KYC AML Meaning: Essential Guide to Compliance Success

Last Revised: May 6, 2025Decoding the KYC AML Meaning for Modern Business

In today’s financial world, understanding what KYC AML means is crucial for every business. KYC (Know Your Customer) and AML (Anti-Money Laundering) are vital for financial security and following the rules. They shield businesses from financial crimes. They also uphold the integrity of the global financial system. This involves verifying customer identities and monitoring transactions for suspicious activities.

KYC: Establishing Customer Identity

KYC focuses on verifying the identity of your customers. Think of it like verifying your own identity when opening a bank account. This process confirms that customers are who they say they are. It usually means gathering details such as name, address, and date of birth. You also check identification documents. For businesses, KYC means checking the company’s legal structure. It also involves finding out who the ultimate beneficial owners are. This helps prevent identity theft, fraud, and other financial crimes.

AML: Detecting and Preventing Financial Crimes

AML has a broader scope than KYC. It involves procedures designed to detect and prevent money laundering. This means watching transactions for unusual patterns. For example, look for large cash deposits or transfers to high-risk areas. AML also requires reporting suspicious activity to the appropriate authorities. The goal is to stop illegal money flow. This will help prevent criminal groups from using financial systems. This requires businesses to establish robust systems for tracking and reporting financial activity.

The Synergy of KYC and AML

KYC and AML are distinct but work together to form a comprehensive defense against financial crime. KYC establishes customer identity, providing the foundation. AML builds on this foundation by monitoring transactions for suspicious behavior. For example, if a new customer makes very large transactions, AML systems can flag it for review. This integrated approach strengthens overall financial security.

KYC AML Compliance in Modern Business

Effective KYC AML procedures are not just a regulatory requirement; they’re a smart business practice. By proactively identifying and mitigating risks, businesses protect their reputation, avoid hefty fines, and build customer trust. This proactive approach can also improve operational efficiency by streamlining customer onboarding and reducing manual compliance tasks. In the current business environment, robust KYC AML compliance is a critical element of success. The growing global threat of money laundering makes understanding KYC and AML more vital than ever. Studies show that 2% to 5% of global GDP—or between EUR 715 billion and 1.87 trillion—is laundered annually. This highlights the urgent need for robust KYC and AML processes. More detailed statistics can be found here: https://www.kychub.com/blog/money-laundering-statistics/

The Hidden Cost of Money Laundering You Can’t Ignore

Money laundering costs businesses and society more than just fines and reputation damage. These costs often go unnoticed, yet they contribute to broader economic instability and social harm. It’s important to grasp what inadequate KYC and AML mean. Understanding this helps you see the value of these measures.

Undermining Economic Stability

Money laundering distorts economic indicators and undermines the integrity of financial markets. Illicit funds in real estate can inflate property prices. This creates artificial bubbles that can burst.

Using laundered money to manipulate stock prices can shake up markets and undermine investor trust. This creates uncertainty and volatility, ultimately harming legitimate businesses and investors.

Fueling Organized Crime and Terrorism

Money laundering is the lifeblood of organized crime and terrorist organizations. It allows these groups to finance operations, expand their reach, and corrupt institutions.

Criminals can clean their illegal money, which lets them act freely. This weakens the law and puts global security at risk. This connection highlights the critical role of AML procedures in disrupting criminal networks.

Eroding Trust and Transparency

The prevalence of money laundering erodes trust in financial institutions and regulatory bodies. When businesses don’t use good KYC and AML measures, they open doors for criminals.

This hurts public trust in the financial system. It makes it harder for honest businesses and draws unwanted scrutiny from regulators. Building and maintaining trust is essential for a healthy financial ecosystem.

The impact of money laundering extends far beyond individual businesses. In 2024, the U.S. Department of the Treasury estimated that $300 billion is laundered each year in the United States. This represents a significant portion of global money laundering. In 2022, this led to over 11,472 AML events resulting in $14 billion in penalties. The increasing use of cryptocurrencies for money laundering presents a further challenge. For a deeper dive into these statistics, see more detailed statistics here.

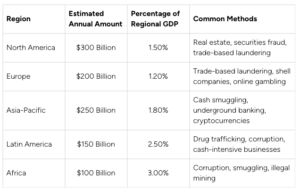

To further illustrate the global scope of this issue, let’s examine some regional data:

Global Money Laundering by Region

This table presents statistics on money laundering activities across different regions to illustrate the global scale of the problem.

As the table shows, money laundering affects all regions, impacting GDP and employing various methods. The percentages of regional GDP affected underscore the significant economic consequences of this criminal activity.

Protecting Your Business and Society

Strong KYC and AML programs do more than ensure compliance. They protect your business, your customers, and the larger economy.

You help build a stable financial system. You do this by identifying and verifying customers. You also watch transactions and report any suspicious activity. These efforts create a strong defense against financial crime. This, in turn, preserves market integrity and promotes sustainable economic growth. A strong KYC AML program is an investment in the future.

Building a KYC Framework That Actually Works

Many businesses see KYC/AML compliance as just another box to tick. Smart organizations turn these requirements into smooth, positive experiences. This builds security and trust with customers. This means shifting from a checklist approach. Focus on efficiency and positive customer interactions instead.

Practical Approaches to Customer Identification

An effective KYC framework finds the right balance between thoroughness and efficiency. This starts with understanding the different levels of risk linked to different customer types. A high-net-worth individual, for instance, might need more in-depth checks than someone opening a basic account.

Customizing documents for lower-risk customers simplifies their experience. At the same time, it ensures that essential checks remain for higher-risk clients. This risk-based approach puts resources where they’re needed most.

Leveraging Verification Technologies

Technology is key to improving KYC efficiency without sacrificing security. Automated document checks, AI risk scoring, and biometric authentication can cut down on manual work. They also speed up processing times.

These technologies not only speed up onboarding but also make it more accurate by reducing human error. This lets compliance teams focus on more complex tasks, like checking suspicious activities.

Implementing Risk-Based Due Diligence

Risk-based due diligence is the foundation of an effective KYC framework. It adjusts the level of scrutiny based on the risk each customer presents. A small business, for example, has a different risk profile than a large multinational corporation.

Businesses can use their resources wisely by focusing on higher-risk customers. They should look at risk factors like industry, transaction volume, and location. This allows for smoother processing of lower-risk accounts while still meeting regulatory requirements.

Optimizing Documentation Requirements

Too much paperwork is a common complaint about KYC processes. But by grouping customers based on risk, businesses can streamline what documents are needed. Low-risk customers might just need basic ID, while higher-risk customers might need to show proof of address or where their funds come from.

This focused method cuts down on hassle for many customers. It also makes sure we collect enough information from those who are higher risk. It improves the customer experience and reduces the workload for compliance teams.

Real-World Examples

Many financial institutions and fintechs have successfully implemented streamlined KYC frameworks. Some people use digital identity verification tools. These tools let customers verify themselves on their phones. Others use automated risk scoring systems for smoother due diligence. These real-world examples show that KYC can be both effective and user-friendly.

Blackbird and similar platforms automate compliance workflows. They provide a straightforward solution for companies that want to enhance their KYC processes and cut down on manual work. For businesses looking to implement or improve their KYC/AML programs, exploring these solutions is a valuable next step. Learn more about streamlining your compliance processes at Blackbird.co.

Navigating the AML Regulatory Landscape With Confidence

The regulatory landscape surrounding Anti-Money Laundering (AML) can be complex. Leading organizations, however, are finding ways to thrive. They are creating flexible frameworks. These will fit needs in various regions and keep operations running smoothly. This involves understanding the core principles of KYC AML and applying them strategically.

Practical Approaches to Risk Assessment

Effective AML compliance begins with a robust risk assessment. This means identifying potential threats specific to your business and industry. Consider these factors: geographic location, customer demographics, and product or service types. A business that sells high-value items may have higher money laundering risks than one selling low-value goods.

After identifying risks, businesses can use resources wisely and target weak spots. This targeted approach maximizes the impact of compliance efforts. This is a core element of understanding practical KYC AML.

Transaction Monitoring and Suspicious Activity Reporting

Robust transaction monitoring systems are essential for detecting suspicious activity. These systems analyze transactions in real-time, searching for unusual patterns. This could mean big transactions, regular transfers to risky countries, or quick changes in customer behavior.

Minimizing false positives is crucial for efficiency. Well-designed systems use algorithms to distinguish between legitimate and suspicious activity, easing the burden on compliance teams. When suspicious activity is detected, prompt and accurate reporting is vital.

Financial institutions must follow procedures for filing Suspicious Activity Reports (SARs). Timely and accurate SARs assist law enforcement in investigating financial crimes. They also demonstrate a commitment to compliance, minimizing the risk of penalties.

Key AML Events: Drug Trafficking and Financial Fraud

Drug trafficking and financial fraud rank among the top AML events worldwide. Between August 2013 and August 2023, drug trafficking accounted for 29.3% of AML events, followed by financial fraud at 22.2%, and money laundering at 17.6%. In the U.S., drug trafficking leads, while in the UK, money laundering is most prevalent.

This shows the growing need for strong KYC and AML procedures. Digital money laundering with cryptocurrencies is on the rise. Learn more in the 2024 Money Laundering and Financial Crime Report.

Building a Proactive Compliance Culture

Navigating AML regulations requires more than just checking boxes. It necessitates a proactive compliance culture embedded within the organization. This begins with training programs that educate employees about AML risks and responsibilities.

When everyone understands compliance, it becomes integral to daily operations. This includes open communication where employees can report suspicious activity without fear. Leadership support is vital for a truly effective program.

Management must demonstrate commitment by allocating resources and fostering ethical behavior. This empowers compliance teams to implement robust procedures and anticipate changing regulations. A strong compliance culture helps fight financial crime. It also boosts reputation and builds customer trust.

Blackbird offers tailored solutions for automating and enhancing these crucial compliance workflows. For more details on streamlining your AML compliance, visit Blackbird.co.

Technology Transforming the KYC AML Landscape

The KYC AML (Know Your Customer/Anti-Money Laundering) rules are always shifting. This change comes from more complex financial crimes. This has led to a growing need for advanced tech solutions that can bolster compliance efforts and effectively reduce risks. Financial institutions face regulatory demands and need easy customer onboarding. Technology offers vital support.

The Rise of AI and Machine Learning in KYC AML

Artificial intelligence (AI) and machine learning (ML) are becoming key players in reshaping KYC AML processes. These technologies help automate tasks, find suspicious patterns, and make better decisions.

-

Automated Customer Onboarding: AI algorithms quickly analyze customer data. They verify identities and assess risk profiles accurately. This leads to faster onboarding, less manual work, lower costs, and happier customers.

-

Enhanced Due Diligence: Machine learning models can find small red flags in customer actions and transactions. These could indicate money laundering or other financial crimes. This allows compliance teams to focus on high-risk cases, making investigations more efficient.

-

Real-time Transaction Monitoring: AI systems watch transactions in real-time. They flag anything suspicious right away. This lets financial institutions react quickly to potential threats and minimize losses.

Biometrics and Identity Verification

Biometric technologies are adding an additional layer of security to KYC procedures.

-

Stronger Security: Biometrics offer more certainty than traditional methods.

-

It’s faster and simpler. This streamlines onboarding and reduces friction.

-

Lower Fraud Risk: Biometric technology uses unique biological traits. This helps cut down the chances of identity theft and account takeover.

Blockchain and Distributed Ledger Technology

Blockchain technology has the potential to make KYC AML processes more transparent and secure.

-

Secure Data Storage: Blockchain keeps customer data safe. Its unchangeable nature protects against tampering.

-

Easy Data Sharing: Distributed ledger technology lets institutions share KYC info safely and efficiently. This cuts down on duplicate work and boosts teamwork.

-

Simplified Compliance: Blockchain solutions can automate compliance tasks. This cuts down on manual labor and boosts accuracy.

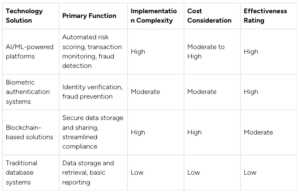

To illustrate the different technological approaches available, let’s examine a comparison of some common KYC AML technology solutions:

KYC AML Technology Comparison

This table highlights the trade-offs between different technologies, with AI/ML and biometrics offering high effectiveness but requiring more complex implementation. Blockchain solutions present a promising future, but currently face higher implementation costs. Traditional database systems are simpler and cheaper, but lack the advanced capabilities of other technologies.

The increasing use of these technologies is driven in part by market growth. Fueled by rising digital transactions and stricter enforcement, the anti-money laundering market is predicted to grow from $2.92 billion in 2024 to $5.98 billion by 2029, a 15.2% CAGR. This growth is fueled by advancements in areas like transaction monitoring, improved KYC processes, and AI-driven solutions. For more detailed statistics, check out this report: Anti-Money Laundering Industry Forecast.

Integrating Technology and Human Expertise

While technology is crucial, human expertise is still essential for effective KYC AML compliance. The most successful compliance teams are those that combine automated systems with human oversight and analysis. This blended approach allows for efficient processing while providing the nuanced understanding needed to identify complex risks. It also ensures that systems are used ethically and responsibly, considering important data privacy concerns. Platforms like Blackbird help bridge this gap by automating routine tasks and offering tools for collaboration and risk management. This allows compliance professionals to focus on strategic decision-making and proactive risk reduction. For more information, explore Blackbird.co.

From Compliance Burden to Business Advantage

Traditionally, KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance have been viewed as costly necessities. However, forward-thinking businesses are recognizing the potential of these frameworks to not only mitigate risk but also drive business growth and enhance customer relationships. Understanding the full scope of KYC/AML transforms compliance from a burden into a strategic advantage.

Building a Culture of Compliance

Creating a culture of compliance requires a shift from simply meeting regulatory requirements to embedding compliance into the core of the organization. This begins with cross-functional teams sharing responsibilities across departments.

For example, sales teams can be trained to identify high-risk customers during initial engagement. Customer service representatives can be empowered to recognize and report suspicious account activity. This distributed approach ensures everyone contributes to maintaining compliance.

Effective training programs are also vital. These programs should equip staff with the knowledge and skills to understand KYC/AML procedures, identify red flags, and follow reporting protocols. Engaging training that goes beyond checklists and incorporates real-world scenarios empowers employees to actively participate in compliance efforts.

Finally, leadership buy-in is essential for securing resources and support for a successful compliance program. When leadership prioritizes compliance, it sets the tone for the entire organization and creates a foundation for long-term success. Adequate resourcing ensures compliance teams have the necessary tools and personnel.

Strengthening Customer Relationships Through Transparency

Implementing KYC/AML procedures doesn’t have to be a negative customer experience. By being transparent about why these checks are necessary and how they protect customers, businesses can build trust and strengthen relationships.

Explaining that identity verification helps prevent fraud and protect customer accounts can reassure customers that their security is a priority. Outlining the steps taken to comply with AML regulations reinforces the company’s commitment to ethical and responsible practices. This open approach fosters customer loyalty and enhances brand reputation.

Enhancing Operational Efficiency Through Automation

While compliance can seem complex, effective implementation can actually enhance operational efficiency. Automating key processes, such as customer identification and document verification, allows compliance teams to focus on higher-risk activities.

This reduces manual effort, lowers costs, improves accuracy, and speeds up customer onboarding. By streamlining these processes, businesses deliver a faster, more efficient customer experience while strengthening their compliance posture.

Achieving Differentiation and Trust-Building

In a competitive market, robust KYC/AML compliance can be a differentiator. Demonstrating a commitment to security and ethical business practices builds trust with customers, partners, and investors. This is particularly valuable in industries like finance and Fintech, where trust is paramount.

For example, a Fintech startup that clearly communicates its robust KYC/AML procedures can attract security-conscious customers. This can be a powerful advantage in a market increasingly concerned with data protection and financial crime.

From Startups to Global Banks: Scaling Compliance

Whether a small startup or a global bank, building a compliance culture that balances security with business growth is possible. Smaller organizations can develop clear, concise KYC/AML policies tailored to their specific needs and risk profiles. Larger institutions can implement sophisticated technology solutions that automate processes and manage complex compliance requirements across multiple jurisdictions. The key is to approach compliance strategically, viewing it as an investment in long-term stability and success.

For a practical approach to automating and enhancing your KYC/AML workflows, explore the solutions offered by Blackbird. Transform your compliance program from a burden into a business advantage.