Investor Onboarding Process: Streamline for Success

Last Revised: May 6, 2025Why a Modern Investor Onboarding Process Matters Now

The financial world runs on relationships. For firms looking to attract and retain investors, the investor onboarding process is the all-important first impression. It’s not just about collecting paperwork. It’s about establishing trust and laying the groundwork for a successful, long-term partnership. So, why is modernizing this process more critical now than ever before?

The Shift From Paperwork to Partnership

Traditionally, investor onboarding involved mountains of paperwork. This often resulted in delays, frustration, and sometimes, missed opportunities. Today’s investors, however, expect a seamless, digital experience similar to what they enjoy in other areas of their lives. Firms clinging to outdated methods risk falling behind.

Think about the difference between completing endless forms and securely uploading documents through an online portal. The latter not only saves time, but also projects an image of efficiency and innovation. This shift is crucial for attracting tech-savvy investors who prioritize speed and convenience.

Compliance and Security in the Digital Age

Investor onboarding has also become increasingly important for fraud prevention and regulatory compliance. In 2022, the Financial Conduct Authority (FCA) in the UK issued a £215.8 million penalty for inadequate onboarding practices. To mitigate such risks, companies are turning to automated verification and onboarding systems.

These systems can onboard investors in seconds while adhering to Know Your Investor (KYI) and Anti-Money Laundering (AML) regulations. Manual verification could take weeks or even months, but technology has dramatically sped up and improved the accuracy of these vital checks. This move towards automation reduces the risk of fraud and strengthens the security and efficiency of the entire onboarding process. Learn more about the importance of KYI and streamlined onboarding: Know Your Investor: Simplifying the Onboarding Process.

The Competitive Edge of a Streamlined Experience

Besides meeting investor expectations and regulatory requirements, a modern investor onboarding process offers a distinct competitive advantage. A smooth, efficient experience can greatly influence client retention and generate positive referrals.

It also frees up staff to focus on building relationships and providing personalized advice, instead of getting bogged down in administrative work. This allows firms to dedicate more resources to client service and ultimately, build stronger partnerships.

In conclusion, modern investor onboarding is no longer a simple administrative task. It’s a strategic necessity for firms that want to succeed in today’s competitive market. By embracing technology and prioritizing the client experience, firms can transform onboarding from a potential weakness into a significant strength. This modernized approach builds stronger client relationships, minimizes risk, and ultimately fuels business growth.

Breaking Through Investor Onboarding Bottlenecks

Even established firms encounter challenges onboarding investors. The process is inherently complex, but this complexity represents an area ripe for improvement. Examining real-world situations helps us identify common weaknesses and see how successful organizations overcome them. This section explores practical solutions to make investor onboarding smoother and improve the overall investor experience.

Common Onboarding Challenges

Many onboarding processes share similar problems. These frequently include slow document collection, verification holdups, and poor communication. These issues can frustrate potential investors, especially those with high-value portfolios, and may even result in losing business.

For example, consider a high-net-worth individual ready to invest. A complicated, paper-based onboarding process could easily discourage them. This not only harms the firm’s reputation but could also lead the investor to other opportunities.

This is particularly true now, as financial institutions face growing pressure to onboard clients quickly and efficiently. Streamlining the investor onboarding process directly affects revenue. Think about corporate clients in banking, where onboarding can take up to 100 days depending on the complexity of services and location. This often leads to client turnover and dissatisfaction. Optimizing this process lets institutions capitalize on market opportunities. Learn more about best practices here: Winning Corporate Clients with Great Onboarding.

Overcoming Hurdles with Strategic Solutions

Solving these challenges demands a multi-faceted approach. Balancing regulatory requirements with a smooth client experience is a critical factor. Finding that balance is a difficult task, but doing so is vital for attracting and keeping investors.

A risk-based approach to verification is one effective strategy. This method adjusts the level of scrutiny based on the risk profile of each investor. Lower-risk clients are onboarded more quickly, while higher-risk individuals and entities still receive the necessary due diligence.

Tailoring Solutions for Different Investor Segments

It’s also important to remember that different investor types need different onboarding strategies. Retail investors, for example, might appreciate simple, fully digital processes. Institutional investors with complex structures, on the other hand, need more specialized attention.

By creating tailored solutions, firms can give every investor a streamlined and efficient onboarding experience. This customized approach improves client satisfaction, builds stronger client relationships, and contributes to lasting success. Effectively addressing bottlenecks creates a positive and productive investor journey, building a solid foundation for a mutually beneficial partnership.

Building Compliance Into Your Investor Journey

This section explores how top financial firms are weaving compliance seamlessly into their investor onboarding process. They’re transforming it from a potential roadblock into a valuable part of the client experience. This proactive strategy not only ensures regulatory adherence but also builds trust and transparency with investors.

Transforming Compliance From Obstacle to Opportunity

Regulations like KYC (Know Your Customer), AML (Anti-Money Laundering), FATCA (Foreign Account Tax Compliance Act), and CRS (Common Reporting Standard) are vital for maintaining the financial system’s integrity. However, these requirements can sometimes create friction during onboarding. Progressive firms are discovering ways to incorporate these checks without impacting the client journey.

For example, imagine investors securely uploading documents via an online portal. This eliminates paperwork, reduces processing time, and provides a modern, efficient experience. It’s a win-win for both the firm and the investor.

Implementing Risk-Based Verification Systems

A smart strategy is implementing a risk-based verification system. This system applies different levels of scrutiny based on the investor’s risk profile. Low-risk clients enjoy faster onboarding, while higher-risk investors receive the necessary due diligence, all without unnecessary hold-ups.

This focused approach streamlines the process and shows a commitment to compliance tailored to each investor. This builds confidence, reassuring investors that their information is handled securely and responsibly.

Maintaining Multi-Jurisdictional Compliance

Working across multiple jurisdictions adds complexity. Each region has its own regulatory requirements, challenging firms to maintain a consistent client experience. Successful firms address this with adaptable compliance solutions.

Think of it like a universal travel adapter. It ensures seamless functionality regardless of the local outlet. Similarly, adaptable compliance systems adjust to different jurisdictional requirements, ensuring a consistent and efficient onboarding experience worldwide.

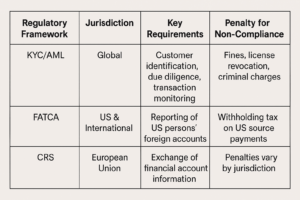

To help illustrate the complexities involved, let’s take a look at a table summarizing key regulatory frameworks and their requirements:

Introduction to the table: The following table provides a simplified overview of the diverse regulatory landscape for investor onboarding. It highlights the varying requirements and penalties across different jurisdictions. This underscores the need for adaptable and robust compliance solutions.

Conclusion of the table: As the table demonstrates, navigating the complex web of global regulations requires a dedicated and adaptable approach. Firms must stay informed and implement flexible solutions to ensure compliance in every jurisdiction they operate in.

The Power of RegTech Solutions

RegTech (Regulatory Technology) is revolutionizing compliance. Automated document verification, AI-driven risk assessment, and real-time monitoring are transforming investor onboarding. RegTech solutions enhance efficiency, accuracy, and transparency.

These tools also allow firms to proactively identify and mitigate compliance risks, protecting both the investor and the firm. This strengthens the client experience and creates a more secure onboarding journey.

Streamlining Documentation Management

Efficient document management is crucial. A centralized repository accessible to both investors and auditors streamlines the process and increases transparency.

Imagine a secure online vault for all investor documents. This simplifies audits, reduces document requests, and ensures information is readily available. It’s a win-win for everyone involved.

By implementing these strategies, financial firms can integrate compliance into the investor onboarding process, creating a positive first impression, fostering trust, and building stronger client relationships. Blackbird offers solutions designed to address these challenges. Learn more at Blackbird.co.

Technology Transforming The Investor Onboarding Process

The financial industry is experiencing a significant technological shift, and investor onboarding is at the forefront. Forward-thinking firms are adopting new technologies to enhance speed, security, and the overall investor experience. This translates to a significant competitive advantage in today’s market.

The Rise of Digital Identity Verification

Digital identity verification is one of the most important advancements in this area. These systems combine AI, biometrics, and data analysis to verify an investor’s identity in minutes. This represents a significant improvement over traditional methods, which often took weeks. This technology significantly reduces onboarding time and strengthens fraud protection.

Imagine an investor verifying their identity through a secure mobile app using facial recognition. This eliminates the need for physical paperwork and manual checks. The result is a faster, more secure process that makes identity theft significantly more difficult.

Automated document processing further streamlines the onboarding workflow. AI-powered systems can extract essential data from uploaded documents, reducing manual data entry and minimizing errors. This leads to increased accuracy and allows staff to focus on more strategic tasks.

However, these technological advances require careful consideration. Balancing increased automation with data privacy is an ongoing challenge. The cost of implementing new technology can be significant, although selecting the right software can result in long-term cost savings by automating labor-intensive compliance tasks.

The Impact of AI and Automation

AI and automation are reshaping the investor onboarding process in several key ways. These technologies can analyze large datasets to assess risk, personalize the onboarding experience, and ensure regulatory compliance. For instance, AI algorithms can detect patterns that suggest potential fraud, flagging suspicious activity for review by compliance teams.

This automation minimizes the risk of financial crimes and improves efficiency. While employee and investor onboarding differ, technology adoption in both areas offers significant benefits. Using technology in employee onboarding has improved both retention and productivity. Similarly, applying AI to investor onboarding enhances compliance and reduces fraud risk. The growing onboarding software market exemplifies the global shift towards digitization. Learn more about these trends: Explore this topic further.

Choosing The Right Technology Partners

Implementing new technology requires careful planning and selecting the right partners. When choosing technology solutions, firms should consider factors like security, scalability, integration with existing systems, and cost-effectiveness. This requires firms to assess their current infrastructure, pinpoint their specific needs, and select vendors who can provide reliable and adaptable solutions.

Preparing the team for these changes is also essential. Training staff on new systems and processes ensures a smooth transition and maximizes the benefits of the new technology.

Integrated Compliance Platforms

Integrated compliance platforms are significantly changing the investor onboarding landscape. These platforms combine KYC/AML checks, document management, and reporting tools into a single, unified system. This centralized approach simplifies compliance management, reduces manual effort, and helps firms meet regulatory requirements.

These platforms often integrate with other systems, such as CRM and portfolio management software, creating a seamless and efficient workflow. This integration removes data silos and streamlines the entire investor lifecycle. Automating these processes is crucial for financial firms, investment funds, and regulated industries to stay competitive and provide an excellent client experience. Blackbird offers solutions designed for these challenges. Discover more about Blackbird at Blackbird.co.

Crafting a Frictionless Investor Experience

Beyond compliance and technology, what truly sets apart an exceptional investor onboarding process? It’s the overall experience. This section explores the psychology and design principles behind onboarding journeys that not only meet but surpass the expectations of today’s investors.

Personalization and Efficiency

A truly frictionless investor onboarding process strikes a balance between personalized service and operational efficiency. Imagine a system that adapts to each investor’s individual profile, automatically adjusting the process based on their risk tolerance and investment objectives. This tailored approach cultivates a sense of individual attention while optimizing the overall workflow.

For instance, a high-net-worth individual may require a dedicated onboarding specialist and bespoke reporting, while a retail investor would likely benefit from an automated, self-service platform. The key is to segment investors strategically and tailor the experience accordingly.

Simplifying Complexity and Providing Guidance

Investor onboarding often involves intricate requirements and regulations. However, these complexities should be handled behind the scenes, providing investors with a clear, concise, and easy-to-navigate experience. Think of a well-designed airport: travelers are guided through complex procedures with minimal stress thanks to clear signage and helpful staff.

Similarly, investor onboarding should offer contextual guidance at every step. This might involve tooltips explaining specific requirements, or interactive checklists that track progress. Providing this type of support reduces confusion and empowers investors to navigate the process confidently.

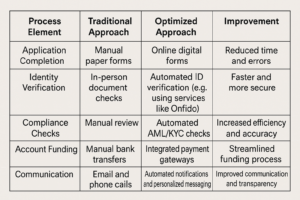

Let’s explore the key differences between traditional and optimized onboarding:

To illustrate the advantages of an optimized onboarding process, consider the following comparison:

This table summarizes how optimized processes leverage technology to streamline each step, resulting in a faster, more efficient, and user-friendly experience.

Creating Moments of Delight

While efficiency and compliance are crucial, a truly exceptional investor onboarding experience goes above and beyond the essentials. Consider incorporating unexpected moments of delight throughout the journey. This could be a personalized welcome video from a senior executive, or a small gift acknowledging a key milestone. These gestures demonstrate a commitment to client satisfaction and foster deeper relationships.

Channel Integration and Human Touchpoints

An effective investor onboarding process seamlessly blends digital channels with human interaction. A robust online platform enables investors to complete tasks at their convenience. However, providing access to human support when needed offers reassurance and builds trust. This might involve a dedicated onboarding team, or a live chat feature for immediate assistance.

This balance of self-service convenience and personalized support creates a truly effective onboarding experience.

Measuring and Eliminating Friction Points

Continuous improvement is vital for any successful investor onboarding process. This involves tracking important metrics, such as completion rates, time to completion, and customer satisfaction scores. This data offers insights into areas where friction still exists.

For example, if many investors abandon the process at a specific step, it indicates a potential bottleneck. This data-driven methodology allows firms to identify and address these friction points, ensuring a smoother and more efficient experience. Blackbird provides a platform to optimize the investor onboarding experience. Learn more at Blackbird.co.

Measuring What Matters in Investor Onboarding

A successful investor onboarding experience isn’t simply about checking off steps; it’s about optimizing each stage for maximum impact. This means moving beyond a checklist mentality and diving deep into the metrics that truly reflect a positive and efficient experience. This section explores the key performance indicators (KPIs) that offer actionable insights and drive meaningful improvements.

Identifying Key Performance Indicators (KPIs)

Many firms fixate on vanity metrics that don’t provide a true understanding of onboarding success. Instead of superficial numbers, focus on KPIs that are directly tied to investor satisfaction and business growth. Some examples include:

- Completion Rates: What percentage of investors successfully complete the onboarding process? A low completion rate can indicate friction points that need attention.

- Time-to-Completion: How long does the entire onboarding journey take for an investor? Streamlining this timeframe can dramatically enhance the investor experience.

- Compliance Accuracy: How effectively does your process adhere to KYC/AML regulations and other crucial compliance standards? High accuracy mitigates risk and protects both the firm and the investor.

- Cost Efficiency: What’s the cost associated with onboarding each new investor? Analyzing this metric can reveal areas for automation and process improvements, leading to reduced operational expenses.

Establishing Meaningful Benchmarks

After identifying your key KPIs, establish benchmarks. These benchmarks provide targets and help measure progress. Research industry best practices and competitor performance to set realistic, yet ambitious goals.

For example, a benchmark for time-to-completion might involve reducing the average onboarding time from two weeks to two days. This provides a clear objective.

Implementing Tracking Systems

Robust tracking systems are essential to effectively measure KPIs. Many onboarding platforms offer built-in analytics dashboards with real-time data on key metrics. Select systems that integrate with existing workflows and offer customizable reporting.

This data-driven approach ensures constant awareness of performance and identifies areas for improvement. It also helps demonstrate the value of onboarding improvements to stakeholders.

Combining Quantitative and Qualitative Feedback

While quantitative data is crucial, it doesn’t tell the complete story. Supplement KPI tracking with qualitative feedback directly from investors. This might involve surveys, feedback forms, or personal interviews.

For example, you could discover that while your time-to-completion is excellent, investors still feel overwhelmed by the amount of required information. This type of insight comes from direct investor communication.

Measuring the Impact on Acquisition and Retention

The success of your investor onboarding process should ultimately reflect in improved investor acquisition and retention rates. Tracking these metrics over time demonstrates the business impact of optimization efforts.

For instance, increased investor referrals after implementing a new onboarding system indicates that your efforts are having a positive impact.

By focusing on the right metrics and combining quantitative data with qualitative feedback, your investor onboarding process can become a key competitive advantage. Blackbird offers a platform designed to help firms improve their onboarding. Learn more at Blackbird.co.

The Future of Investor Onboarding Process

The investor onboarding process is changing rapidly. To stay competitive, firms need to understand and be ready for the emerging trends shaping this critical process. This requires looking beyond current best practices and anticipating what lies ahead.

Decentralized Finance and Self-Sovereign Identity

Decentralized finance (DeFi) and self-sovereign identity (SSI) are set to reshape how investors manage and verify their identities. DeFi removes intermediaries, increasing transparency and control over financial data. SSI empowers investors to own their digital identities, enabling them to securely share information with financial institutions.

This combination of DeFi and SSI has the potential to drastically reduce reliance on traditional KYC/AML (Know Your Customer/Anti-Money Laundering) procedures. Imagine investors verifying their identities through a secure, decentralized platform, eliminating the need for repeated document submissions and manual checks.

The Role of Behavioral Analytics

Behavioral analytics will be increasingly important for understanding investor preferences and creating tailored onboarding experiences. By analyzing online behavior, firms can build more personalized journeys that address each investor’s specific needs. This shift from a one-size-fits-all approach to customized experiences can significantly improve investor satisfaction.

Picture an onboarding system that anticipates an investor’s questions based on their online activity, proactively providing relevant information and guidance.

Addressing Emerging Challenges

As investor onboarding becomes more automated and data-driven, new challenges will naturally emerge. Data security and privacy will be paramount. Firms will need to implement strong security measures and show a firm commitment to protecting sensitive investor information.

Ensuring accessibility for all investors will also be essential. As technology progresses, firms must ensure their onboarding solutions are inclusive and address diverse needs and varying degrees of technological literacy.

Preparing for the Future of Onboarding

To place your organization at the forefront of these changes, consider these points:

- Embrace Innovation: Explore and test emerging technologies like DeFi, SSI, and behavioral analytics.

- Prioritize Security and Privacy: Implement robust security measures to protect investor data and build trust.

- Focus on the Investor Experience: Design personalized and intuitive onboarding journeys that cater to individual needs.

- Stay Agile and Adaptable: Be ready to adjust your strategies as regulations and technology evolve.

By proactively addressing these challenges and embracing new opportunities, financial firms can improve the investor experience and gain a significant competitive edge. Blackbird helps firms navigate these evolving demands with its investor onboarding platform. Learn more at Blackbird.co.