Advanced Compliance Risk Assessment Strategies

Last Revised: May 6, 2025The Foundations: Why Compliance Risk Assessment Matters

Navigating today’s regulatory environment is a growing challenge for businesses. The increasing complexity requires a shift from reactive compliance to a proactive strategy focused on anticipating potential risks. This is where compliance risk assessment comes in. It’s the foundation of a strong compliance program, not just a routine task.

A well-executed compliance risk assessment helps organizations identify vulnerabilities before they become major issues. This proactive method can save a company significant financial penalties and, importantly, protect its reputation.

Leading organizations use these assessments to anticipate regulatory changes, adapting their operations to maintain a competitive edge. This foresight allows for strategic planning and efficient resource allocation, focusing compliance efforts where they’re most needed.

Why Traditional Compliance Methods Fall Short

Traditional compliance methods often react to existing regulations – a strategy that’s no longer sufficient. Regulations are constantly changing, often across different jurisdictions, making it difficult for businesses to keep pace. Furthermore, outdated methods leave organizations exposed to new and developing risks.

This reactive approach can result in unexpected fines, legal disputes, and reputational harm. A robust compliance risk assessment, however, creates a framework for proactive risk management, allowing businesses to stay ahead of the curve.

Many organizations struggle to implement a truly comprehensive compliance risk assessment. While 84% of Chief Compliance Officers (CCOs) report using both qualitative and quantitative measurements in their assessment process, a significant 32% are uncertain about the involvement of their business units, operations, and IT management in assessing risks. Only 27% of CCOs strongly agree they actively monitor regulatory changes, highlighting the ongoing challenge of proactive compliance. More detailed statistics can be found here: Compliance Program Statistics.

The Benefits of a Proactive Approach

A proactive compliance risk assessment provides crucial benefits, empowering organizations to:

- Identify potential violations early: This allows for quick corrective action, minimizing potential fines.

- Adapt to regulatory changes: Anticipating changes helps businesses adjust their operations smoothly.

- Protect reputation: A strong compliance program shows a commitment to ethical practices, building trust with stakeholders.

- Gain a competitive advantage: Proactively addressing compliance risks allows businesses to operate more efficiently and confidently.

A well-structured compliance risk assessment is an investment in long-term stability and success. It provides a crucial framework for navigating the complexities of today’s regulatory environment. This allows businesses to focus on core operations while minimizing the risk of costly compliance failures. This proactive approach is essential in today’s business world.

Building Blocks: Crafting Your Risk Assessment Framework

Building a successful compliance risk assessment takes time and careful planning. It involves creating a robust framework that considers every potential area of risk. This section explores the crucial components that create the foundation of an effective framework for evaluating and mitigating compliance risks. These building blocks help identify both the obvious and the less apparent risks facing your organization.

Defining Meaningful Risk Criteria

A solid framework starts with defining clear risk criteria. These criteria should be relevant to both regulators and business executives. They should encompass potential impacts such as financial losses, damage to reputation, legal liabilities, and disruptions to operations. Aligning the assessment with business goals and regulatory requirements is paramount. Well-defined criteria establish a consistent and unbiased approach to evaluating risks.

Establishing a Risk Scoring System

After defining the criteria, a structured scoring system becomes essential for a consistent evaluation process. This system should assign numerical values to each risk level, enabling objective comparisons and prioritization. A simple 1-5 scale, or a more nuanced matrix, can be employed. This quantitative method improves communication and decision-making regarding risk mitigation. It ensures everyone understands the relative significance of different risks.

Documentation and Strategic Intelligence

Detailed documentation transforms raw compliance data into valuable strategic insights. The documentation should encompass the entire assessment process, including all identified risks, assigned scores, and planned mitigation strategies. This comprehensive record becomes a crucial tool for demonstrating compliance to regulators and for informing strategic business choices. Thorough documentation also supports continuous improvement of the compliance risk assessment process.

Scalable Assessment Structures

A truly effective framework must be scalable across different business units. This ensures consistency and adaptability as the organization grows and changes. A modular design, for instance, allows adaptation to different departments or product lines while maintaining its core principles. This scalability is key for effectively managing compliance across a complex organization. Maintaining analytical integrity and regulatory relevance is essential for long-term success.

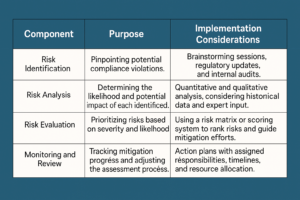

To further illustrate the essential elements of a comprehensive risk assessment, let’s delve into a detailed table. This table will outline the necessary components and their practical considerations.

The following table, “Components of a Comprehensive Risk Assessment,” outlines the essential elements that should be included in any thorough compliance risk assessment framework.

As this table highlights, a robust risk assessment process involves not just identifying potential issues, but also analyzing their potential impact, evaluating their severity, and implementing and monitoring appropriate mitigation strategies.

Building a strong compliance risk assessment framework is essential for any organization’s success. By focusing on these key elements, your organization can proactively identify, analyze, and mitigate compliance risks, ensuring stability and long-term prosperity in today’s complex regulatory landscape.

From Theory to Practice: Implementing Your Assessment

A robust framework for compliance risk assessment is crucial. However, the true test lies in its practical application. This means transforming your meticulously planned strategy into actionable steps that deliver tangible benefits for your organization. This section provides practical guidance on effectively launching and managing your assessments.

Securing Executive Buy-In

Achieving executive buy-in is paramount for successful implementation. This extends beyond mere approval; it requires cultivating a genuine understanding of the assessment’s significance. Clearly articulating the potential financial and reputational repercussions of non-compliance is essential. Position the assessment not as an expense, but as a strategic investment safeguarding the company’s future. This can facilitate the allocation of appropriate resources and promote a culture of compliance.

Establishing a Practical Assessment Schedule

Defining the frequency and scope of your assessments is vital. A balanced approach is necessary to ensure thoroughness without straining resources. For instance, high-risk domains may necessitate more frequent evaluations, while lower-risk areas can be assessed less often.

Developing an adaptable schedule that responds to evolving regulatory requirements and internal shifts is key. This guarantees the assessment remains pertinent and impactful. Furthermore, the frequency of these assessments can differ significantly.

A survey revealed that while 58% of advisory firms conducted a risk assessment within the past six months, 42% had not. This disparity underscores the potential for unaddressed compliance risks. Learn more about this research: Compliance Risk Assessment Frequency.

Selecting the Right Methodology

Choosing the appropriate assessment methodology hinges on your organization’s specific requirements and industry context. A standardized approach may suffice for some, while others may require a more customized strategy. Consider factors such as your organizational structure, available resources, and the complexity of the regulations you encounter.

The selected methodology should also align with your company culture and encourage interdepartmental collaboration. This ensures seamless integration of the assessment process with existing workflows.

Overcoming Implementation Roadblocks

Implementing a compliance risk assessment inevitably presents obstacles. Resource constraints, departmental resistance, and data collection difficulties can impede progress. Open communication, clearly defined roles and responsibilities, and user-friendly tools can mitigate these challenges. This fosters collaboration and streamlines the assessment process. Addressing these challenges proactively is fundamental to establishing a sustainable compliance program.

By prioritizing these practical implementation aspects, you can ensure your compliance risk assessment evolves from a theoretical framework into a potent tool for managing and mitigating regulatory risks. This proactive stance significantly contributes to long-term organizational success.

Making Smart Choices: Analyzing and Prioritizing Risks

Effective compliance risk assessment starts with knowing which risks need immediate attention versus routine monitoring. This focused approach helps maximize your resources and ensures the greatest impact. Let’s explore how to effectively analyze and prioritize risks, transforming assessment data into actionable strategies.

Evaluating Risk Severity, Likelihood, and Impact

Analyzing risk means understanding its potential fallout. We need to consider the severity of a potential violation, how likely it is to occur, and its impact on the organization. A data breach, for example, might have a high impact but a low likelihood. Conversely, minor regulatory infractions might be more likely but less impactful. This nuanced understanding is key to informed decision-making.

Frameworks for Distinguishing Critical Risks

Several frameworks help distinguish critical risks from lower-priority ones. A common method is the risk matrix, which visually plots risks based on their likelihood and impact. This helps quickly pinpoint high-priority risks demanding immediate action. Another approach assigns numerical scores to risks based on predefined criteria, allowing for objective comparison and prioritization.

Quantifying Qualitative Risks

Many compliance risks, like reputational damage or loss of customer trust, are qualitative. But even these intangible risks can be quantified. For instance, reputational damage can be estimated by considering potential customer or revenue loss. This quantification allows us to incorporate qualitative risks into the overall risk assessment.

Establishing Meaningful Risk Thresholds

Risk thresholds define the acceptable level of risk for an organization. These thresholds should align with the organization’s overall risk appetite and strategic goals. Clearly defined thresholds guide decisions and trigger specific actions when exceeded, ensuring proactive and consistent risk management.

Applying Risk Scoring Methodologies

Various scoring methodologies help translate compliance concerns into metrics that executives understand. This might involve a simple 1-5 numerical scale or a more complex weighted system, assigning different weights to various risk factors. This provides a clear, consistent way to communicate risk across the organization, improving decision-making.

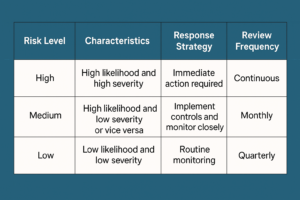

To illustrate how we can prioritize risks effectively, let’s look at a simplified risk prioritization matrix. This matrix combines likelihood and severity to define risk levels and suggest appropriate responses.

Risk Prioritization Matrix

A comparison of different risk levels based on severity and likelihood, with recommended response strategies for each category

This matrix demonstrates how prioritizing risks based on likelihood and severity creates a practical framework for resource allocation and action. Through these methods, your compliance risk assessment offers a clear roadmap for protecting your organization from potential threats.

Beyond Identification: Creating Powerful Mitigation Strategies

Identifying risks within a compliance risk assessment is just the first step. The true value of a compliance program lies in its ability to effectively mitigate those risks. This involves designing controls and processes that directly address vulnerabilities without hindering operations. This section explores the balance between risk reduction and business efficiency.

Balancing Risk and Efficiency

Effective mitigation requires a tailored approach. One-size-fits-all solutions rarely address the nuances of each organization’s unique risk profile. Think of it like a doctor prescribing medicine – they diagnose the specific illness and prescribe a targeted treatment. Similarly, mitigation strategies must be tailored to the specific risks identified in your compliance risk assessment.

This targeted approach ensures resources are used effectively and avoids unnecessary operational bottlenecks. It allows organizations to focus on the most critical risks while maintaining a smooth and efficient workflow. A well-balanced approach strengthens compliance without sacrificing productivity.

Frameworks for Mitigation

Several frameworks can help organizations deploy the right mix of preventive, detective, and corrective measures. Preventive controls aim to stop issues before they occur, much like installing a security system to deter theft. Detective controls, like regular audits, focus on identifying issues after they happen to uncover discrepancies. Corrective controls, such as patching software vulnerabilities after a breach, address the root cause of the problem.

Utilizing a combination of these measures strengthens your overall compliance posture. By addressing risks from multiple angles, organizations create a more robust and resilient compliance program. This multi-layered approach is key to effectively managing and mitigating potential issues.

Establishing Accountability

Assigning clear accountability for remediation efforts is crucial. Each mitigation strategy should have a designated owner responsible for its implementation and effectiveness. This promotes ownership and ensures follow-through, much like assigning project managers to specific initiatives creates focus and drives progress. Without clear accountability, mitigation efforts can become disjointed and ineffective.

Clearly defined roles and responsibilities create a sense of ownership and ensure that tasks are completed effectively. This focused approach streamlines the remediation process and increases the likelihood of successful mitigation. Regular communication and progress updates are also essential for maintaining momentum and ensuring that everyone is on the same page.

Tracking Mitigation Progress

Tracking the progress of your mitigation strategies is essential for demonstrating program effectiveness. Regularly monitoring implementation and measuring results provide valuable insights into what’s working and what needs adjustment. This data is also essential for reporting to regulators and leadership. Think of it like tracking key performance indicators (KPIs), which gives you a clear picture of your progress and allows you to make data-driven adjustments.

This continuous monitoring ensures your compliance program stays relevant and effective. By tracking progress and making adjustments as needed, organizations can maintain a proactive approach to compliance. This allows them to adapt to evolving risks and regulatory requirements, ensuring the long-term effectiveness of their compliance program.

Demonstrating Program Effectiveness

Finally, communicating your program’s effectiveness to stakeholders is crucial. This involves presenting clear, concise reports on implemented mitigations, risk reduction achieved, and remaining challenges. This transparency builds confidence and demonstrates the value of your compliance risk assessment efforts. It also helps secure buy-in for future initiatives.

By showcasing the program’s value, you build support for its continued development and improvement. This allows the program to adapt to the ever-changing compliance landscape and maintain its effectiveness in the face of new challenges. Clear communication and demonstrated results are key to gaining and maintaining stakeholder support.

The Living Assessment: Evolving Your Program Over Time

A compliance risk assessment isn’t a one-and-done deal. It’s a continuous process that needs to adapt and evolve to stay relevant and effective, much like a living, breathing thing. This constant improvement ensures your program keeps up with your organization’s growth and the ever-changing regulatory landscape. Let’s explore some practical strategies for maintaining a dynamic and responsive assessment process.

Establishing Meaningful Review Cycles

Regular reviews are the lifeblood of a living assessment. These reviews shouldn’t be random; they need to be scheduled strategically. Consider things like how often regulations change in your industry, the pace of technological advancements, and the introduction of new products or services. For example, highly regulated industries may need quarterly reviews, while others might only need an annual review.

These review cycles should be formally documented and included in the organization’s compliance calendar. This builds structure and accountability, ensuring the compliance risk assessment remains a top priority. This regular rhythm keeps the assessment current and relevant to the organization’s present operating environment.

Incorporating Feedback Loops

Feedback from everyone involved is crucial for continuous improvement. This means not just the compliance team, but also people from different departments, like legal, finance, operations, and IT. Gather input on how well current controls are working, how clear the risk criteria are, and how practical the mitigation strategies are. Feedback from the IT department, for instance, can be incredibly valuable when assessing cybersecurity risks and putting relevant controls in place.

Getting these diverse perspectives makes the assessment more accurate and relevant. It also encourages buy-in across the organization by making sure everyone has a voice. This collaborative approach strengthens the entire compliance program.

Refining Your Methodology

Learning from the past is key. After each review cycle, analyze what you learned during implementation. Were there any unexpected hurdles? Did the assessment accurately foresee emerging risks? How effective was the risk scoring system? Use these insights to fine-tune your methodology, adjusting risk criteria, scoring systems, and mitigation strategies. For example, if you underestimated certain risks, adjust the scoring system accordingly.

This iterative process makes the assessment more precise and effective over time. It’s a constant process of refinement, adapting to new information and strengthening the organization’s risk management capabilities. This constant improvement is key to maintaining a robust and resilient compliance program.

Adapting to Change

Organizations and regulations are in constant flux. New business ventures, expanding into new regions, and emerging technologies can all introduce new risks. Likewise, regulatory changes can completely shift your risk profile overnight. Your compliance risk assessment must be flexible enough to handle these changes.

Expanding into a new country, for instance, means understanding and addressing the specific compliance rules of that region. Failing to adapt can expose the organization to serious risks. Staying informed about regulatory updates and proactively adjusting the assessment keeps it a valuable tool for managing compliance.

This adaptability requires continuous monitoring of regulatory developments, industry best practices, and emerging risks. This proactive approach lets organizations anticipate changes and adapt their compliance program accordingly, ensuring its effectiveness in a dynamic environment.

Balancing Consistency and Flexibility

While adaptability is essential, maintaining consistency within your compliance program is just as important. This ensures your assessment process remains dependable and comparable over time. Establish core principles and procedures that stay constant, even as specific risk factors and controls evolve.

This balance between consistency and flexibility is the secret sauce for a successful compliance risk assessment. Think of it like navigating a ship – you need to change course to avoid obstacles but maintain a general direction to reach your destination. Your compliance program needs to adapt to change while sticking to established principles.

A strong compliance risk assessment is a dynamic process that demands regular attention and refinement. By using these strategies, you can build a living assessment that strengthens your organization’s compliance and protects it from new threats.

Ready to transform your KYC and investor onboarding process? Blackbird automates compliance workflows, reduces manual effort, and speeds up due diligence. Learn how Blackbird can keep your organization ahead of the curve: Visit Blackbird