KYC Automation in 2025: Trends Private Market Firms Can’t Afford to Ignore

Last Revised: September 8, 2025At a Glance

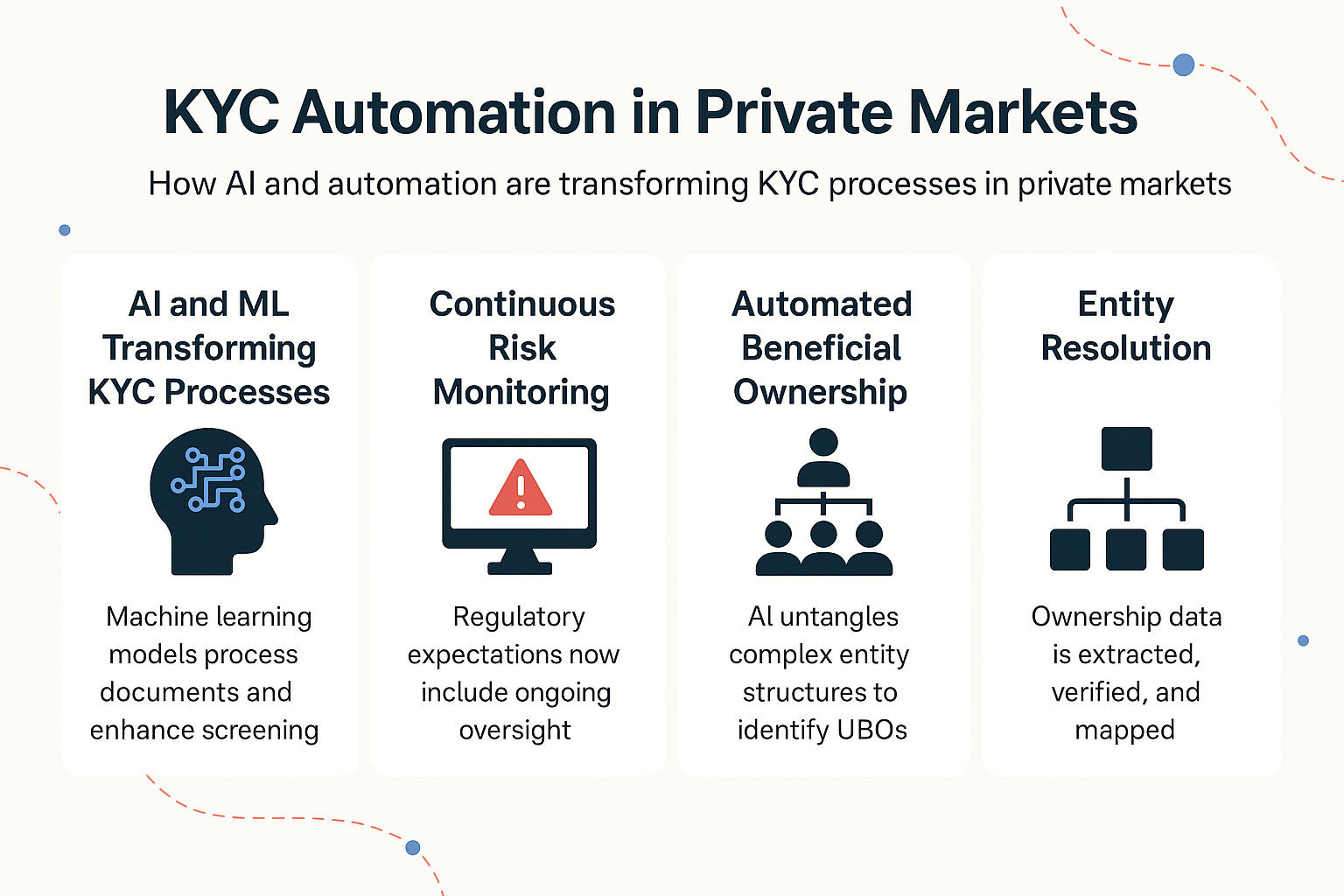

This article explores how AI and automation are transforming KYC processes in private markets, from continuous risk monitoring to entity resolution; and what compliance teams need to do now to stay ahead.

The KYC landscape is evolving rapidly, driven by both regulatory updates and advancements in technology: according to Allvue’s 2025 GP Outlook Report, 82% of private equity and venture capital firms have already adopted AI in some form. Staying ahead of these shifts is essential for both asset managers and fund administrators. Emerging approaches to KYC automation are reshaping how compliance teams manage investor due diligence, improve auditability, and streamline the onboarding experience.

AI and ML Transforming KYC Processes

Machine learning models can quickly process documents such as passports, corporate registries, and fund subscription agreements — extracting and validating key data points that traditionally require manual review. AI also enhances sanctions, PEP, and adverse media screening by reducing false positives and flagging material risks more accurately.

For compliance teams, this means faster identification of beneficial owners, smarter jurisdictional risk scoring, and streamlined exception handling. These systems continuously learn from new data, improving accuracy over time. The result is not only stronger protection against financial crime but also a more efficient, auditable onboarding experience for investors.

ML models can quickly process documents such as passports, corporate registries, and fund subscription agreements

Continuous Monitoring Made Easy

KYC is much more than point-in-time verification completed at onboarding, with regulators increasingly expecting firms to maintain ongoing oversight. That means screening investors and entities against updated sanctions and PEP lists, monitoring adverse media, and reassessing risk when ownership structures or jurisdictions change.

Automation makes this process far more efficient. Instead of relying solely on periodic reviews, AI-driven tools can trigger alerts in real time when relevant data changes, ensuring compliance teams respond quickly without adding manual workload. This event-driven approach strengthens compliance, while delivering a smoother investor experience.

Automated Beneficial Ownership & Entity Resolution

In private markets, one of the greatest KYC challenges is untangling complex entity structures — from offshore SPVs to family offices with layered trusts. Identifying ultimate beneficial owners (UBOs) is not only a regulatory requirement but also a major source of operational drag during investor onboarding.

Automation is transforming this process. AI-driven platforms can extract and verify ownership data from corporate filings, fund documents, and registries, automatically mapping relationships and highlighting risk exposures. Instead of weeks of back-and-forth with investors, compliance teams can achieve clarity in hours. This both strengthens compliance and accelerates the onboarding experience for institutional and entity investors.

How are AI and automation transforming KYC processes in private markets in 2025?

How Are Regulators Treating Technological Advancements?

Regulators increasingly expect firms to leverage technology that strengthens AML and KYC effectiveness. While rules differ across jurisdictions, the direction is clear: compliance teams must demonstrate not just completion of checks, but also the ability to maintain accurate, auditable records and respond quickly to emerging risks. Regulators are open to innovation — provided firms retain accountability and control.

For private market firms, this creates both pressure and opportunity. Regulators expect faster, smarter controls — and the market is already responding. According to Fintech Global, global spending on AML and KYC technology is projected to reach $2.9 billion in 2025, underscoring how rapidly firms are backing AI-enabled compliance. By adopting automation, managers can reduce onboarding delays, improve investor experience, and enhance risk management without expanding headcount.

The Bottom Line

KYC automation in private markets is no longer optional. Firms that embrace AI-driven solutions will onboard investors faster, stay aligned with regulators, and build the trust needed to compete in a tightening market.

Why Blackbird?

Blackbird offers an AI-first solution tailored to private market firms — covering KYC, AML, and Due Diligence in one seamless platform. Our built-in automation means faster onboarding and compliance, without the added headcount.

Want to see it in action? Book a demo with our team.

For more insights (or fun KYC memes), follow us on LinkedIn.

About the Author

Linoy Doron is a Content Strategist at Blackbird, where she translates complex fintech and compliance topics into clear, actionable insights. With a strong background in technology, SaaS, and UX, she crafts narratives that connect product value to the real needs of asset managers in the private market.