Mid-Sized Asset Managers Can Do More with Less: Embracing AI-Driven KYC

Last Revised: August 4, 2025At a Glance

Mid-sized asset managers can cut onboarding costs, improve investor experience, and reduce compliance strain by adopting AI-powered KYC solutions.

What KYC Challenges Do Mid-Sized Asset Managers Face?

In the competitive world of asset management, mid-sized firms face a challenging balancing act: maintaining stringent KYC (Know Your Customer) processes to mitigate costly risks, while providing investors with a seamless, personalized onboarding experience – all without the deep budgets and large teams of industry giants.

Why Is Manual KYC Causing Investor Loss?

Whether you’re a private equity, a venture capital, or a hedge fund manager, you already know manual KYC is a major operational strain. It stretches limited teams thin and slows onboarding timelines. And speaking of slow – according to a recent Fenergo report, in 2024, 74% of asset management firms lost investors due to delayed onboarding processes.

From collecting and verifying identity documents to screening sanctions lists and monitoring ongoing compliance, KYC has earned its reputation as resource-intensive. When handled manually, it becomes not only slow and costly – but also error-prone, increasing the risk of fines and reputational damage.

Good news, though.

AI-driven KYC platforms like Blackbird offer a smarter way forward. By automating repetitive tasks, AI enables teams to do more with less. When the mundane is streamlined, human professionals can focus on high-value work – and both firms and investors reap the benefits.

So, how can automated KYC help mid-sized asset managers optimize onboarding without breaking the bank? And how can firms empower their human teams in this new environment? Let’s dive in.

Automate the Routine, Amplify the Intricate: How Can AI Help?

By automating tedious tasks, AI-powered KYC tools dramatically reduce manual effort. This unlocks a new and improved division of labor:

AI handles the repetitive, data-heavy (and let’s face it – boring) tasks that typically slow teams down and carry a high risk of human error when done manually. These include intelligent document processing, real-time risk scoring, and continuous monitoring.

Meanwhile, your teams can focus on what they do best: conducting nuanced risk analysis, strengthening investor relationships through personalized support, and navigating a fast-evolving regulatory landscape.

New Work Division in the AI Era

In fact, according to Forbes, AI-powered KYC platforms can cut onboarding costs by over 70% and reduce turnaround time by as much as 90%.

Sounds good, right?

Let’s take a closer look at some of the biggest KYC challenges that asset managers face – and how, with AI, they’re no longer uphill battles. They might not be a walk in the park, but they’re at least a leisurely coffee pick-up on the way to the office.

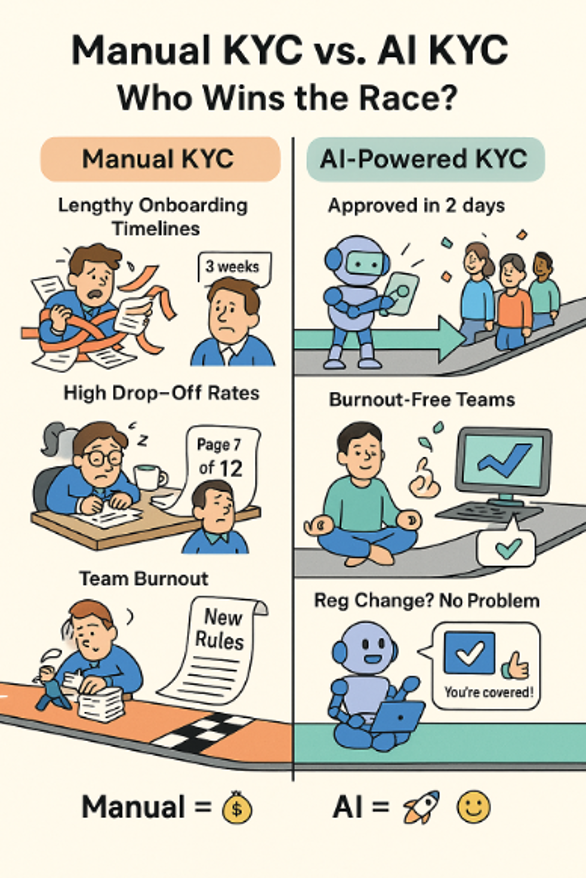

Key KYC Challenges: Manual vs. AI-Powered Performance

Time to get real: below is a snapshot of some day-to-day KYC challenges – and what they look like with and without AI.

⏳ Lengthy Onboarding Timelines

Manual:

Compliance teams spend weeks and months reviewing documents, chasing missing information, and verifying identities – often juggling multiple disconnected. The financial toll is significant: Fenergo found that U.S. asset managers spend an average of $2,664 per KYC review.

With AI:

Automated document verification and real-time risk scoring speed onboarding timelines from months to days, accelerate fundraising, and improve investor satisfaction.

🚫 High Investor Drop-Off Rates

Manual:

Cumbersome, slow processes frustrate investors, leading to drop-offs and lost capital. The numbers are stark: according to Finextra, in the UK, up to 40% of customers abandon onboarding when it takes too long or demands too much effort.

With AI:

Intelligent workflows guide investors step by step, flag issues early, and send automated reminders – improving completion rates and boosting investor experience.

🔥 Compliance Workload & Team Burnout

Manual:

Ops and compliance teams get buried in repetitive tasks, increasing error risk and leading to burnout.

With AI:

According to a Tanium and Pure Profile survey, automation reduces employee burnout and boosts productivity. Compliance workflow automation lets teams focus on complex risk cases and strategic initiatives – lifting morale and reducing mistakes.

⚖️ Keeping Pace with Regulatory Change

Manual:

In today’s fast-evolving, fine-prone regulatory environment, updating policies and workflows manually is time-consuming and leaves room for costly gaps.

With AI:

Modern KYC platforms can adapt automatically to evolving requirements such as AML directives, GDPR, and SEC Rule 206(4)-7. This helps firms stay compliant without adding headcount or operational overhead.

Manual vs. AI-Driven KYC

How Can You Equip Your Human Workforce for the AI Era?

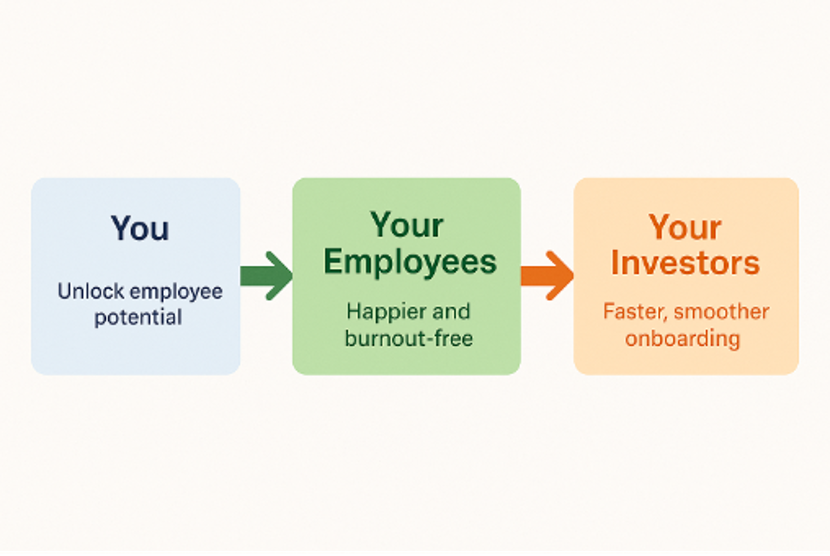

As mentioned earlier, adopting AI-powered KYC is not just about making the most of your technology – it’s also about getting more from your people. When you look at it this way, intelligent automation becomes a triple win:

You unlock your team’s potential by freeing them to focus on what they do best.

Your employees are more engaged and less burned out – no longer bogged down by repetitive tasks, and empowered to take on creative, dynamic work.

Your investors enjoy faster, smoother onboarding, without long waits or endless email threads and bureaucracy.

AI-Powered KYC: Everyone Benefits

Yes, AI is doing more of the heavy lifting – but that makes it even more important to support your teams as they adapt and grow. Here are a few actionable tips for education, training, and success in the AI era:

🔁 Shift your team’s focus

With AI handling the routine, your compliance and operations teams can focus on deep risk assessments, strategic planning, and building investor relationships.

📚 Invest in training and change management

Educate staff on how AI enhances – not replaces – their roles. Offer hands-on training with new tools and build feedback channels to continuously refine workflows.

📈 Redefine success metrics and recognition

As roles evolve, so should KPIs. Focus on high-impact human contributions like decision-making, collaboration, and process optimization to reinforce your team’s value in an AI-powered world.

The Bottom Line: Do More with Less, and Do It Better

For mid-sized asset managers, the pressure to streamline KYC while keeping costs in check is real – and often overwhelming. But AI-driven KYC solutions offer a smarter path forward: automate the manual, empower your people, and deliver a faster, more seamless investor onboarding experience.

With the right tech in place, mid-sized firms don’t just keep up – they get ahead. AI provides them with the edge they need to stay competitive in a fast-moving market.

Why Blackbird?

Blackbird offers an AI-first solution tailored to private market firms — covering KYC, AML, and Due Diligence in one seamless platform. Our built-in automation means faster onboarding and stronger compliance, without the added headcount.

Want to see it in action? Book a demo with our team.

For more insights (or fun KYC memes), follow us on LinkedIn.

About the Author

Linoy Doron is a Content Strategist at Blackbird, where she translates complex fintech and compliance topics into clear, actionable insights. With a strong background in technology, SaaS, and UX, she crafts narratives that connect product value to the real needs of asset managers in the private markets.