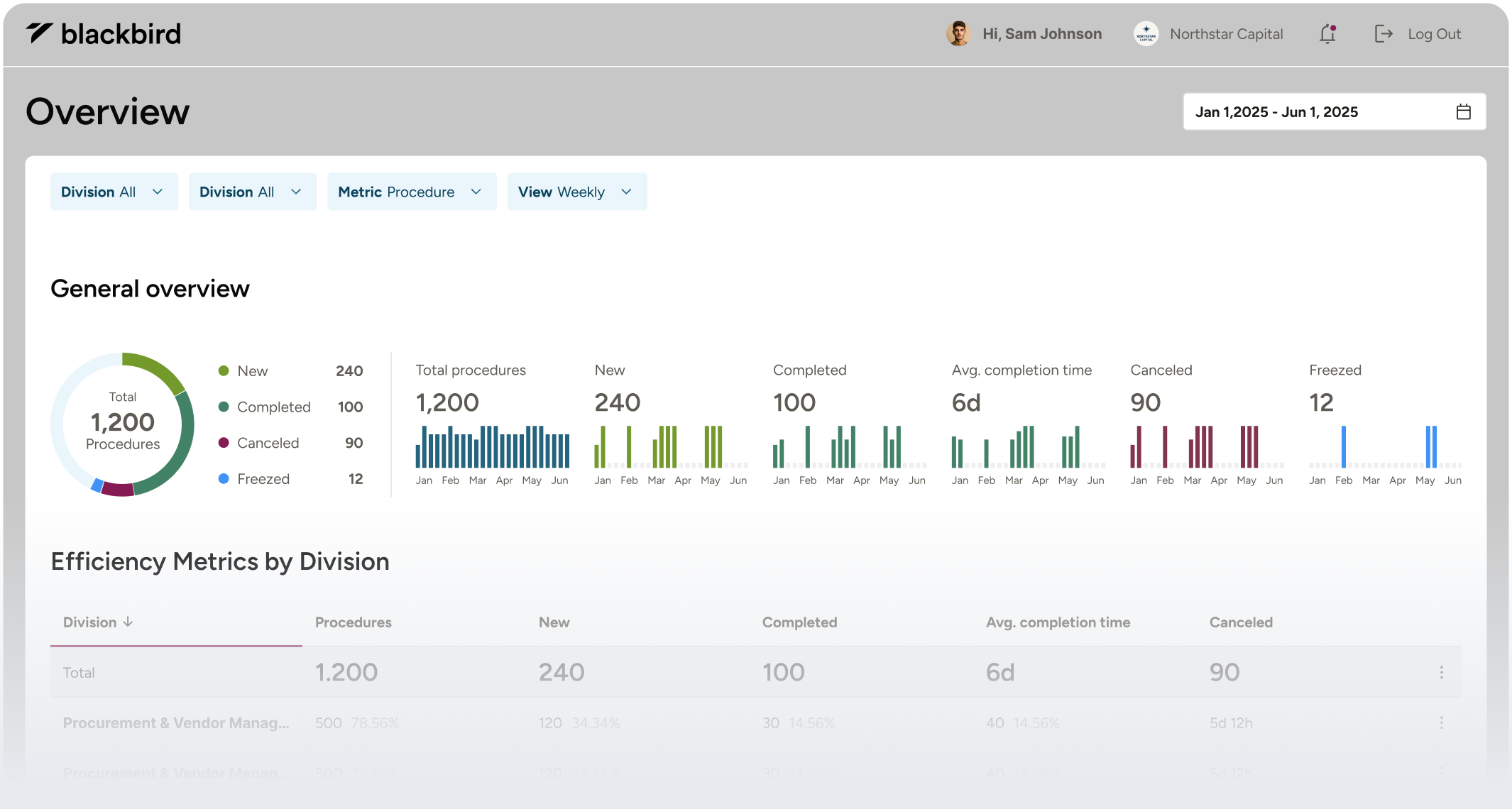

End-to-end compliance platform.

Unlike KYC tools or patched-together spreadsheets, we give you a single pane of glass across onboarding, investor data, and ongoing compliance, fully integrated and audit-ready.

Unlike KYC tools or patched-together spreadsheets, we give you a single pane of glass across onboarding, investor data, and ongoing compliance, fully integrated and audit-ready.

faster onboarding

visibility

chaos

Built for private markets

Forget tedious “if X, then go to page 22” instructions. Our digital subscription streamlines the process, allowing each LP to complete only what’s relevant to them. This dramatically reduces manual effort by 60-80%, even for high-touch processes.

Adaptive logic that handles edge cases (directors, UBOs, trusts)

Pre-populating previous sub-docs gets you to 70% completion from the start

Let AI handle the busywork. Blackbird classifies investor types, verifies submitted documents, and sends smart reminders — so your team can focus on what matters.

From the first touch to audit trail

All-in-one interface for onboarding, KYC,

ongoing reviews, and renewals.

Before Blackbird, approvals took 6 days. Now? 2 hours!

No more conflicting versions or chasing updates.

Real-time visibility for compliance officers, fund admins, and legal

Seamless coordination between LPs, GPs, lawyers, and compliance

Tracks status, flags blockers, and keeps everyone in sync

Crafted for capital flows

From onboarding to follow-up, everything is smooth, fast, and reusable. Investors don’t have to re-enter the same data or manage multiple accounts — everything happens in your own branded space.

Investors can securely upload, store, and manage their documents — all in a dedicated space they control.

SOC 2, ISO 27001, and GDPR compliance built in — so your data stays safe, encrypted, and audit-ready.

Why now?