Enhanced Due Diligence Checklist: What Are the 7 Essential Items for 2025?

Last Revised: September 8, 2025Enhanced due diligence (EDD) is a cornerstone of compliance in private markets, where investor structures and regulations are often complex. Beyond basic KYC procedures, when it comes to high-risk clients — firms must conduct extensive checks to ensure reliability as well as compliance with regulatory requirements. However, EDD tends to be burdensome as it is important: a 2024 Accenture survey found that 83% of private equity leaders describe their due diligence practices as outdated, and 75% point to growing deal complexity outstripping their current tools.

When is Enhanced Due Diligence (EDD) Required?

Standard due diligence (DD) applies to every investor as part of basic KYC — verifying identity, collecting documents, and screening against sanctions. EDD, however, is triggered when the risk profile is higher: for example, when onboarding PEPs, investors from high-risk jurisdictions, or complex structures like trusts and multi-layered SPVs.

Enhanced due diligence in private markets often means untangling complex webs of investors, SPVs, and beneficial owners.

This guide highlights seven essential EDD measures to help asset managers, private equity, venture capital, and hedge fund teams streamline onboarding, strengthen compliance, and remain audit-ready.

1. What Is Customer Identity Verification (IDV) and Why Is It Important?

The gist:

Customer Identity Verification (IDV) is the foundation of any due diligence process. It confirms that investors are who they claim to be, reduces onboarding risk, and helps safeguard against regulatory breaches. For enhanced due diligence (EDD) on high-risk clients, firms must go beyond basic ID checks by validating personal details (such as name, date of birth, and address) against multiple official documents. This establishes a reliable baseline before deeper due diligence is conducted. IDV is further supported by sanctions and PEP screening (addressed separately in Sections 3 and 4).

The challenges:

- Collecting and validating documents from global investors can be time-consuming, especially when structures involve SPVs, trusts, or multiple jurisdictions.

- Manual checks across fragmented systems slow down onboarding and increase error risk.

- Privacy and data-handling obligations (e.g., GDPR) add complexity when storing sensitive investor information.

- Overly intrusive requests or repeated document collection can frustrate investors and harm their onboarding experience.

What you should do:

- Ensure automated ID verification tools are integrated into onboarding workflows, minimizing manual exceptions and delays.

- Apply a risk-based approach: lighter checks for low-risk investors, enhanced review for high-risk profiles.

- Provide upfront, standardized document request lists and use a single platform for document uploads to reduce back-and-forth and investor frustration.

- Centralize verification data in a single platform with automated sanctions/PEP updates for audit readiness.

2. Source of Wealth (SoW) and Source of Funds (SoF) Documentation

The gist:

Source of Wealth (SoW) relates to how an investor accumulated their overall wealth, while Source of Funds (SoF) is about the specific money being used for an investment; and both are central to EDD. For asset managers, this step helps mitigate risks of money laundering and ensures that subscription capital originates from legitimate channels. Documentation typically includes audited financial statements, tax returns, inheritance records, or title deeds, among others. This documentation is later validated during ongoing fund flow monitoring (see section 5).

The challenges:

- Complex investor structures (SPVs, trusts, feeder funds) obscure the true source of funds.

- Multi-jurisdiction documentation makes verification slow and inconsistent.

- Reliance on certified translations and notarized documents creates delays.

- High-net-worth investors may see repeated requests for sensitive documents as intrusive.

- Manual review strains compliance resources and risks inconsistent decision-making.

What you should do:

- Align documentation requirements with regulatory expectations (FATF, SEC, FCA, and the EU frameworks) and apply them consistently across all vehicles.

- Apply a risk-based approach: escalate checks only for higher-risk jurisdictions or complex structures.

- Use trusted data providers (e.g., World-Check, LexisNexis) to corroborate investor disclosures.

- Automate document intake and validation to flag missing, expired, or uncertified documents.

Checking SoW and SoF ensures that both the investor’s overall assets and the specific investment capital are legitimate.

3. Politically Exposed Persons (PEPs) and Family Members & Close Associates

The gist:

Screening for Politically Exposed Persons (PEPs) and their Relatives and Close Associates (RCAs) is a core component of enhanced due diligence. Because of their access to public resources and higher exposure to corruption or bribery risks, investors with political connections require heightened scrutiny. For private markets, this means screening investors against reliable PEP databases, identifying family and close business ties, and applying enhanced monitoring where appropriate (as a person’s PEP status may change over time).

The challenges:

- Complex relationships hidden within layered structures.

- False positives from common names and transliteration differences.

- Jurisdictional differences in PEP definitions.

- Resource-intensive monitoring without automation.

- Repeated clarification requests can frustrate investors.

What you should do:

- Rely on trusted global providers such as World-Check for updated and comprehensive coverage.

- Apply a risk-based approach, distinguishing between local officials and senior government figures.

- Combine automation with manual review to clear false positives and investigate complex cases.

- Implement continuous monitoring with adverse media integration.

- Ensure audit trails capture both clearance rationales and escalation steps for regulatory defensibility.

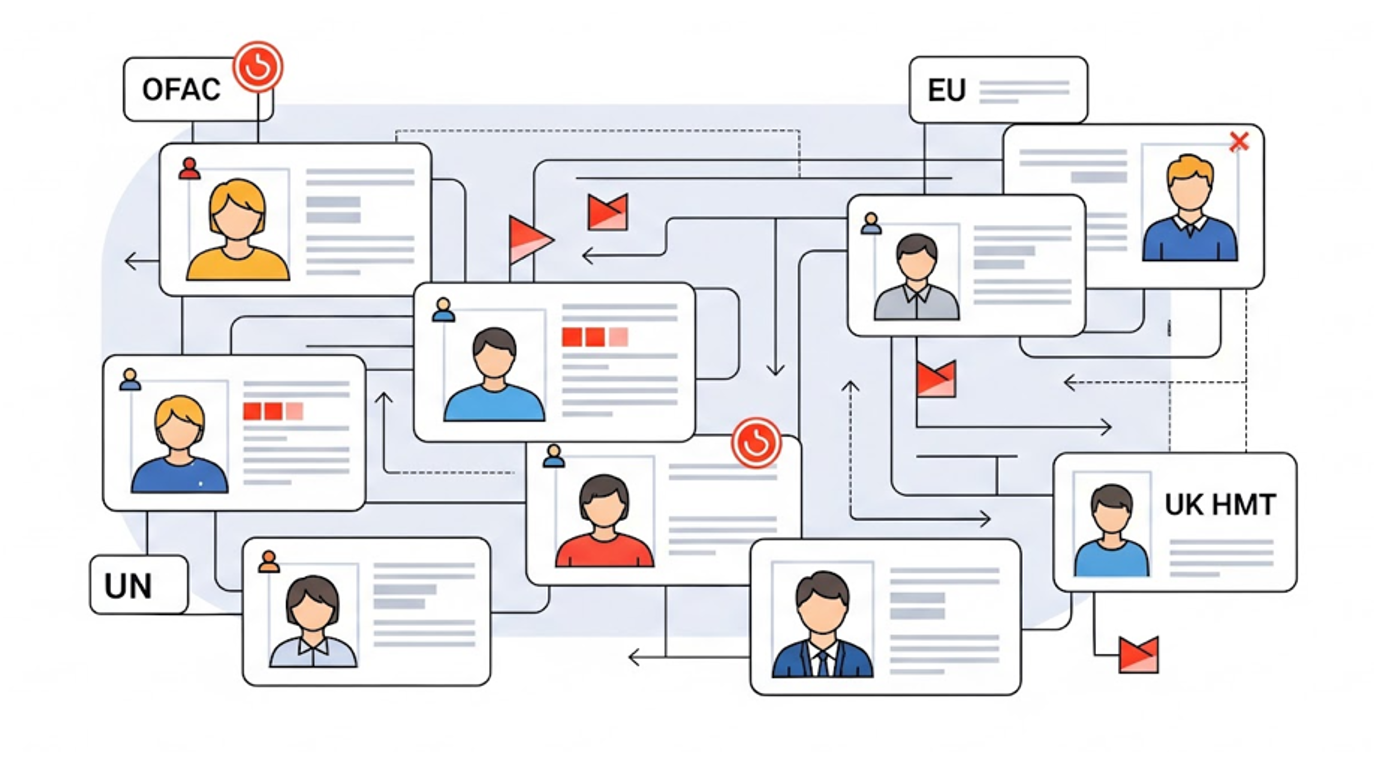

4. Screening Investors Against Sanctions, Watchlists, and Adverse Media

The jist:

Screening investors and their related entities against global sanctions and watchlists is a non-negotiable part of EDD. For private market firms, this ensures that no investor, beneficial owner, or connected entity is subject to restrictions from regulators such as OFAC, the UN, the EU, or the UK HMT. Beyond initial onboarding, sanctions exposure must also be considered at key events like capital calls, distributions, and secondary transfers.

The challenges:

- Complex ownership structures obscure ultimate beneficial owners.

- Multiple overlapping sanctions lists require constant updates.

- False positives from name variations increase manual workload.

- Limited investor data reduces screening accuracy.

- Ongoing monitoring without automation consumes resources.

What you should do:

- Screen at onboarding and all fund lifecycle events (capital calls, distributions, transfers).

- Rely on an enterprise-grade sanctions provider (e.g., World-Check) integrated directly into compliance systems to avoid gaps.

- Combine fuzzy matching with human review to reduce false positives without missing genuine risks.

- Automate continuous re-screening to detect changes in real time.

- Define escalation workflows and document all outcomes for audit readiness.

Effective EDD requires continuous screening of investors and entities against sanctions lists and adverse media to prevent hidden risks.

5. Fund Flow Monitoring and Unusual Transaction Review

The gist:

In private markets, “transaction monitoring” takes a different shape than in banking. Asset managers are not processing thousands of daily payments, but they must still monitor fund flows for unusual activity. This includes ensuring that subscription inflows, capital calls, distributions, and secondary transfers align with the investor’s profile and declared source of funds. The goal is to identify red flags such as unexplained incoming payments from third parties or subscription inflows inconsistent with the investor’s wealth profile.

The challenges:

- Payments from third-party or nominee accounts complicate reconciliation and increase risk of money laundering.

- Cross-border wires in multiple currencies create AML complexity.

- Secondary transfers can obscure the true beneficial owner.

- Disconnected systems between fund admin, finance, and compliance slow detection.

- Manual exceptions increase the risk of missed red flags.

What you should do:

- Reconcile inflows against declared investor accounts; escalate any third-party or nominee payments.

- Screen again at fund events such as distributions, redemptions, and transfers.

- Automate reconciliation and alerts to flag mismatches between expected and actual flows.

- Establish escalation and approval protocols for unusual transactions.

- Train teams to flag anomalies specific to private markets, e.g., capital calls funded from unexpected accounts or redemptions inconsistent with fund terms.

6. Ultimate Beneficial Ownership (UBO) and Business Purpose Verification

The gist:

For private market firms, enhanced due diligence requires full transparency over who ultimately owns or controls an investment. UBO verification ensures firms can identify and verify the individuals behind layered structures such as trusts, SPVs, and nominee vehicles, and confirm that they are not attempting to obscure true ownership. Clear documentation of who the UBOs is, is critical to meet AML standards and to support efficient periodic reviews (see section 7).

The challenges:

- Complex ownership structures (trusts, SPVs, nominee vehicles) obscure UBOs.

- Disclosure requirements vary by jurisdiction.

- Certified translations and notarizations delay onboarding.

- Some investors resist providing full ownership details.

What you should do:

- Standardize UBO documentation and certification requirements across all investors.

- Use technology to map and visualize ownership layers, flagging missing or vague links.

- Escalate high-risk or unexplained structures to senior compliance or legal teams.

- Maintain consistent, audit-ready ownership files accessible across funds.

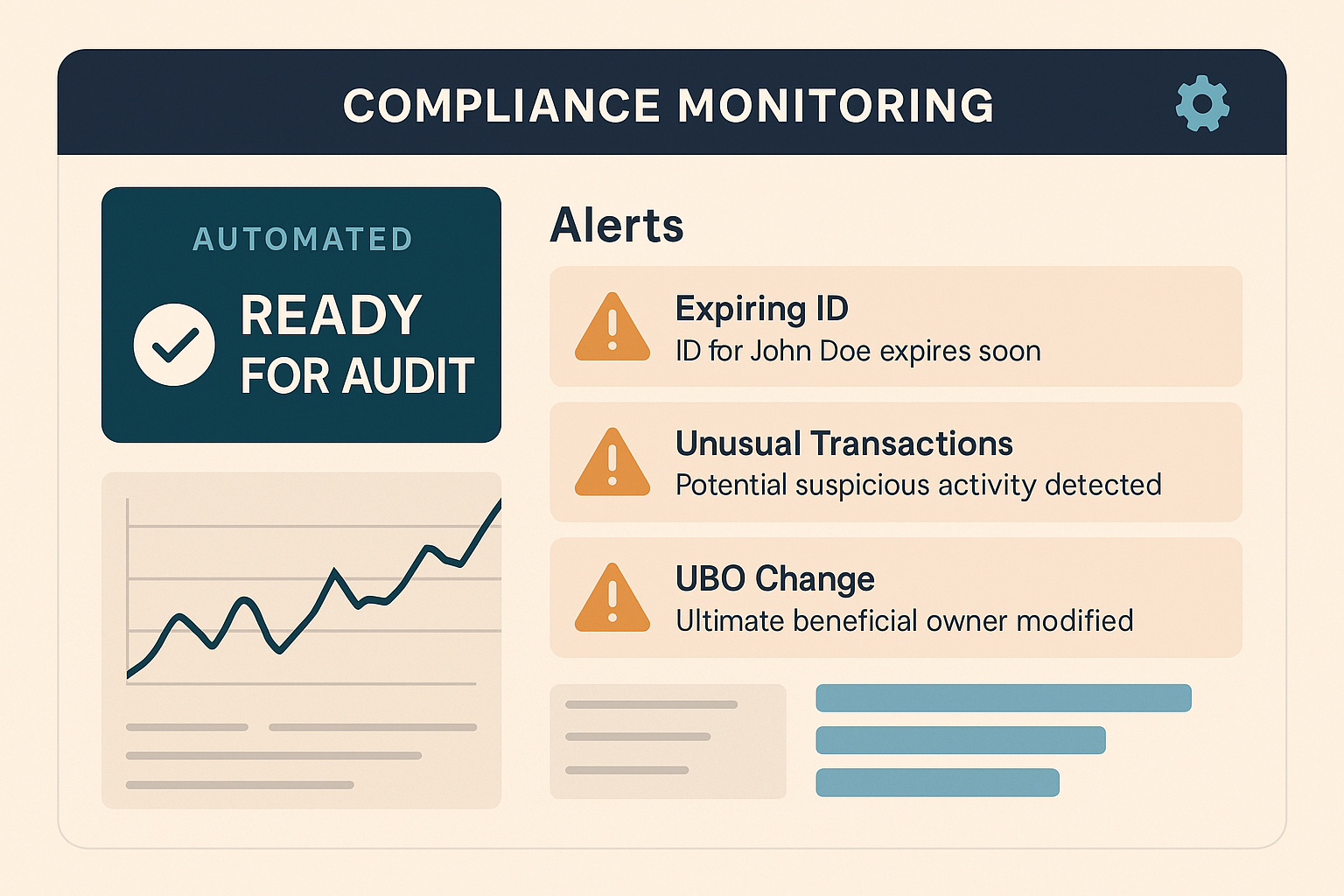

Centralized monitoring dashboards reduce manual work and ensure firms remain audit-ready at all times.

7. Maintaining Continuous Compliance Via Ongoing Monitoring and Periodic Reviews

The gist:

EDD doesn’t end at onboarding. For private market firms, ongoing monitoring and periodic reviews ensure investor risk profiles remain accurate and that firms are audit-ready. Effective monitoring depends on accurate and complete upfront ownership and business purpose verification (see section 6).

The challenges:

- Manual reviews for hundreds of investors consume resources.

- Regulators differ on required review frequency.

- Multi-fund investors may be reviewed multiple times unnecessarily.

- Tracking document expirations (IDs, passports) without automation is difficult.

- Repeated requests risk frustrating investors.

What you should do:

- Apply risk-based review cycles (e.g., annual for high-risk, 2–3 years for normal or low-risk investors).

- Apply reviews based on event triggers (e.g., payments from accounts not disclosed during onboarding, or the emergence of adverse media).

- Automate re-screening and expiry tracking for IDs, passports, and utility bills.

- Centralize investor records to streamline monitoring and reduce duplication.

- Maintain clear audit trails of reviews, updates, and escalation decisions.

The Bottom Line: Embracing EDD Innovation to Stay Ahead

Enhanced due diligence in private markets is complex by nature: multi-layered ownership structures, fragmented documentation, cross-border regulatory requirements, and constant monitoring demands all create significant operational strain. Manual processes can no longer keep pace with investor expectations or regulator scrutiny.

The path forward lies in automation: centralized platforms that streamline document collection, integrate with data providers, synchronize with fund admin systems and CRMs, and automatically trigger reviews when documents expire or risk factors change. Allvue’s 2025 GP Outlook found that 82% of private equity and VC firms have already adopted AI in some form — underscoring that automation is not optional, but essential.

Solutions built specifically for private market firms — like Blackbird — bring these capabilities together in one environment. By combining AI-driven KYC/AML with integrations across World-Check, DocuSign, Salesforce, fund admin systems, and Excel, Blackbird enables firms to accelerate onboarding, strengthen compliance, and scale without adding headcount.

👉 If you’d like to see the Blackbird platform in action, reach out to our team to arrange a demo.

Visit our LinkedIn for more tips, insights, or fun KYC memes.

About the Author

Linoy Doron is a Content Strategist at Blackbird, where she translates complex fintech and compliance topics into clear, actionable insights. With a strong background in technology, SaaS, and UX, she crafts narratives that connect product value to the real needs of asset managers in the private market.