Streamline KYC and AML Compliance for Success

Published: April 27, 2025The Critical Role of KYC and AML in Business Success

KYC and AML programs are often seen as just another regulatory hurdle. However, their importance goes far beyond simply checking compliance boxes. Effective Know Your Customer (KYC) and Anti-Money Laundering (AML) initiatives are crucial for long-term business success. They not only shield organizations from financial crimes, but also build a stronger reputation and foster customer trust.

This, in turn, improves relationships with financial institutions. Ultimately, it creates a more stable and profitable business environment.

Understanding the Interplay of KYC and AML

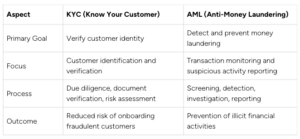

Many businesses struggle to understand the nuances between KYC and AML. While interconnected, they have distinct purposes. KYC focuses on verifying customer identities. It ensures customers are who they say they are. This involves collecting and verifying customer information, allowing businesses to assess risk and meet regulatory requirements.

AML, on the other hand, aims to detect and prevent money laundering. This includes monitoring transactions, identifying suspicious patterns, and reporting potentially illegal activities.

To illustrate the difference, consider this travel analogy. KYC is like obtaining a passport—it confirms your identity. AML is similar to airport security—it checks for prohibited items. Both are necessary for safe travel.

Similarly, both KYC and AML are vital for secure financial operations. This interconnectedness is essential because solid KYC procedures are the bedrock of effective AML programs. By accurately identifying customers, businesses can better monitor transactions for unusual behavior that might signal money laundering.

This proactive approach minimizes risks and strengthens overall financial integrity. The scale of global money laundering is staggering. Estimates indicate that 2% to 5% of global GDP, or approximately EUR 715 billion to 1.87 trillion, is laundered annually. Find more detailed statistics here The magnitude of this illicit activity highlights the crucial need for robust AML measures paired with streamlined customer onboarding.

The Benefits of Robust KYC and AML Practices

Implementing strong KYC and AML programs provides several key benefits:

- Reduced Risk of Financial Crime: This is the most direct benefit. By verifying identities and monitoring transactions, businesses significantly lower their exposure to fraud, money laundering, and terrorist financing.

- Enhanced Reputation and Trust: A commitment to compliance fosters trust with customers, partners, and regulators, resulting in stronger relationships and a positive brand image.

- Improved Regulatory Compliance: Adherence to KYC and AML regulations prevents costly fines and penalties, saving valuable financial resources.

- Competitive Advantage: Businesses with robust compliance programs project reliability and trustworthiness, giving them a competitive edge.

KYC vs. AML: Key Differences and Relationships

To further clarify the distinct but connected roles of KYC and AML, the following table outlines key differences:

Robust KYC and AML frameworks are vital for any business operating in today’s financial landscape. These processes are not simply about meeting regulatory requirements. They are about protecting the business, fostering customer trust, and creating a more secure financial ecosystem. By prioritizing KYC and AML, businesses protect themselves from financial crime while bolstering their reputation and contributing to a more stable and transparent financial world.

Navigating the Complex World of KYC and AML Regulations

The regulatory landscape surrounding KYC and AML is constantly changing. Staying ahead of these changes is crucial for any financial institution. This means not only understanding current regulations but also anticipating future trends and adapting strategies. Success requires a proactive compliance mindset, not just a reactive checklist.

Understanding Key Legislation

Navigating KYC and AML regulations means interpreting and implementing key legislation. In the US, the Bank Secrecy Act (BSA) is the foundation of AML efforts, requiring financial institutions to have programs to detect and prevent money laundering. The EU Anti-Money Laundering Directives provide a framework for EU member states, impacting organizations operating across borders. Understanding these regulations is paramount.

Managing Multi-Jurisdictional Compliance

For organizations in multiple countries, KYC and AML compliance becomes even more complex. Different jurisdictions may have varying, sometimes conflicting, requirements. A strategic approach is essential for managing compliance across different legal landscapes. A risk-based approach, tailoring KYC and AML procedures to the specific risks of each jurisdiction, is often effective. Understanding the marketing landscape is also important. For more insights, see Digital Marketing for Financial Services.

The Role of International Coordination

International bodies, like the Financial Action Task Force (FATF), shape global AML/KYC standards. The FATF sets international standards and promotes effective implementation of measures for combating money laundering, terrorist financing, and related threats. This international coordination helps create a more unified approach to AML, facilitating cooperation between countries. Staying informed about FATF recommendations is crucial for compliance in an interconnected world. In 2020, financial institutions faced $10.4 billion in fines for AML non-compliance. Find more detailed statistics here. This highlights the need for robust AML/KYC solutions.

Adapting to a Changing Landscape

Successful KYC and AML compliance isn’t about memorizing regulations; it’s about continuous learning and adaptation. As technology and criminal methods evolve, organizations must adjust their compliance strategies. This includes investing in technology, training personnel, and regularly reviewing internal policies. A dynamic approach to KYC and AML helps organizations mitigate risks and build trust with customers and stakeholders.

Building a KYC Framework That Actually Works

Effective KYC and AML programs are more than just ticking boxes. They proactively identify and mitigate risks, balancing thorough checks with operational efficiency. This requires a strong framework built on risk-based verification. This means recognizing that different customers present different levels of risk, and KYC procedures should reflect these varying levels.

Implementing Risk-Based Verification

Risk-based verification helps businesses use their resources wisely. Low-risk customers can go through simplified checks, while high-risk customers undergo more detailed scrutiny. This ensures that resources are concentrated where they matter most.

For example, a new customer making a small, one-time purchase might be low-risk. A customer making frequent, large international transfers, however, requires a higher level of scrutiny.

Streamlining Identity Verification

A smooth identity verification process is key to a positive customer experience. Several techniques enhance this process while maintaining security. Document authentication verifies the legitimacy of submitted documents. Biometrics, like facial recognition or fingerprint scanning, adds another layer of security.

Digital solutions, including automated KYC platforms like Blackbird, automate much of the verification process. This significantly improves speed and efficiency.

Tackling Complex Challenges

Verifying beneficial ownership and navigating complex entity structures can be difficult. Understanding the layers of ownership is vital for KYC and AML compliance. Leading organizations use several techniques to address this.

These include using specialized databases and conducting thorough background checks. Ongoing monitoring helps identify ownership changes that might indicate increased risk. These measures maintain compliance integrity even in complicated scenarios.

To illustrate the concept of risk-based KYC implementation, the table below outlines different verification steps and monitoring frequencies appropriate for each risk category.

KYC Implementation Steps by Risk Level

This table outlines the recommended verification steps for different customer risk categories

As shown in the table, the required documentation, verification steps, and monitoring frequency increase with the risk level. This ensures a balanced approach where resources are allocated proportionately to the potential risk.

Building a Practical and Effective KYC Framework

Building a successful KYC framework requires understanding your business and its customers. It means tailoring your approach to the specific risks your organization faces.

By adopting a risk-based strategy, simplifying identity verification, and addressing complex challenges directly, businesses can create KYC programs that are both effective and efficient. This not only protects the business from financial crime but also builds customer trust and supports long-term growth. A practical KYC framework requires vigilance and continuous improvement as regulatory requirements and criminal tactics change.

Investing in training and advanced solutions like Blackbird helps companies maintain strong compliance. This is vital for creating a secure and transparent financial ecosystem.

Designing Intelligent AML Monitoring Systems

Effective Anti-Money Laundering (AML) involves more than just basic transaction monitoring. It requires building intelligent systems capable of detecting complex financial crimes while minimizing disruptive false positives. This demands a strategic approach to developing adaptable monitoring frameworks that keep pace with evolving criminal tactics.

Building Adaptive Monitoring Frameworks

Leading organizations are moving away from static AML monitoring systems and embracing dynamic, adaptive solutions. These systems learn and evolve as criminals develop new techniques. This adaptability is key to combating financial crime effectively. Advanced analytics and machine learning are incorporated into these frameworks to identify subtle patterns indicative of illicit activity.

For instance, an advanced system might detect not only large, suspicious transactions but also a series of smaller transactions strategically structured to bypass detection thresholds. This level of detection requires understanding the broader context of customer behavior.

Establishing Effective Detection Thresholds

Finding the right detection thresholds is a delicate balance. Overly sensitive thresholds generate excessive false positives, burdening compliance teams and wasting valuable resources. Conversely, thresholds that are too lenient risk allowing suspicious activity to go unnoticed. A risk-based methodology is the optimal approach, adjusting thresholds based on the inherent risk associated with various customer segments and transaction types.

This targeted approach maximizes AML monitoring effectiveness while reducing unnecessary alerts. Regular review and adjustment of these thresholds are crucial to maintain their efficacy.

Creating Efficient Alert Management Workflows

An efficient alert management workflow is fundamental to effective AML. When an alert is triggered, prompt and thorough investigation is critical. A well-defined process for prioritizing alerts, assigning them to investigators, and documenting the investigation is essential. This should also include escalation procedures for high-risk alerts.

This streamlined approach ensures efficient handling of suspicious activity. Tools like Blackbird can automate many of these processes, lessening manual workload and improving accuracy.

Optimizing Suspicious Activity Reporting

Identified suspicious activity must be reported through a Suspicious Activity Report (SAR). Optimizing the SAR process involves ensuring accurate and comprehensive reporting without unnecessary delays. Leveraging technology to automate data collection and report generation is crucial.

Furthermore, meticulous audit trails are essential for demonstrating compliance with regulatory requirements. Proper documentation protects the organization during regulatory reviews.

Balancing Machine Precision with Human Judgment

While technology is vital in AML, human judgment remains indispensable. Machine learning algorithms can identify patterns, but human investigators provide experience and intuition. The most effective AML systems leverage the strengths of both.

An algorithm may flag a transaction as unusual, but a human investigator can assess the customer’s history and context to determine whether further investigation is warranted. This balanced approach ensures AML systems are both effective and fair. It minimizes the risk of falsely flagging legitimate transactions, reducing disruptions for customers. Combining technology with human expertise creates robust AML systems that offer genuine protection without overwhelming compliance teams.

How Technology Is Revolutionizing KYC and AML Compliance

The regulatory landscape for KYC and AML (Anti-Money Laundering) is complex and ever-changing. This poses challenges for organizations working to stay compliant. However, technology offers substantial opportunities to not only address these challenges but also to make KYC and AML processes more efficient and effective.

The Power of Machine Learning

Traditional rule-based systems can struggle to identify complex money laundering schemes. This is where machine learning becomes invaluable. Machine learning algorithms analyze large datasets, uncovering subtle patterns and anomalies that may signal suspicious activity. For example, machine learning can detect unusual transaction patterns or links between seemingly unrelated individuals that a human analyst might miss. This allows compliance teams to concentrate on the highest-risk situations, boosting overall efficiency.

API Integration for Seamless Verification

API integration is essential for streamlining KYC processes. APIs facilitate real-time data exchange between various systems, automating several steps that were previously manual. This allows customer information to be verified quickly and automatically from different sources, shortening onboarding time and improving the customer experience. API integration also enables organizations to connect their KYC and AML systems with third-party data providers like Blackbird, providing access to current information on sanctions lists and other vital data.

Emerging Technologies: Blockchain, Biometrics, and Automation

Emerging technologies are continuing to transform KYC and AML. Blockchain technology has the potential to provide secure and transparent identity verification. Biometric authentication adds another layer of security and simplifies customer identification. Automated screening tools accelerate due diligence and help organizations keep pace with changing regulatory requirements.

The Importance of Human Oversight

Despite technological advances, human oversight remains crucial for effective compliance. Technology is a powerful tool for compliance professionals, but it cannot replace human judgment and experience. This is especially important when handling complicated cases or interpreting regulatory nuances. Combining the precision of technology with the critical thinking of human analysts ensures that compliance programs are both robust and equitable.

One key trend in the KYC and AML sector is the increase in global spending on related services. In 2023, global spending on AML/KYC data and services was expected to rise by 12.4% to $2.22 billion, contributing to a 5-year Compound Annual Growth Rate (CAGR) of 22.0%. This growth highlights the increasing need for effective compliance measures as financial institutions face stricter regulations. Explore this topic further. This trend underscores the significance of robust AML/KYC practices, especially with the growth of digital financial services.

Implementing Technology Within Budget

Many organizations are hesitant to adopt new technologies because of budgetary limitations. However, successful implementation doesn’t necessitate vast resources. A phased approach allows organizations to prioritize investments and integrate technology incrementally. Focusing initial efforts on areas where technology can have the greatest impact, such as automating manual processes, provides early returns on investment. This early success can then support further investment in more complex technologies like machine learning and AI-powered solutions. In the long run, technology is an investment that can reduce costs by increasing efficiency and minimizing the risks of non-compliance.

Creating KYC and AML Experiences Customers Actually Trust

Compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations doesn’t have to be a negative experience. Forward-thinking organizations are turning these essential processes into opportunities to build stronger customer relationships and demonstrate a commitment to security. Instead of roadblocks, KYC/AML becomes a showcase for responsible financial practices.

Transparency and Communication Are Key

Open communication is crucial for a positive KYC/AML experience. Clearly explaining the “why” behind these checks helps customers understand their importance. This transparency fosters trust and reduces any perception of intrusion.

For instance, instead of simply asking for a passport copy, explain how this step protects the customer from identity theft and supports regulations designed to combat financial crime. Setting clear expectations about the process and timeline also minimizes customer anxiety.

Streamlining the Verification Process

A smooth, efficient verification process is key to a positive customer experience. Minimizing required steps and using technology to automate data collection and verification significantly reduces friction. Solutions like Blackbird provide automated document verification and AI-driven classification to speed things up.

This allows customers to spend less time on compliance and more time accessing the services they need. Seamless integration of these processes into the customer journey also prevents disruptions and maintains a positive user experience.

Implementing Progressive Verification

Progressive verification balances security with convenience. The level of verification is adjusted based on the customer’s risk profile and transaction type. A simplified process might suffice for low-risk customers, while higher-risk situations necessitate more extensive checks.

This flexible approach tailors KYC/AML procedures to individual customer needs. It minimizes the burden on low-risk customers while ensuring appropriate scrutiny for higher-risk situations.

Turning Compliance into a Competitive Advantage

Focusing on customer experience transforms KYC/AML processes into a competitive edge. Customers prefer businesses that prioritize their convenience and security. This fosters loyalty and reinforces a perception of trustworthiness.

Measuring and Optimizing the Compliance Journey

Leading companies constantly evaluate and optimize their compliance journey. They identify pain points in the customer experience and find ways to address them, perhaps through A/B testing different verification methods or gathering customer feedback.

This data-driven approach allows organizations to refine processes and ensure they meet customer needs while staying compliant. By understanding customer challenges, companies can improve the compliance journey, making it easier and more efficient. This continuous improvement builds trust and transforms necessary compliance into a positive aspect of the customer relationship.

Future-Proofing Your KYC and AML Strategy

The regulatory landscape for KYC and AML is constantly changing. Your compliance strategy can’t just meet today’s requirements; it needs to adapt to future challenges. This forward-looking approach is essential for long-term success.

Emerging Trends and Challenges

Several key trends are reshaping KYC and AML requirements. The growing use of digital assets presents new challenges for identity verification and transaction monitoring. Customers also expect more efficient and user-friendly KYC processes. These factors, combined with ongoing regulatory updates, create a complex compliance environment.

Building Adaptable Compliance Frameworks

A future-proof KYC and AML strategy requires a flexible framework. This means moving away from rigid, rule-based systems towards more agile approaches. A key aspect is using risk-based procedures. This involves tailoring the level of scrutiny to the risk of each customer and transaction, improving resource allocation and security.

Organizations also need scalable processes. This means systems that can handle growing data and transaction volumes without impacting efficiency or accuracy. Scalability is crucial for future growth and changing regulatory demands. Consider flexible technology, such as that offered by Blackbird, to build an adaptive and scalable program.

Addressing Key Challenges

Leading organizations are proactively addressing future compliance challenges. Cross-border compliance, with its diverse regulations and data privacy laws, requires robust data management and international collaboration. The rise of digital identity verification offers better security and streamlined processes, but also requires strong security to prevent fraud and protect customer data.

Balancing strong security with customer privacy is also vital. Being transparent with customers about how their data is used for compliance builds trust and improves their experience.

Developing Competitive Advantages

Future-proofing your KYC and AML strategy isn’t just about meeting minimum requirements. It’s about building compliance capabilities that create lasting competitive advantages. With flexible, scalable systems and a focus on customer experience, organizations can transform compliance from a cost center into a value driver. This proactive approach builds customer trust, strengthens regulatory relationships, and contributes to a more stable financial system.

Investing in technology, like the automated solutions from Blackbird, can automate workflows, reduce manual work, and improve the accuracy of your compliance program. This lets your team focus on higher-level strategic initiatives and build a truly future-proof KYC and AML strategy.