What Makes Document Lifecycle Management Critical for Private Market Firms?

Last Revised: February 12, 2026At a Glance

In private markets, fragmented document handling slows onboarding and drives compliance risk. Document Lifecycle Management (DLM) uses automation and AI to streamline retrieval, enforce retention, and keep firms audit-ready at scale.

In private markets, every investor document is both a compliance requirement and a critical business record. From subscription agreements to passports and corporate filings, firms must capture, store, and retrieve these materials with precision. A structured approach to document lifecycle management (DLM) provides the foundation for efficiency, compliance, and scale.

Why is Document Lifecycle Management Critical for Private Investment Firms?

Effective DLM delivers measurable advantages in a highly regulated environment:

- Efficiency → Retrieve investor documents instantly when regulators or auditors call.

- Compliance → Maintain audit trails, versioning, and retention aligned with KYC/AML.

- Scalability → Automate archiving and avoid duplication as records grow.

- Collaboration → Provide controlled access and a single source of truth for teams.

Firms with structured document lifecycle management demonstrate stronger audit readiness, faster investor response times, and greater operational resilience compared to peers relying on manual or fragmented processes.

A structured approach to DLM provides the foundation for efficiency, compliance, and scale.

How is Document Lifecycle Management Different from Simple Document Storage?

Many firms still equate document management with storage — typically on shared drives or basic cloud repositories. While this preserves files, it lacks the governance and auditability that regulators increasingly expect.

Document Lifecycle Management (DLM) goes further. It ensures that investor materials, from subscription agreements to corporate filings, are all:

- Tagged and searchable with investor, entity, and fund identifiers.

- Auditable, with clear version histories and access logs.

- Governed by workflows, so documents can move through compliance checks, approval steps, and retention schedules with minimal manual intervention.

- Monitored for expiry, with alerts when passports, licenses, or attestations require renewal.

With every misfiled document costing $120 in labor costs on average (Worldmetrics.org report, 2024) the difference is critical: while storage is static, structured document management provides active oversight — reducing risk, supporting compliance, and keeping firms audit-ready.

What Are the Core Components of Effective DLM?

Effective document management relies on a set of integrated components that transform basic storage into a compliance-ready system, giving firms centralized visibility and control over investor information.

Intelligent Document Capture

Manual re-keying of investor information slows teams and increases errors. Intelligent capture, powered by AI, can extract key fields (e.g., investor name, date of birth, entity type, passport number) directly from subscription documents and IDs — reducing manual entry and accelerating onboarding.

Metadata Frameworks for Precision Retrieval

It’s not enough to store files; they must be instantly retrievable. However, according to IDC, 30% of employees spend nearly one-third of their workday searching for documents. Metadata tagging structures documents by investor, entity, jurisdiction, and fund association. In multi-entity or cross-border structures, this makes it possible for compliance officers to pull all relevant records for a specific investor during an audit or regulator review.

Metadata tagging makes investor records instantly searchable by fund, entity, or jurisdiction.

Advanced Version Control

Outdated or duplicate documents can trigger costly compliance errors. Version control ensures that only the latest approved subscription form or KYC record is used, while preserving a complete audit history regulators expect to see.

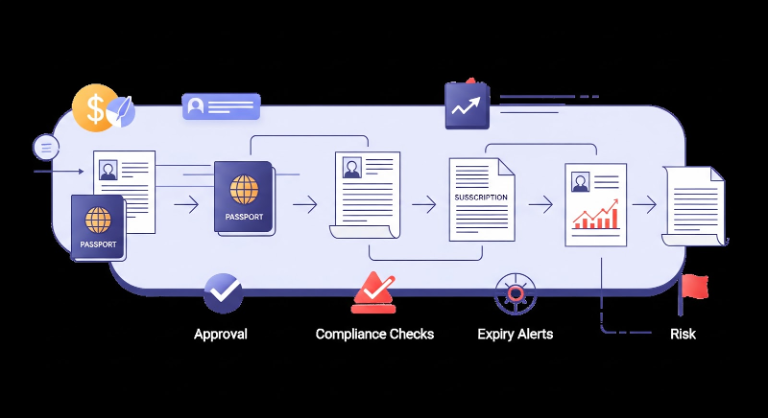

Workflow Automation

Good compliance is more than proper storage; it’s continuous oversight. Workflow automation can route investor documents through the correct review and approval steps, trigger alerts when IDs are about to expire, and flag high-risk cases for enhanced due diligence. This reduces manual chasing and ensures nothing falls through the cracks.

Automated workflows ensure investor documents move seamlessly through reviews, approvals, and compliance checks.

Compliance and Security Protocols

Protecting sensitive investor data is a regulatory expectation. Effective DLM includes role-based access controls to ensure only authorized staff can view or edit documents, encryption to safeguard information in transit and at rest, and audit trails to record every action. These measures strengthen compliance while maintaining operational flexibility, ensuring firms remain both secure and audit-ready.

What Are Key Practical Considerations in DLM Implementation?

Even with strong processes, implementing Document Lifecycle Management (DLM) is not without its hurdles. Two issues commonly surface in private market firms:

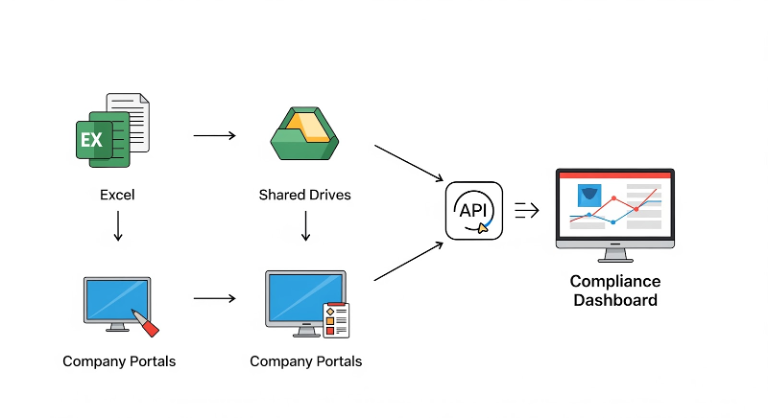

Integration with Legacy Systems

Many firms still manage investor records through a patchwork of Excel trackers, shared drives, and fund administrator portals. Replacing these outright is rarely feasible. A practical framework integrates with existing infrastructure — through APIs, middleware, or phased adoption, so compliance teams can benefit without disrupting established fund admin relationships.

A practical framework integrates with existing infrastructure — through APIs, middleware, or phased adoption.

Scaling with Growing Document Volumes

As firms launch new funds and onboard additional investors, document volumes expand rapidly. Subscription forms, corporate filings, and KYC records multiply across jurisdictions and entities. A scalable system ensures retrieval remains seamless even as repositories grow, while automated archiving policies keep historical files accessible for audits without overwhelming active workflows.

What Are the Tangible Benefits of a Strong DLM System?

A strong document management system does more than maintain compliance. It reshapes day-to-day operations in private markets — reducing regulatory risk, enabling faster audits, and equipping teams with automation-driven tools to manage investor documentation with confidence.

Streamlined Retrieval and Lower Operational Burden

With DLM, retrieving critical records takes seconds, not hours. During an SEC exam or investor due diligence request, compliance teams can immediately locate the correct subscription agreements, IDs, or corporate resolutions. Automated archiving reduces duplication and ensures documents are consistently organized, freeing operations staff from manual searches.

Minimized Errors and Smarter Collaboration

Version control ensures teams always work from the most recent investor documents. Outdated IDs or subscription drafts no longer slip through, reducing costly errors and rework. With legal, operations, and compliance teams collaborating from a single, centralized source of truth, accuracy improves and approval cycles shorten.

Legal, operations, and compliance teams collaborating from a single, centralized source of truth.

Strengthened Compliance and Robust Security

DLM embeds compliance into daily workflows. Permission-based access, audit trails, and automated retention policies help firms align with regulator expectations around record-keeping and data security across SEC, FCA, ESMA and others. Sensitive investor data stays protected while remaining accessible for review, reducing reputational risk and keeping the firm audit-ready at all times.

The Bottom Line

In private markets, documentation is more than a compliance requirement. It underpins investor trust, regulatory alignment, and operational resilience. But too many firms still rely on fragmented storage and manual processes that create delays, errors, and audit risk.

The cost of inefficiency is not abstract. Research shows that private fund advisers spend an average of $54,000 annually just to meet SEC regulatory compliance obligations (Harvard Law School). For firms juggling multiple funds and investors, that recurring burden compounds quickly.

Innovative platforms like Blackbird change this. By unifying DLM with KYC, AML, and due diligence in one AI-first platform, they automate capture, streamline workflows, enforce retention, and ensure auditability from day one. The result: faster onboarding, stronger compliance, and reduced operational burden — without the need to add headcount.

Visit here to learn more about our platform, or simply reach out to schedule a demo.

About the Author

Linoy Doron is a Content Strategist at Blackbird, where she translates complex fintech and compliance topics into clear, actionable insights. With a strong background in technology, SaaS, and UX, she crafts narratives that connect product value to the real needs of asset managers in the private market.