KYC and CDD Tactics: Achieve Compliance Success

Last Revised: May 6, 2025Demystifying KYC and CDD: What Successful Teams Know

Many organizations treat Know Your Customer (KYC) and Customer Due Diligence (CDD) as simple checklists. But successful teams understand these processes are crucial for preventing financial crime and protecting their business. This requires a deeper understanding of these essential elements. Let’s explore what sets these processes apart and how leading organizations leverage them for success.

Understanding the Core Difference

KYC is the first step in verifying a customer’s identity. It’s about establishing a basic understanding of who your customer is. This typically involves gathering identifying information such as names, addresses, and government-issued ID.

CDD, however, delves much deeper. It focuses on understanding the nature of the customer’s business and evaluating their risk profile. This might include analyzing transaction patterns or investigating the source of their funds. This thorough approach creates a more robust defense against illegal activities.

Transforming Compliance into Business Intelligence

Smart organizations recognize that KYC and CDD are more than just defensive measures. They see the valuable business intelligence that can be gleaned from the data gathered during these processes.

This data can offer valuable insights into customer behavior, market trends, and potential business risks. This empowers businesses to make data-driven decisions about customer relationships, new product development, and overall strategy. Strong KYC/CDD programs also boost an organization’s reputation, building trust with both customers and partners.

The Importance of Robust Frameworks and Real-World Impact

Solid KYC and CDD frameworks are essential in today’s world of increasing regulatory scrutiny. Enforcement of KYC and CDD regulations has risen significantly globally. In 2023, penalties for non-compliance reached $6.6 billion, a 57% increase from the prior year. Fines specifically related to KYC and CDD jumped to $219 million. Find more detailed statistics here. This underscores the vital role these regulations play in preventing financial crimes like money laundering and terrorist financing.

Practical Applications and Adaptability

Real-world examples show the power of effectively implemented KYC/CDD. By identifying suspicious activity early, organizations can avoid substantial financial losses and protect their reputation. But these processes shouldn’t be static. Successful organizations tailor their KYC/CDD frameworks to their specific industry. They also continually refine these processes to address emerging threats and changes in regulatory requirements. This proactive approach is vital for maintaining strong compliance and staying ahead of potential risks.

Navigating the KYC and CDD Regulatory Maze

The regulatory landscape for Know Your Customer (KYC) and Customer Due Diligence (CDD) is complex and constantly changing. Understanding the core principles and creating adaptable strategies can make compliance easier for businesses. This section will break down key frameworks and offer guidance on building a resilient KYC and CDD program.

Key Regulatory Frameworks: A Global Perspective

Various international and national regulations shape KYC and CDD requirements. The Financial Action Task Force (FATF) Recommendations offer a globally recognized framework for combating money laundering and terrorist financing. These recommendations influence national laws around the world, creating a baseline for KYC and CDD practices.

Regional directives, such as the EU Anti-Money Laundering Directives, add another layer of complexity, especially for businesses operating internationally. In the United States, the Bank Secrecy Act (BSA) requires specific KYC and CDD procedures for financial institutions. This demonstrates how different jurisdictions interpret and apply these crucial principles.

Identifying Core Compliance Principles

While specific regulations differ, core compliance principles remain consistent. A strong KYC and CDD program should prioritize customer identification, risk assessment, and ongoing monitoring. These principles form the basis of protection against financial crime.

Accurately identifying customers from the start, using reliable documentation, is essential. This information informs the risk assessment process, determining the necessary level of due diligence. Ongoing monitoring helps ensure customer profiles and risk assessments stay current, reflecting any changes in behavior or circumstances.

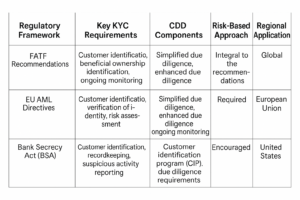

To better illustrate the differences and similarities in global KYC and CDD requirements, let’s examine a comparison across major regulatory frameworks:

Global KYC and CDD Regulatory Comparison

This table compares key KYC and CDD requirements across major regulatory frameworks and jurisdictions.

As highlighted in the table, while regional specifics vary, the emphasis on risk assessment and customer identification remains a global constant. This shared focus allows businesses to develop compliance strategies that adapt to different jurisdictional requirements.

Building Adaptable KYC and CDD Programs

Navigating the regulatory complexities requires adaptable programs, not rigid checklists. Compliance officers experienced with multi-jurisdictional requirements recommend building flexible frameworks. This involves designing systems that can adapt to regulatory changes, avoiding expensive overhauls with each update.

A key strategy involves implementing a risk-based approach. This allows businesses to focus resources on higher-risk customers and activities, streamlining compliance and making the process more efficient and effective. Understanding regulatory trends and prioritizing accordingly is also crucial for effective resource allocation.

Building KYC and CDD Processes That Actually Work

Understanding the difference between Know Your Customer (KYC) and Customer Due Diligence (CDD) is crucial. But how do you make these processes truly effective? This section explores the practical challenges of implementing robust KYC and CDD programs. We’ll examine strategies for balancing thorough verification with a positive customer experience, highlighting the key elements that contribute to success.

Streamlining Documentation and Workflow

One of the biggest hurdles in KYC and CDD is managing the documentation. Customers often abandon the process due to complex requirements and lengthy procedures. Leading organizations are tackling this by implementing streamlined documentation workflows. They utilize technology to automate data collection and verification, minimizing manual work and customer frustration.

For example, solutions like Blackbird automate document verification and classification, ensuring quick and precise compliance checks. This accelerates the process and reduces the risk of human error, leading to more accurate and dependable results. These automated processes create a more efficient workflow, saving time and resources previously spent on manual reviews.

Effective Risk Assessment Frameworks

A core element of successful KYC and CDD is a solid risk assessment framework. This framework should pinpoint real threats instead of generating numerous false positives. Effective risk assessment involves understanding the customer’s business, their transaction history, and their overall risk profile.

This allows organizations to apply the appropriate level of scrutiny. Lower-risk customers might undergo simplified due diligence, while higher-risk customers necessitate a more in-depth investigation. This risk-based approach optimizes resource allocation, ensuring that the most serious threats are addressed. Furthermore, effective risk assessment frameworks should be adaptable, adjusting to changes in customer behavior and emerging risks.

Implementing Ongoing Monitoring Systems

Effective KYC and CDD involves continuous monitoring, not just a one-time check. Monitoring systems should detect suspicious activity without overwhelming teams with false positives. This requires using advanced technology and analytics to track customer transactions and behavior.

However, implementing effective KYC and CDD has faced challenges due to customer awareness. A UAE study revealed that while banks rely on specialized software, false positives remain common, leading to customer dissatisfaction. Learn more about this issue here. This underscores the need for customer education and improved systems. Systems should be fine-tuned to identify genuine anomalies while minimizing false alerts, striking a balance between security and customer experience.

Avoiding Implementation Pitfalls

Implementing KYC and CDD programs has its challenges. Common pitfalls include over-dependence on manual processes, insufficient training for compliance teams, and failing to adapt to evolving regulations. Successful compliance teams sidestep these pitfalls by investing in technology, delivering thorough training, and staying up-to-date with regulatory changes.

They also focus on cultivating a culture of compliance across the organization. This ensures everyone understands the importance of KYC and CDD and their role in safeguarding the business. By avoiding these common mistakes, organizations can establish robust systems that withstand regulatory scrutiny and protect them from financial crime.

Leveraging Technology To Transform KYC and CDD

Technology is changing how organizations handle Know Your Customer (KYC) and Customer Due Diligence (CDD). This presents both opportunities and challenges for compliance teams. Let’s explore how technology is reshaping these essential processes and how organizations can effectively evaluate these new tools.

Digital Identity Verification: A New Era of KYC

Digital identity verification is changing the traditional KYC process. Solutions automate identity checks using various methods, from biometric authentication to document scanning. This automation significantly reduces manual work and speeds up onboarding. It also provides greater security compared to manual document checks.

These systems can detect forged documents and identify inconsistencies in customer information, lowering fraud risk. This ultimately makes KYC faster, safer, and more efficient, contributing to a smoother customer experience and a more secure financial environment.

AI-Powered Screening: Enhancing CDD Effectiveness

Artificial intelligence (AI) plays a growing role in CDD. AI-powered tools analyze large amounts of data to spot suspicious activity and evaluate customer risk profiles. This surpasses simple rule-based systems, allowing for more accurate risk assessments.

For instance, AI can analyze transaction patterns, identify unusual behavior, and flag potential money laundering or terrorist financing. This lets compliance teams focus on high-priority cases, improving overall effectiveness and minimizing false positives. This also reduces unnecessary burdens on compliance teams and minimizes customer friction.

Blockchain Solutions: Securing the Future of KYC and CDD

Blockchain technology has the potential to reshape KYC and CDD by creating secure and transparent digital identities. With blockchain, customer data can be shared securely between institutions, reducing duplicated effort and improving the overall customer experience.

This method also enhances data integrity, making it harder to tamper with or forge. Instead of relying on multiple sources, organizations can access a shared, verified record of customer data, potentially reducing the time and resources needed for KYC and CDD, increasing efficiency and cost-effectiveness.

Evaluating Technology Investments: Focusing on Outcomes

While technology offers significant benefits, organizations need to evaluate their investments carefully. Successful organizations prioritize solutions that address specific compliance needs and integrate seamlessly with current systems. They also consider long-term costs and benefits, ensuring a good return on investment.

The global market for Anti-Money Laundering (AML) services, which includes KYC and CDD solutions, is growing rapidly. In 2023, the market was valued at $3.1 billion and is projected to reach $6.8 billion by 2028, a 17% CAGR. Learn more about the AML market. By carefully evaluating technology investments, organizations can transform KYC and CDD from burdensome requirements into efficient, value-added processes.

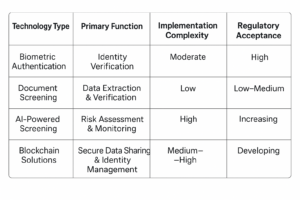

The following table provides a comparison of different technologies used for KYC/CDD implementation. It highlights the strengths and weaknesses of each approach to help organizations make informed decisions.

KYC and CDD Technology Comparison

This table summarizes various technology options for KYC and CDD, ranking from simpler solutions like document scanning to more complex systems like AI and Blockchain. While biometric authentication and document scanning offer relatively straightforward implementation, AI and blockchain require more specialized expertise. Costs vary depending on the complexity and features of the chosen technology. Regulatory acceptance is generally high for established technologies, while newer technologies like blockchain are still gaining acceptance. Choosing the right technology involves balancing cost, complexity, and the specific needs of the organization.

Mastering Risk-Based KYC and CDD Approaches

Effective KYC (Know Your Customer) and CDD (Customer Due Diligence) programs aren’t one-size-fits-all. Instead, a risk-based approach allows businesses to use resources wisely and tackle real threats. Let’s explore how successful organizations build these adaptable systems.

Developing Effective Customer Risk Models

A strong risk-based approach starts with a thorough customer risk model. This model identifies and groups customers based on their potential risk. Factors include industry, location, transaction history, and the products or services they use.

This method prioritizes due diligence. High-risk customers get more scrutiny, while lower-risk customers have simpler checks. A high-volume cryptocurrency trader is likely higher risk than someone opening a basic savings account. This lets compliance teams focus on the most important areas.

Implementing Tiered Due Diligence

A risk-based approach uses tiered due diligence. Different levels of scrutiny are applied based on the risk. Simplified due diligence might work for low-risk customers. Enhanced due diligence is vital for higher-risk customers, possibly involving deeper background checks and ongoing monitoring.

This tiered system creates a more efficient KYC/CDD process. It thoroughly investigates high-risk customers while avoiding unnecessary burdens on others, improving the customer experience.

Documenting Risk Decisions for Regulatory Scrutiny

Documenting risk assessments and decisions is crucial for regulatory compliance. Regulators need clear records explaining assigned risk levels and the due diligence used.

Documentation should include the factors considered during assessment, the reason for the assigned risk level, and the mitigation steps. This ensures transparency and accountability, showing a commitment to compliance.

Continuous Refinement and Balancing Business Objectives

The risk landscape is always changing. Risk assessments must be continually refined based on new threats and changes in customer relationships. Successful organizations stay informed about new regulations, industry best practices, and evolving criminal tactics. They update their risk models and adjust due diligence accordingly.

This proactive approach ensures long-term effectiveness. It also requires balancing compliance with business goals. While compliance is vital, it shouldn’t stop growth. Effective KYC and CDD programs find this balance, protecting the organization while fostering a positive customer experience. Global spending on AML/KYC data and services demonstrates this importance. In 2023, spending reached $2.22 billion, with a five-year CAGR of 22%. You can find detailed statistics here. This growth highlights the increasing focus on mitigating financial crime risk and ensuring regulatory compliance.

The Future of KYC and CDD: Staying Ahead of the Curve

The world of Know Your Customer (KYC) and Customer Due Diligence (CDD) is constantly evolving. Regulations change, criminal tactics adapt, and technology continues to advance. This requires businesses to not only meet current compliance standards but also anticipate what’s coming next. This section explores emerging trends in KYC and CDD and offers strategies for a future-proof compliance program.

Perpetual KYC: Moving Beyond Periodic Reviews

Traditional KYC often involves periodic reviews of customer information. This approach can create gaps in compliance, especially in rapidly changing environments. Perpetual KYC, a continuous monitoring system, offers a more robust solution. It updates customer profiles in real-time, reflecting changes in risk factors as they occur.

This real-time monitoring allows for immediate responses to potential threats, minimizing the window of opportunity for illicit activities. It also streamlines compliance by reducing the administrative burden of periodic reviews. The result is a more efficient and effective compliance program.

Cross-Border Information Sharing: Transforming Due Diligence

Financial crime increasingly operates across international borders, making global cooperation essential for effective KYC/CDD. Cross-border information sharing initiatives are facilitating access to and exchange of data regarding high-risk individuals and entities.

This enhanced transparency is crucial for uncovering complex money laundering schemes and other criminal activity. While careful consideration of data privacy remains vital, these initiatives hold significant promise for strengthening global compliance.

Digital Identity Solutions: Revolutionizing Customer Verification

Digital identity solutions are reshaping customer verification. These solutions utilize technologies like biometric authentication and decentralized identifiers for quick and secure identity verification. This shift reduces reliance on traditional paper-based documentation, leading to a smoother, more efficient onboarding process.

For instance, verifiable credentials empower individuals to securely control and share their identity information. This enhances privacy and reduces the risk of identity theft. These solutions also offer robust fraud protection, making them an important tool for KYC/CDD compliance.

Future-Proofing Your Compliance Program: Practical Strategies

A future-proof compliance program requires a proactive strategy. This includes implementing technology that supports continuous monitoring and automation. It also necessitates ongoing staff training to ensure compliance teams stay informed about best practices and emerging threats.

Furthermore, organizations should integrate Environmental, Social, and Governance (ESG) factors into their due diligence. ESG considerations can illuminate potential risks linked to a customer’s business practices, bolstering overall risk assessment. Advanced analytics are playing a growing role in suspicious activity detection, significantly enhancing the effectiveness of monitoring systems. Finally, adaptable systems are key for long-term success, allowing seamless integration of new regulations and technologies.

Ready to optimize your KYC/CDD processes? Blackbird automates compliance workflows and minimizes manual effort, resulting in faster due diligence and an improved investor experience. Learn more at https://blackbrd.co.