From Static KYC to Perpetual Compliance: What Is Risk-Based Due Diligence?

Last Revised: February 12, 2026At a Glance

Private market firms are moving from static KYC to dynamic, risk-based due diligence as regulators tighten expectations. Automation now makes proportional, continuous compliance both achievable and essential.

Historically, investor due diligence (DD) focused on verifying identity and collecting core documentation. While this confirmed who an investor was, it often failed to uncover what risks they posed, such as complex ownership structures or links to sanctioned entities.

Today’s landscape demands far more. The growing sophistication of financial crime, heightened regulator scrutiny, and investor expectations for faster onboarding require a shift from static verification to continuous, risk-based due diligence management.

In recent years, due diligence frameworks in private markets have evolved dramatically. Firms are increasingly integrating KYC, AML, and broader DD measures into unified, technology-driven platforms, and emerging practices like perpetual KYC (pKYC) — where client data and risk profiles are continuously refreshed — reflect the industry’s shift toward dynamic, risk-aware compliance.

Risk-based due diligence: an industry shift toward dynamic, tech-driven, risk-aware compliance.

What Are the Different Tiers of Due Diligence?

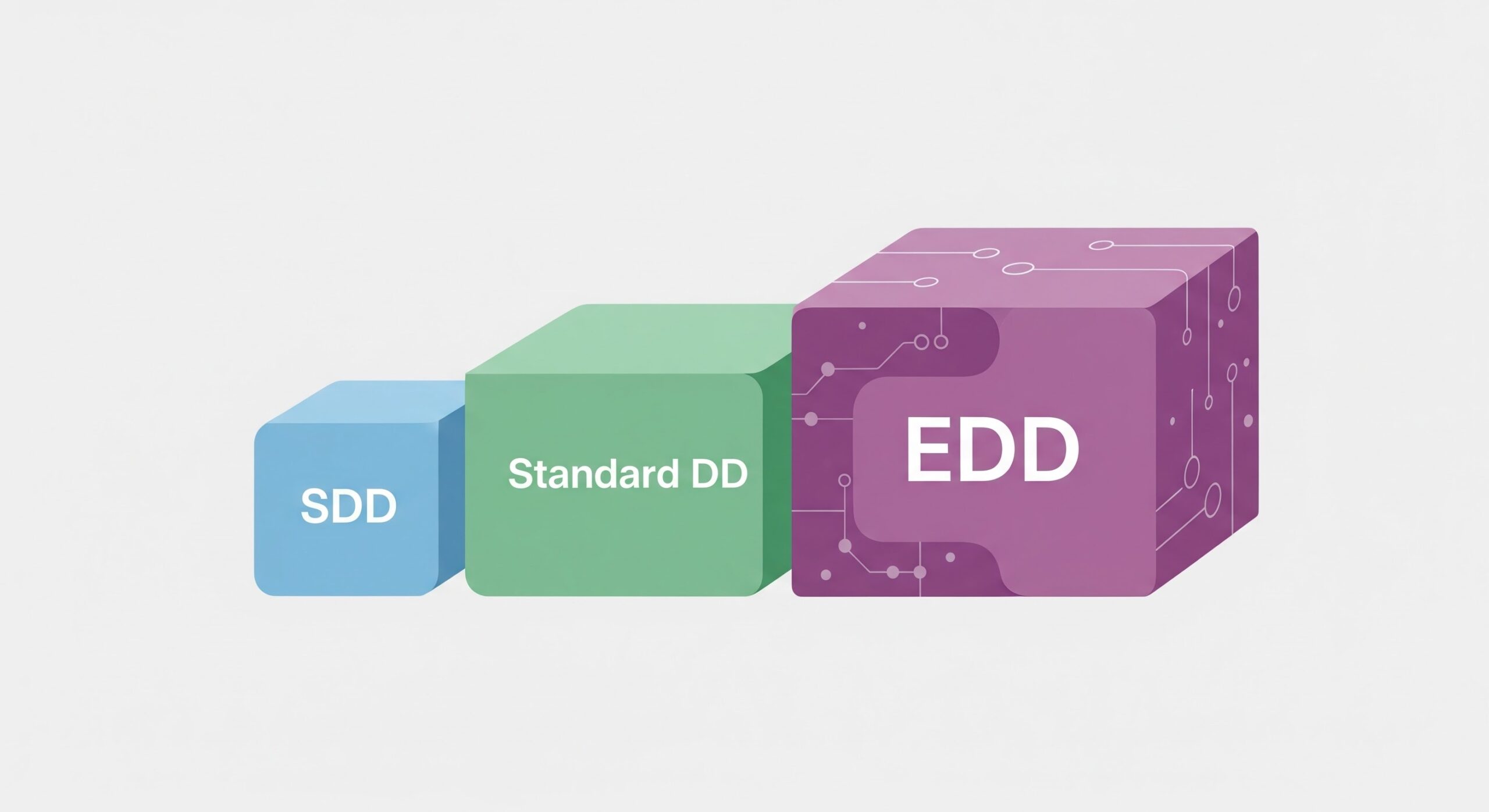

A risk-based approach recognizes that not every investor poses the same level of financial crime risk. Global regulators, including FATF, FinCEN, and the EU’s AML Directives (AMLD) expect firms to apply due diligence proportionate to that risk, resulting in three primary tiers:

Simplified Due Diligence (SDD):

Applied to low-risk investors, such as regulated financial institutions or entities in low-risk jurisdictions. Verification requirements are minimal, allowing faster onboarding while maintaining essential controls.

Standard Due Diligence (SDD):

The baseline for most investors. It covers identity verification, beneficial ownership confirmation, and understanding the nature and purpose of the relationship — ensuring compliance with core AML/KYC obligations.

Enhanced Due Diligence (EDD):

Required for high-risk investors or situations involving complex ownership, high-risk geographies, or politically exposed persons (PEPs). This involves verifying source of wealth and funds, reviewing related entities, and implementing ongoing monitoring. To learn more about EDD triggers and best practices, visit here.

Applying these tiered approaches enables firms to focus resources where risk is highest. Automation platforms like Blackbird can streamline this process by dynamically assigning the right level of due diligence based on real-time risk scoring.

Risk-based due diligence: applying tiered approaches enables firms to focus resources where risk is highest.

Building Your Risk-Based Due Diligence Approach

Not all investors present the same level of financial crime risk. A standardized due diligence process can create inefficiencies and expose firms to unnecessary scrutiny. A risk-based approach, however, allocates resources proportionally — maximizing both compliance integrity and operational efficiency. According to FATF, organisations implementing effective risk-based monitoring identify up to 40% more suspicious activities while reducing compliance costs by 30%.

What is a Risk Score in Due Diligence?

The foundation of a risk-based program is clear, measurable risk criteria. These should align with your firm’s investor profile, regulatory obligations, and jurisdictional exposure.

Common risk factors include:

- Investor type: Individual, corporate, fund-of-funds, trust, or PEP.

- Jurisdictional risk: Residence or incorporation in high-risk or sanctioned countries.

- Source of funds and wealth: Transparency and legitimacy of capital origins.

- Ownership structure: Number of layers, offshore vehicles, or nominee shareholders.

- Transactional behavior: Capital flows inconsistent with the investor’s stated profile.

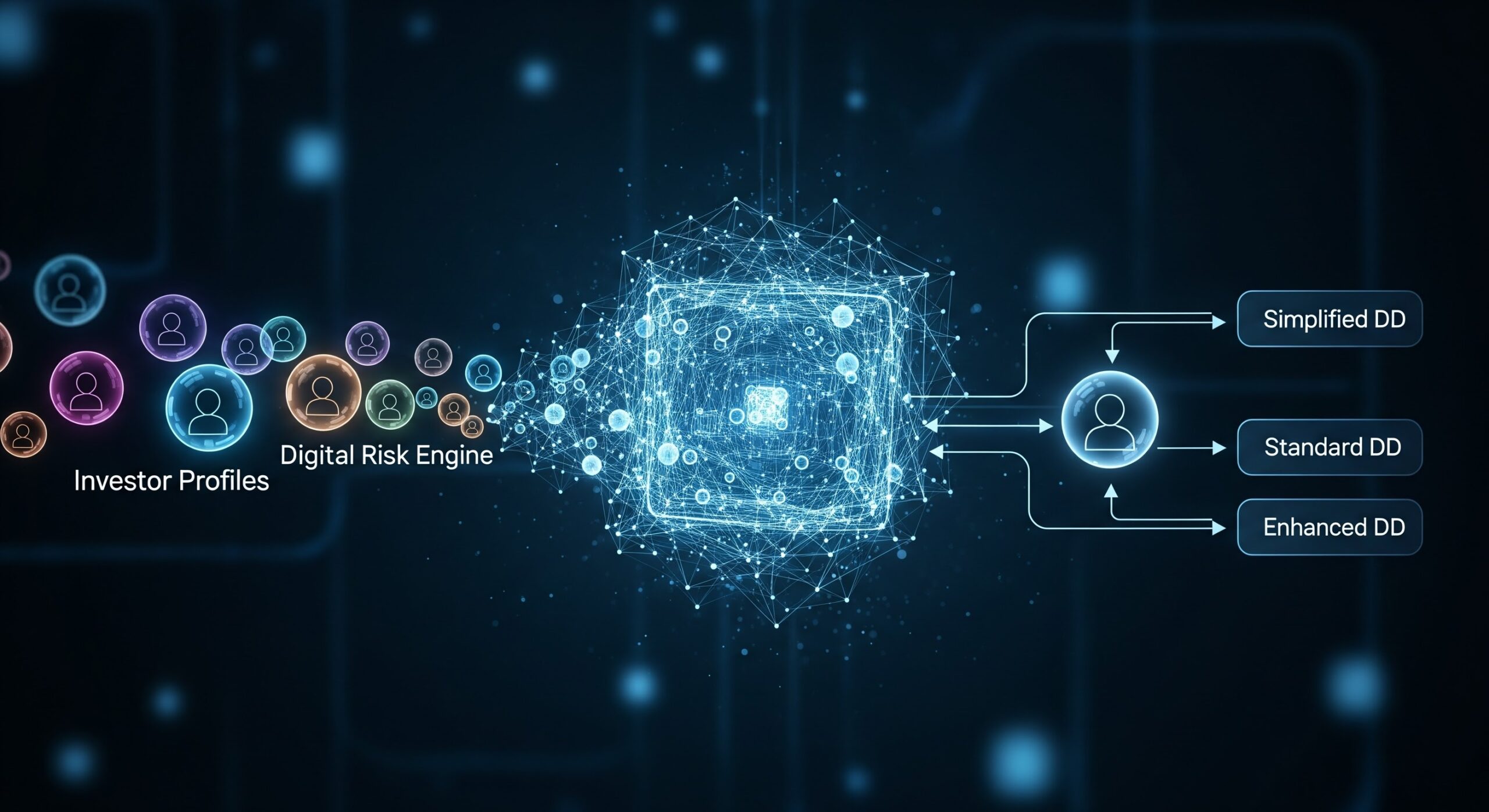

Once criteria are set, each is assigned a weighted value within a risk scoring model. This quantifies overall investor risk, allowing for consistent, auditable decision-making. Automated scoring systems can flag investors exceeding set thresholds, triggering the appropriate level of due diligence.

How Do Risk Matrices Help Assign Due Diligence Levels?

A risk matrix maps investor scores to due diligence levels — typically simplified, standard, or enhanced.

- High-risk investors (e.g., PEPs or entities in offshore jurisdictions) trigger Enhanced Due Diligence (EDD), including source-of-funds validation and ongoing monitoring.

- Low-risk investors (e.g., regulated institutions) undergo Simplified Due Diligence (SDD) with basic verification.

Embedding these matrices into automated workflows ensures consistency, reduces human error, and accelerates onboarding. Platforms like Blackbird can support this by automating classification and maintaining a full audit trail for regulatory review.

Risk-based due diligence: a risk matrix maps investor scores to due diligence levels: simplified, standard, or enhanced.

What Implementation Challenges Are Firms Facing?

Data quality and completeness directly affect risk accuracy. Incomplete or inconsistent investor data can distort scoring and escalate false positives.

Additionally, not all risk factors fit neatly into a model. For example, a low-risk investor might display unexpected fund flows or indirect links to higher-risk entities. Clear escalation procedures for these “mixed indicators” are essential.

Regular model validation and governance oversight ensure continuous improvement. Addressing these operational hurdles allows firms to build agile, regulator-ready due diligence frameworks that adapt to evolving risks while maintaining onboarding efficiency.

Tiered Due Diligence: Building An Action Plan

Turning due diligence principles into consistent practice requires a structured, evidence-based framework. This suggested action plan outlines the key components of a high-performing KYC program — from governance and training to technology enablement and regulator engagement.

Developing Risk-Appropriate Policies and Procedures

Effective policies define how the firm applies its risk-based approach in daily operations. They should align with the firm’s risk appetite, regulatory obligations, and investor profile.

Key elements include:

- Defining responsibilities and escalation paths for KYC and EDD reviews.

- Specifying acceptable documentation and verification standards by investor type or jurisdiction.

- Setting risk thresholds and review frequencies for ongoing monitoring.

Policies should be reviewed regularly to reflect changes in regulation, internal structure, or market exposure, ensuring consistency and defensibility in audits.

Effective policies should align with the firm’s risk appetite, regulatory obligations, and investor profile.

Creating Targeted, Role-Specific Training

Training programs should go beyond compliance theory. They must equip staff with the practical ability to identify red flags, interpret risk scores, and apply judgment under pressure. Role-specific content — for example, onboarding analysts vs. compliance officers — ensures relevance and accountability.

Leveraging Technology for Scalable Compliance

Firms increasingly rely on intelligent automation to handle growing data volumes and regulatory complexity: a 2024 PwC survey across EMEA found that 55% of respondents plan to allocate more than 10% of their AML budget to digital tools over the next two years. AI-driven tools streamline document verification, sanctions screening, and ongoing monitoring — reducing manual error while maintaining a clear audit trail.

Integrated platforms like Blackbird bring these functions together, connecting fragmented data sources, automating document verification and risk scoring, and ensuring that every compliance decision is traceable and regulator-ready.

Integrated platforms connect fragmented data, automate document verification and risk scoring, and ensure traceable audit trails.

Implementing Quality Assurance and Continuous Improvement

Quality assurance remains critical even in automated KYC environments. Rather than manual spot checks, modern QA validates the accuracy and performance of automated workflows and data integrations. Regular reviews highlight anomalies, verify risk scoring logic, and document remediation actions — ensuring that automation remains both effective and well-supervised.

Engaging Productively With Regulators

Transparent communication and well-maintained records are the foundation of successful regulator engagement. Firms should prepare for examinations by maintaining comprehensive KYC files, decision logs, and QA results that are easily accessible for review. When findings arise, timely remediation and documented follow-up show genuine commitment to compliance improvement.

The Bottom Line

Effective risk-based due diligence is no longer optional. It is a regulatory expectation and a commercial necessity. By embedding automated scoring, tiered due diligence, and ongoing monitoring into unified systems, firms strengthen compliance while improving efficiency and investor experience. The future of private market compliance lies in continuous, intelligent assessment — where technology turns complexity into control.

Why Blackbird?

Blackbird brings KYC, AML, and investor due diligence together in one platform — purpose-built for private market firms including private equity, venture capital, and hedge funds.

Our AI-driven automation supports firms in applying a dynamic, risk-based approach while maintaining a full audit trail without extra headcount or fragmented tools. The result is faster onboarding, consistent compliance, and measurable efficiency gains.

Want to see it in action? Book a demo with our team today.

🔗 For more insights (and the occasional compliance meme), follow us on LinkedIn.

About the Author

Linoy Doron is a Content Strategist at Blackbird, where she simplifies complex RegTech and compliance topics into clear, actionable insights. With a background in SaaS, UX, and technology, she connects product value with what asset managers in private markets actually need.