Measuring KYC Automation Success: What Metrics Actually Matter?

Last Revised: February 12, 2026At a Glance

For private market asset managers, KYC automation can speed onboarding, cut compliance costs, strengthen risk management, and improve investor experience — but these benefits only matter if they’re measurable. This post lays out KPIs and how to keep track of them.

Automating Know Your Customer (KYC) processes is a significant investment for any private market asset manager — from software licensing and system integration to process redesign and staff training. The payoff can be substantial: faster onboarding, reduced compliance costs, stronger risk management, and a smoother investor experience.

But here’s the challenge: those benefits don’t automatically show up on your balance sheet. Once the system is live, how do you prove it’s delivering value — not just in theory, but in measurable outcomes?

Whether you’re a Chief Compliance Officer ensuring regulatory readiness, a COO driving operational efficiency, or a CFO monitoring ROI, the question is the same: Is your KYC automation delivering measurable results?

That’s where Key Performance Indicators (KPIs) come in. The right metrics turn vague claims of “greater efficiency” into concrete, trackable results. They reveal whether automation is truly reducing costs, strengthening compliance, and improving the client journey.

In this post, we’ll look at the metrics that matter most for investment funds and asset managers when assessing KYC automation: operational efficiency, compliance performance, and customer experience. Together, these measures create a clear, data-backed picture of success.

Measuring KYC success: a crucial best practice

Operational Metrics: Measuring Efficiency Gains

Operational metrics provide valuable data on how KYC automation streamlines internal processes. These measurements reveal actual efficiency gains, demonstrating how automation optimizes workflows and resource allocation.

- Processing Time Reduction: Measure the time it takes to complete the full KYC process — from document collection to verification and risk screening — before and after automation. Automation can reduce this by as much as 80%, enabling funds to onboard investors in hours instead of weeks.

- First-Pass Verification Rate: Track the percentage of applicants verified on the first attempt without manual rework. Higher rates reflect cleaner data capture and better straight-through processing, which McKinsey links to meaningful efficiency gains in KYC operations.

- Manual Touchpoints: Count the number of times human intervention is required during the KYC process. Reducing manual touchpoints not only cuts costs but also minimizes the risk of human error and speeds capital deployment.

- Cost Per Verification: Calculate all-in cost per client, including software, labor, vendor data, and exception handling. McKinsey notes automation and shorter handling times can lower KYC operating costs by ~20–30% when applied at scale.

Compliance Metrics: Demonstrating Regulatory Effectiveness

KYC automation isn’t just about speed; it’s also about strengthening compliance and safeguarding the firm’s reputation. These metrics help you prove that your KYC system is robust, audit-ready, and truly fighting financial crime.

- Suspicious Activity Detection Accuracy: Measure how effectively your system flags genuine suspicious activity. While exact accuracy benchmarks vary, AI-powered solutions are widely recognized for enabling real-time suspicious activity detection, improving risk assessment precision while maintaining consistent compliance.

- Audit Readiness: This metric focuses on how quickly you can produce documentation, audit trails, and verification logs during regulatory reviews. Automated systems capture and store time-stamped records of every verification step, which should make audits smoother and faster.

- False Positive Rate: While identifying suspicious activity is crucial, minimizing false positives is equally important. A high false positive rate can overwhelm compliance teams with unnecessary reviews. Track this metric to refine your automation rules.

Customer Experience Metrics: Driving Business Growth

Your KYC process is often an investor’s first experience with your firm. A seamless, user-friendly experience doesn’t just reduce friction—it builds trust, preserves conversion rates, and fuels growth.

- Abandonment Rate: How many potential customers abandon the KYC application process? A high abandonment rate signals problems within the process. Automation should lower this rate through a smoother, faster verification process.

- Customer Satisfaction Scores (CSAT or NPS): Collect customer feedback on their KYC experience. Positive feedback indicates a user-friendly and efficient process, which contributes to a positive brand image.

- Time to Account Activation: How long does it take for a customer to access services after completing KYC? Shorter activation times improve customer satisfaction and encourage engagement.

Establishing Baselines and Setting Targets

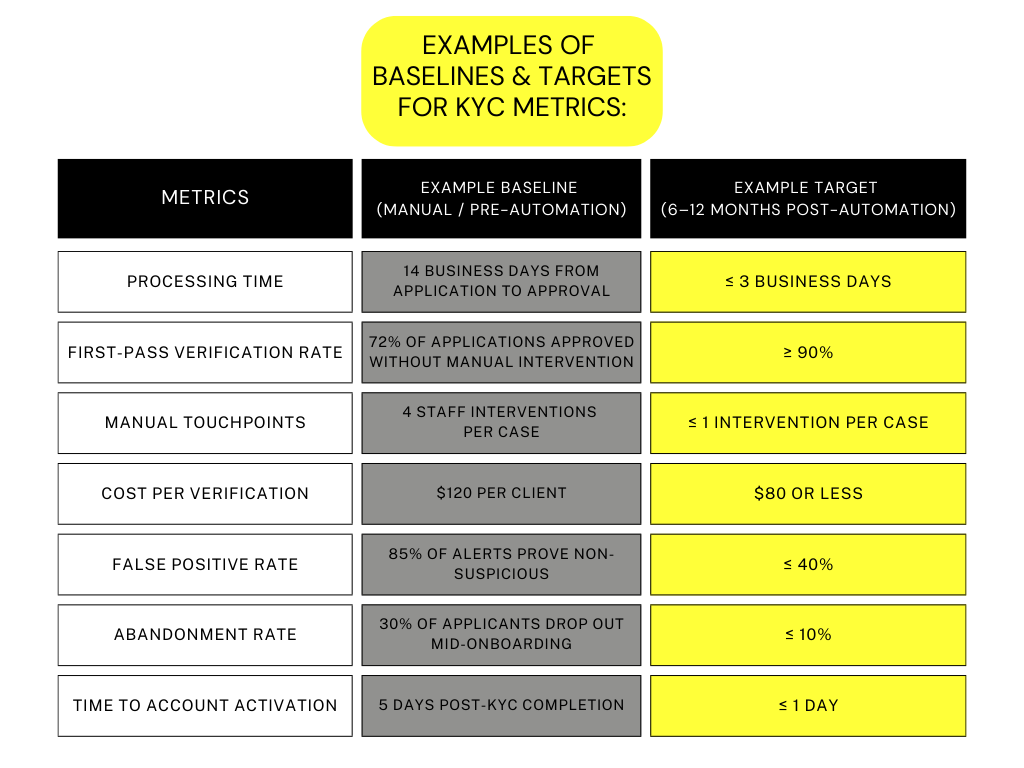

Before implementing KYC automation, it’s critical to establish a baseline for each KPI. A baseline is your current performance level, measured using your existing (often manual or semi-automated) process. Once you know where you’re starting from, you can set targets — specific, realistic improvements you aim to achieve within a defined timeframe.

Here are examples of baselines and targets for KYC metrics:

Examples of baselines & targets for KYC metrics

Pro Tip: Set targets that are ambitious but attainable. Cutting processing time from 14 days to 3 days is aggressive but realistic with automation. Expect incremental gains, especially in areas like false positives, where fine-tuning detection models can take multiple review cycles.

Continuous Improvement: Maximizing Value Year After Year

Implementing KYC automation isn’t a set-it-and-forget-it process — but with the right provider, it comes close. A well-built system will handle most of the monitoring, updates, and optimizations in the background, freeing your team to focus on core operations.

That said, a light-touch review of key metrics a few times a year can help you stay ahead of evolving regulations and client expectations. For example, quarterly KPI checks can flag opportunities to further reduce onboarding times, cut false positives, or fine-tune customer experience.

Your provider should also take the lead on:

- Proactive system updates in line with new compliance requirements.

- Ongoing model refinement to maintain accuracy and detection rates.

- Benchmarking your results against industry standards and best practices.

With the right partner, “continuous improvement” becomes low-maintenance and high-impact — delivering compounding value year after year without demanding constant oversight from your team.

The Bottom Line

Measuring KYC automation success comes down to tracking the right metrics: operational efficiency, compliance performance, and customer experience. Establish clear baselines, set realistic targets, and choose a provider that minimizes oversight while keeping you audit-ready. For asset managers, these KPIs turn automation from a cost into a growth driver — cutting onboarding times, reducing compliance risk, and boosting investor satisfaction year after year.

Why Blackbird?

Blackbird offers an AI-first solution tailored to private market firms — covering KYC, AML, and Due Diligence in one seamless platform. Our built-in automation means faster onboarding and worry-free compliance, without the added headcount.

Want to see it in action? Book a demo with our team.

For more insights (or fun KYC memes), follow us on LinkedIn.

About the Author

Linoy Doron is a Content Strategist at Blackbird, where she translates complex fintech and compliance topics into clear, actionable insights. With a strong background in technology, SaaS, and UX, she crafts narratives that connect product value to the real needs of asset managers in the private market.