change management process is essential for maintaining compliance and mitigating risks. An effective process helps organizations perform better in audits and examinations. This is achieved through timely detection, analysis, and execution of regulatory changes, optimizing resource use by prioritizing high-impact changes. Learn more about creating an effective process here. Ultimately, this proactive approach strengthens competitive advantage.

Positioning Compliance as a Business Enabler

Transforming compliance into a competitive advantage requires a clear strategy for positioning the compliance function as a business enabler. This involves developing frameworks for measuring the strategic value of regulatory excellence. For example, organizations can track metrics like reduced compliance costs, faster time to market, and increased market share in new regions.

These measurable results provide concrete evidence of the value a robust regulatory change management process brings. This data-driven approach helps demonstrate the return on investment in compliance initiatives.

Communicating Value to Stakeholders

Communicating this value to executive stakeholders is crucial. This involves presenting compliance achievements in a way that aligns with business objectives. Instead of focusing solely on compliance metrics, emphasize how regulatory excellence contributes to overall business goals.

Highlight how it contributes to increased revenue, improved profitability, and a stronger brand reputation. By demonstrating the tangible business benefits of a strong compliance program, organizations can secure leadership buy-in and ensure continued investment in regulatory change management.

Leveraging Technology To Supercharge Your RCM Process

The regulatory landscape is constantly changing. Manual processes struggle to maintain the pace. Forward-thinking organizations are adopting RegTech (regulatory technology) solutions to improve their regulatory change management (RCM) processes. This isn’t just about tracking regulations; it’s about using technology for real-time impact assessments, efficient workflows, and insightful compliance dashboards.

Why Technology Matters In Regulatory Change Management

Staying ahead of regulatory changes requires more than awareness. It requires the ability to quickly assess impact, adapt internal processes, and demonstrate compliance. Technology is key to achieving this agility.

For example, the banking sector faces increasingly complex regulatory reporting requirements, involving multiple stakeholders across the organization. This requires a robust change management process that extends beyond corporate finance. As of 2024, organizations are encouraged to follow a structured RCM process. This involves identifying changes, analyzing impact, developing plans, implementing changes, and communicating updates. This structured approach helps organizations maintain compliance and avoid penalties. Explore this topic further Using RCM software can automate data collection, simplify recordkeeping, and provide real-time regulatory updates. This proactive approach helps organizations stay ahead of compliance risks.

How RegTech Transforms RCM

RegTech solutions offer a range of capabilities that empower organizations to manage regulatory change effectively:

- Real-time Monitoring and Alerts: Automated tracking provides timely awareness of changes, eliminating manual searches and reducing the risk of overlooking critical information.

- Impact Assessment Tools: Software can analyze the potential impact of regulatory changes on business processes, helping organizations prioritize and allocate resources.

- Streamlined Workflows: Automated workflows improve collaboration and communication between stakeholders involved in the change management process.

- Compliance Dashboards: Visual dashboards offer real-time insights into compliance status, enabling organizations to identify and address gaps quickly.

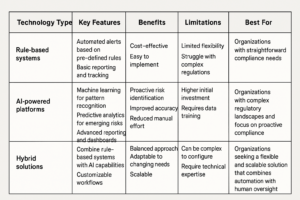

To help illustrate the differences between various RegTech solutions, the following table provides a comparison based on key features, benefits, and limitations.

Introducing a detailed comparison table: “Comparing RCM Technology Solutions”. This table compares different types of regulatory change management technologies across key features, benefits, and limitations to help you select the best fit for your organization.

Key insights from the table include the importance of considering your specific regulatory needs and resources when selecting a technology. While rule-based systems offer a cost-effective entry point, AI-powered platforms provide more sophisticated capabilities for proactive risk management. Hybrid solutions offer a balance between automation and customization.

Choosing The Right Technology For Your Needs

Choosing the right RegTech solution requires careful consideration:

- Specific Regulatory Requirements: Industries face unique regulatory challenges. Choose a solution that addresses your specific needs.

- Integration with Existing Systems: Seamless integration with your current IT infrastructure is crucial for data flow and avoiding data silos.

- Scalability and Flexibility: The solution should adapt to your organization’s growth and evolving complexity.

- User-Friendliness and Support: Choose an intuitive solution with comprehensive support.

Measuring The ROI Of RegTech

Investing in RegTech offers tangible benefits:

- Reduced Compliance Costs: Automation reduces manual effort and the need for extensive legal resources.

- Improved Efficiency: Streamlined workflows accelerate the implementation of regulatory changes.

- Enhanced Accuracy: Automated data collection and analysis minimizes errors and ensures data integrity.

- Reduced Risk: Proactive monitoring and alerts minimize non-compliance risks and potential penalties.

By strategically using technology, organizations can transform their RCM process from a reactive burden to a proactive source of efficiency and competitive advantage.

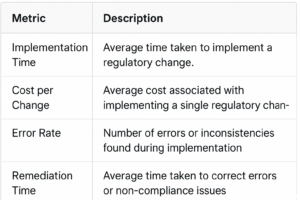

Measuring What Actually Matters in Your RCM Success

How do you know your regulatory change management (RCM) process is truly effective? Simply checking off compliance boxes isn’t enough. This section explores the key performance indicators (KPIs) that demonstrate real value, moving beyond basic compliance to measure the true impact of your RCM efforts.

Establishing a Baseline: Where Do You Stand?

Before measuring progress, you need a starting point. Establishing baseline measurements provides a snapshot of your current RCM effectiveness. This involves assessing factors like the time it takes to implement regulatory changes, the associated costs, and the level of stakeholder engagement.

These initial measurements serve as a benchmark for future progress. For example, tracking the average time it takes to implement a new regulation creates a baseline for targeted improvements.

Setting Realistic Targets: Aiming for Continuous Improvement

With a baseline established, the next step is setting realistic targets. These targets should align with organizational goals and reflect a commitment to continuous improvement.

For instance, if your baseline implementation time is six months, a realistic target might be to reduce it to three months within the next year. This provides a clear objective for your RCM team.

Quantifying Success: The Power of Metrics

Effective measurement involves using both quantitative and qualitative data. Quantitative metrics, like implementation timeliness and cost efficiency, offer objective measures of RCM success. Tracking the percentage of regulatory changes implemented on time offers a clear, quantifiable metric.

Qualitative assessments, such as stakeholder satisfaction and process maturity, provide valuable context. Gathering feedback through surveys or interviews can uncover areas for improvement and highlight effective practices.

Communicating Achievements: Telling Your RCM Story

Communicating RCM achievements to stakeholders is essential. Present information clearly and concisely, using visuals like dashboards to illustrate progress. Tailor your message to each audience, emphasizing relevant benefits. Executives may prioritize cost savings, while operational teams value process improvements.

By combining quantitative and qualitative assessments, organizations gain a comprehensive understanding of RCM effectiveness. This balanced approach not only demonstrates RCM’s value but also fosters continuous improvement and prepares the organization for future regulatory changes.

Streamline your KYC and investor onboarding with Blackbird. Automate compliance workflows, accelerate due diligence, and ensure a seamless investor experience.