2025 Due Diligence Checklist: 7 Key Areas to Cover

Published: May 5, 2025Navigating the Investment Landscape: Why Due Diligence Matters

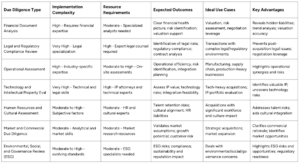

This due diligence checklist provides seven critical areas to examine before any investment. From financial analysis and regulatory compliance to operational assessments and ESG review, this list ensures comprehensive scrutiny. A thorough due diligence process mitigates risks, reveals hidden opportunities, and protects your investments. This checklist empowers informed decisions, setting the stage for successful transactions. Blackbird streamlines the process and minimizes manual effort if you would like to automate your due diligence.

1. Financial Document Analysis

Financial document analysis is a critical component of any robust due diligence checklist. It involves a comprehensive review of all financial documents to assess the target company’s financial health, performance trends, and potential risks. This deep dive provides a clear picture of the target’s financial standing, enabling informed decision-making and potentially uncovering hidden liabilities or growth opportunities. This process is crucial for accurately valuing the target company, justifying the investment, and providing leverage during negotiations. It involves examining a range of documents, including financial statements (income statement, balance sheet, cash flow statement), tax returns, audit reports, cash flow records, debt obligations, and financial projections.

The infographic above summarizes the key aspects of financial document analysis, highlighting the core documents reviewed and the insights they provide. As visualized, the analysis focuses on understanding profitability, solvency, liquidity, and future growth potential. This comprehensive view is essential for a thorough due diligence process.

This analysis typically includes reviewing three to five years of historical financial statements to identify trends and assess the sustainability of performance. It also involves a detailed review of tax compliance to identify any potential liabilities and an assessment of the company’s debt structure and obligations to understand its financial leverage and risk profile. Evaluating cash flow patterns and their sustainability is another critical aspect, offering insights into the company’s ability to generate cash and meet its financial obligations. Finally, comparing financial projections with historical performance helps assess the realism and feasibility of the target company’s future plans.

Key Takeaways:

- Documents Reviewed: Financial statements, tax returns, audit reports, debt obligations, financial projections.

- Key Insights: Profitability, solvency, liquidity, growth potential, risk assessment.

- Time Horizon: 3-5 years of historical data.

These key takeaways serve as a quick reference for the core components of financial document analysis. Moving forward, let’s explore the advantages and disadvantages of this crucial due diligence step.

Pros:

- Comprehensive Financial Picture: Provides a thorough understanding of the target’s financial health and performance.

- Risk Identification: Helps identify hidden liabilities, financial risks, and potential deal breakers.

- Valuation Justification: Enables informed valuation and provides leverage during price negotiations.

- Trend Analysis: Reveals trends that might not be immediately apparent in current financial statements.

Cons:

- Resource Intensive: Can be time-consuming and require significant resources, particularly for complex businesses.

- Specialized Expertise: Requires specialized accounting and financial expertise to interpret and analyze the data effectively.

- Historical Limitations: Historical financial data may not always accurately predict future performance.

- Accounting Method Variations: Financial statements might be prepared using different accounting methods, requiring careful comparison and adjustments.

Examples of Successful Implementation:

- Berkshire Hathaway & Precision Castparts: Warren Buffett’s team conducted extensive financial analysis, revealing consistent cash flow generation that justified the $32 billion acquisition price.

- Microsoft & LinkedIn: Financial due diligence revealed LinkedIn’s significant growth potential, supporting the $26.2 billion valuation despite its limited profitability at the time.

Tips for Effective Financial Document Analysis:

- Standardized Template: Use a standardized financial review template to ensure consistency and thoroughness.

- Benchmarking: Compare financial metrics against industry benchmarks to assess relative performance.

- Cash Flow Focus: Pay particular attention to working capital and cash flow trends, as they are key indicators of financial health.

- Anomaly Detection: Look for unusual patterns or one-time events that might distort the results.

- Specialized Analysts: Engage specialized financial analysts for complex situations or when internal expertise is limited.

Popularized By:

- McKinsey & Company’s due diligence methodology

- Harvard Business Review’s M&A best practices

- Financial Accounting Standards Board (FASB)

Financial document analysis is an indispensable part of the due diligence process. By thoroughly examining a company’s financial records, stakeholders can gain a deep understanding of its financial position, identify potential risks and opportunities, and make informed decisions regarding investments and acquisitions. This rigorous approach ultimately contributes to more successful and sustainable business outcomes.

2. Legal and Regulatory Compliance Review

A crucial component of any robust due diligence checklist is the Legal and Regulatory Compliance Review. This systematic examination delves into all legal facets of the target company, providing the acquiring company with a comprehensive understanding of the legal risks and obligations they would assume post-transaction. This review is not merely a formality; it’s a critical step that can protect the acquirer from unforeseen legal pitfalls and financial liabilities. It helps uncover hidden issues that could significantly impact the deal’s value or even derail the entire acquisition process.

This review encompasses a range of critical areas, including: reviewing corporate records and organizational documents; examining all material contracts and commitments (e.g., leases, customer agreements, vendor contracts); analyzing pending or threatened litigation; conducting a regulatory compliance assessment; verifying intellectual property (IP) rights; and performing an employment law compliance check. By scrutinizing these aspects, potential legal liabilities, contractual obligations, and regulatory hurdles can be identified before the transaction closes.

Why is this essential for your due diligence checklist? This step provides a clear picture of the target company’s legal standing, empowering informed decision-making and strategic negotiation. By understanding the potential legal and regulatory landscape, acquirers can better assess the true value of the target company and negotiate more favorable terms.

Features and Benefits:

- Corporate Records and Organizational Document Review: Confirms the target’s legal structure and proper authorization for the transaction.

- Contractual Obligations Analysis: Identifies ongoing contracts, potential liabilities, and change-of-control clauses that could impact the acquisition.

- Litigation Review: Uncovers pending lawsuits, potential disputes, and associated financial risks.

- Regulatory Compliance Assessment: Determines adherence to industry-specific regulations and potential compliance gaps.

- Intellectual Property Rights Verification: Validates ownership and enforceability of patents, trademarks, and copyrights, crucial for companies with IP-driven business models.

- Employment Law Compliance Check: Assesses compliance with labor laws, minimizing the risk of post-acquisition employment disputes.

Pros:

- Identifies potential legal liabilities before transaction completion.

- Prevents unexpected legal issues post-acquisition.

- Provides negotiation leverage for risk allocation.

- Ensures compliance continuity after the transaction.

Cons:

- Requires highly specialized legal expertise, often increasing costs.

- Can extend timelines significantly due to complexity.

- Quantifying potential legal risks can be challenging.

- International transactions require multi-jurisdictional expertise, adding further complexity.

Examples of Successful Implementation:

- Verizon’s acquisition of Yahoo: Legal due diligence uncovered two major data breaches, enabling Verizon to renegotiate a lower purchase price.

- Facebook’s acquisition of Instagram: Thorough IP review ensured no patent infringement issues threatened the platform’s future.

Actionable Tips:

- Engage specialist attorneys with expertise in industry-specific regulations.

- Create a comprehensive contract review matrix classified by importance.

- Evaluate change-of-control provisions in key agreements.

- Conduct a thorough IP freedom-to-operate analysis.

- Pay special attention to cross-border regulatory requirements if applicable.

Popularized By:

- American Bar Association’s M&A Committee guidelines

- Skadden, Arps, Slate, Meagher & Flom LLP’s due diligence protocols

- World Intellectual Property Organization (WIPO) standards

By incorporating a thorough Legal and Regulatory Compliance Review into your due diligence checklist, you can mitigate risk, protect your investment, and pave the way for a successful acquisition. This step is particularly crucial for CFOs, Investors Relations Managers, and Compliance Officers who need to ensure the financial and legal soundness of the transaction.

3. Operational Assessment

A thorough operational assessment is a critical component of any robust due diligence checklist. This in-depth evaluation delves into the target company’s operational infrastructure, processes, efficiency, capacity, and scalability. It aims to provide a comprehensive understanding of how the target company functions on a day-to-day basis and to identify potential risks and opportunities related to its operations. This includes reviewing production capabilities, supply chain management, quality control systems, operational costs, and identifying any existing or potential operational risks. The goal is to pinpoint potential operational synergies, anticipate integration challenges, and ultimately, inform strategic decision-making.

The operational assessment typically involves several key features: production facility assessments, supply chain resilience evaluations, quality control systems reviews, analysis of operational efficiency metrics, technology infrastructure assessments, and operational risk identification. By examining these areas, the acquiring company can gain a holistic view of the target’s operational landscape.

This stage of due diligence is essential for several reasons. First, it identifies potential operational synergies and integration opportunities, revealing areas where the combined entity could achieve greater efficiency or enhanced capabilities. Second, it highlights operational inefficiencies that could be improved post-acquisition, offering potential cost savings and productivity gains. Third, the insights gleaned from the operational assessment inform the development of a comprehensive post-acquisition integration strategy. Finally, and perhaps most importantly, it can uncover hidden operational costs or risks that might otherwise be overlooked.

Examples of Successful Implementation:

- Amazon’s acquisition of Whole Foods: A key element of Amazon’s due diligence was a detailed assessment of Whole Foods’ distribution networks and supply chain capabilities. This allowed Amazon to seamlessly integrate grocery delivery services into its existing platform.

- Disney’s acquisition of Pixar: Operational due diligence focused on Pixar’s production pipelines and creative development processes, ensuring that the acquisition did not disrupt Pixar’s renowned operational excellence.

Actionable Tips for Conducting an Effective Operational Assessment:

- Use industry benchmarking: Compare the target company’s operational performance to industry averages and best practices.

- Conduct site visits with operational specialists: On-site visits provide firsthand observations and opportunities to interact with key operational personnel.

- Interview operational managers across different departments: Gather diverse perspectives on operational strengths and weaknesses.

- Analyze capacity utilization and bottlenecks: Identify areas where capacity constraints might hinder future growth.

- Map critical operational dependencies and single points of failure: Assess vulnerabilities and develop mitigation strategies.

Pros and Cons of Operational Assessment:

Pros:

- Identifies operational synergies and integration opportunities

- Highlights operational inefficiencies that could be improved

- Helps plan post-acquisition integration strategy

- Reveals hidden operational costs or risks

Cons:

- Requires industry-specific operational expertise

- Time-consuming on-site assessments often necessary

- Operational data may be incomplete or inconsistent

- Cultural aspects of operations can be difficult to quantify

Popularized By: Toyota Production System principles, Boston Consulting Group’s operational due diligence framework, Supply Chain Operations Reference (SCOR) model, Lean Six Sigma methodologies.

For Chief Compliance Officers, CFOs, Investor Relations Managers, and other key stakeholders, the operational assessment provides crucial insights into the target company’s operational health and potential. This step in the due diligence checklist helps mitigate risk by ensuring a comprehensive understanding of the target company’s operational landscape, thereby facilitating informed decision-making and a smoother post-acquisition integration process.

4. Technology and Intellectual Property Evaluation

In any acquisition or significant investment, a comprehensive due diligence checklist is crucial. A critical component of this checklist, and often a deal-breaker, is Technology and Intellectual Property Evaluation. This process involves a thorough assessment of the target company’s technology assets, IT infrastructure, intellectual property portfolio, and overall digital capabilities. This evaluation is essential to understanding the true value, potential risks, and future prospects of the target company in today’s technology-driven market. This item rightfully deserves its place in the due diligence checklist as it can significantly impact the long-term success of the investment.

What it entails and how it works:

This evaluation delves into the core of the target company’s technological foundation. It examines the following key areas:

- Technology Stack and Architecture Assessment: Understanding the underlying technologies used by the target company is vital. This includes analyzing the programming languages, frameworks, databases, and overall architecture to determine their modernity, efficiency, and scalability.

- Software and System Scalability Evaluation: Can the target company’s technology infrastructure handle future growth and increased demand? This assessment ensures the technology can support the projected expansion plans without significant reinvestment or performance degradation.

- Patent and Trademark Portfolio Analysis: A detailed review of existing patents and trademarks helps ascertain the strength and breadth of the target company’s IP protection. This analysis helps identify potential revenue streams, competitive advantages, and legal defensibility.

- Cybersecurity and Data Privacy Assessment: In today’s digital landscape, robust cybersecurity measures are paramount. This assessment identifies vulnerabilities, data breaches risks, and compliance with relevant regulations like GDPR and CCPA.

- Intellectual Property Ownership Verification: Confirming the rightful ownership of all claimed IP is crucial to avoid future legal disputes and ensures the acquiring company receives the full value of the acquired assets.

- Technology Integration Feasibility Assessment: Evaluating the compatibility and ease of integration of the target company’s technology with the acquiring company’s existing systems is crucial for a smooth transition and operational synergy.

- Digital Transformation Maturity Evaluation: Understanding the target company’s progress in adopting and leveraging digital technologies provides insights into their future competitiveness and innovation potential.

Examples of Successful Implementation:

- Google’s acquisition of Motorola Mobility for $12.5 billion: Driven primarily by Motorola’s extensive patent portfolio, Google conducted extensive IP due diligence to assess the value and strength of over 17,000 patents and applications.

- Microsoft’s acquisition of GitHub: A thorough evaluation of GitHub’s distributed version control architecture ensured its scalability and security met enterprise-level requirements before Microsoft proceeded with the acquisition.

Actionable Tips for Effective Technology and IP Due Diligence:

- Engage specialized IP attorneys: Expert legal counsel is essential for accurate patent strength assessment and navigating complex IP legal landscapes.

- Conduct technical debt analysis: Identify hidden technical liabilities and estimate future investment requirements for updating and maintaining existing systems.

- Perform source code reviews for critical proprietary software: Verify the quality, security, and maintainability of core software assets.

- Assess cybersecurity posture through penetration testing: Proactively identify vulnerabilities and strengthen security defenses before they are exploited.

- Evaluate third-party technology dependencies and licensing terms: Understand potential limitations, costs, and risks associated with relying on external technologies.

Pros and Cons:

Pros:

- Identifies valuable IP assets that might justify acquisition premium.

- Reveals technology integration challenges early.

- Validates technology-based competitive advantages.

- Exposes cybersecurity or technical debt issues.

Cons:

- Requires specialized technical expertise in relevant domains.

- Complex technology systems can be difficult to fully assess in limited time.

- IP valuation is often subjective and challenging.

- Technical documentation may be incomplete or outdated.

When and why to use this approach:

Technology and IP Due Diligence is critical anytime a company considers an acquisition, merger, strategic investment, or even a significant partnership. It is particularly important when the target company operates in a technology-intensive industry or when technology plays a significant role in its business model.

Popularized By: Standards and frameworks from organizations like AIPLA (American Intellectual Property Law Association), Gartner’s IT due diligence framework, NIST Cybersecurity Framework, and IBM’s technology assessment methodology offer valuable guidance for conducting effective technology and IP due diligence.

By meticulously evaluating the technology and IP landscape of a target company, investors and acquiring companies can make informed decisions, mitigate potential risks, and maximize the value of their investments. This comprehensive evaluation provides a clear understanding of the target’s technological strengths and weaknesses, empowering stakeholders to negotiate favorable terms and confidently move forward with strategic decisions.

5. Human Resources and Cultural Assessment

A thorough due diligence checklist must include Human Resources and Cultural Assessment. This systematic evaluation of the target company’s workforce, organizational structure, and corporate culture is crucial for understanding potential risks and opportunities related to the human capital. Overlooking this critical aspect can lead to post-acquisition integration challenges, unexpected costs, and even deal failure. This process helps identify key talent retention risks, cultural alignment challenges, and potential HR liabilities that could significantly impact the value of the acquisition. It’s an essential part of any comprehensive due diligence checklist.

How it Works:

The Human Resources and Cultural Assessment involves a multi-faceted approach, analyzing various aspects of the target company’s HR practices and overall cultural landscape. This includes:

- Organizational structure and reporting lines analysis: Understanding the existing hierarchy and reporting relationships is crucial for identifying key personnel and potential redundancies.

- Key personnel identification and retention risk assessment: Identifying top performers and assessing the risk of losing them post-acquisition is vital for maintaining business continuity.

- Compensation and benefits programs review: This helps in understanding the true personnel costs, including hidden benefits, and identifying potential discrepancies that need to be addressed.

- Employment contracts and policies evaluation: A review of existing contracts and policies ensures compliance with legal requirements and identifies potential liabilities.

- Cultural assessment and alignment analysis: Evaluating the target company’s culture and its compatibility with the acquirer’s culture is crucial for successful integration. This involves understanding shared values, communication styles, and leadership approaches.

- HR compliance and litigation history review: This step identifies potential legal risks associated with past or ongoing HR-related issues.

- Talent management systems evaluation: Assessing the target company’s talent acquisition, development, and performance management processes helps understand the strength of their talent pipeline.

Examples of Successful Implementation:

- Microsoft & LinkedIn: Microsoft’s acquisition of LinkedIn provides a prime example of the importance of cultural assessment. Their due diligence led to the decision to maintain LinkedIn as a separate brand with its own distinct culture, rather than forcing a full integration. This strategic decision acknowledged the unique cultural aspects that contributed to LinkedIn’s success.

- Marriott & Starwood Hotels: Marriott’s acquisition of Starwood Hotels demonstrated the value of detailed HR due diligence. By identifying overlapping positions and developing retention strategies for key talent early in the process, Marriott minimized disruption and ensured a smoother transition.

Actionable Tips for Conducting HR and Cultural Assessment:

- Conduct cultural assessment surveys or interviews with anonymized results: This provides valuable insights into employee perceptions and cultural nuances.

- Create retention packages for identified key personnel early in the process: Proactive retention efforts can minimize the risk of losing valuable talent during the transition.

- Review employee turnover patterns and exit interview data: This historical data can reveal underlying cultural issues or management challenges.

- Assess potential labor union or works council implications: Understanding the target company’s labor relations landscape is critical for navigating potential complexities.

- Develop a cultural integration plan before the transaction closes: Planning for integration upfront helps mitigate potential cultural clashes and facilitates a smoother transition.

Pros and Cons:

Pros:

- Identifies critical talent retention requirements.

- Helps prepare integration plans that address cultural differences.

- Reveals potential employee-related liabilities.

- Assesses true personnel costs, including hidden benefits.

Cons:

- Cultural assessment can be inherently subjective.

- Employee morale may be affected by the due diligence process.

- Quantifying cultural integration risks can be challenging.

- Confidentiality concerns may limit access to sensitive HR data.

Popularized By:

- Deloitte’s cultural integration methodology

- Society for Human Resource Management (SHRM) due diligence guidelines

- Edgar Schein’s organizational culture framework

- McKinsey’s 7-S Framework for organizational assessment

Why it deserves its place on the due diligence checklist: A robust Human Resources and Cultural Assessment is not just a box to tick; it’s a critical component of a successful acquisition. For Chief Compliance Officers, CFOs, Investors, and Compliance Directors, understanding the target company’s human capital and cultural dynamics is essential for making informed decisions and mitigating potential risks. This process provides valuable insights into the “people” side of the deal, which is often the most crucial factor in determining long-term success. Neglecting this element can result in costly integration challenges, loss of key personnel, and ultimately, diminished returns on investment. Therefore, Human Resource and Cultural Assessment earns its crucial place on the due diligence checklist.

6. Market and Commercial Due Diligence

Market and Commercial Due Diligence is a critical component of any robust due diligence checklist, especially for mergers and acquisitions. It involves a comprehensive analysis of the target company’s market position, competitive landscape, customer relationships, sales pipeline, marketing effectiveness, and growth potential. This deep dive validates the commercial assumptions underpinning the transaction and identifies both market-related opportunities and risks, enabling informed decision-making and strategic planning. For Chief Compliance Officers, Heads of Compliance, Compliance Directors, CFOs, and Investor Relations Managers, understanding the target’s market standing is crucial for assessing the overall viability and long-term sustainability of the investment.

How it Works:

Market and commercial due diligence scrutinizes various aspects of the target’s commercial operations. This includes analyzing the size and growth trajectory of the target market, assessing the competitive positioning of the target company (including market share and competitive advantages), evaluating customer concentration and the strength of customer relationships, reviewing the effectiveness of the sales organization, assessing the marketing strategy and brand equity, analyzing product/service pricing strategies, and evaluating market share trends and future growth potential. This multifaceted approach builds a holistic picture of the target’s commercial viability.

Features of Market and Commercial Due Diligence:

- Market size and growth trajectory analysis: Understanding the overall market size and its projected growth helps determine the potential for the target company to expand its operations.

- Competitive positioning assessment: Identifying the target’s key competitors, their strengths and weaknesses, and the overall competitive dynamics provides insights into the target’s market position and defensibility. Frameworks like Porter’s Five Forces can be invaluable here.

- Customer concentration and relationship evaluation: Assessing the target’s reliance on key customers and the strength and longevity of those relationships is critical for understanding revenue stability and potential risks.

- Sales organization effectiveness review: Analyzing the structure, processes, and performance of the sales team helps determine the target’s ability to generate future revenue.

- Marketing strategy and brand equity assessment: Evaluating the effectiveness of the target’s marketing efforts and the strength of its brand helps understand its ability to attract and retain customers.

- Product/service pricing analysis: Examining the target’s pricing strategy relative to competitors helps determine its competitiveness and profitability.

- Market share trends and growth potential evaluation: Analyzing historical market share trends and projecting future growth potential provides insights into the target’s long-term prospects.

Pros:

- Validates strategic rationale for the acquisition: Provides a data-driven assessment of the acquisition’s strategic fit and potential for success.

- Provides realistic view of market potential and growth projections: Grounds overly optimistic projections in market realities.

- Identifies customer retention risks and opportunities: Highlights potential vulnerabilities and areas for improvement in customer relationships.

- Helps develop post-acquisition commercial strategy: Informs the development of a robust go-to-market strategy for the combined entity.

Cons:

- Market projections inherently contain uncertainty: Future market conditions are difficult to predict with absolute certainty.

- Competitor information may be limited or difficult to verify: Gathering accurate and reliable information on competitors can be challenging.

- Customer interviews require careful handling to maintain confidentiality: Sensitivity is required when engaging with the target’s customers.

- Rapidly changing markets can quickly invalidate findings: Market dynamics can shift rapidly, impacting the relevance of the due diligence findings.

Examples of Successful Implementation:

- Amazon’s acquisition of Whole Foods Market involved extensive market analysis of grocery shopping trends and the evolving consumer behavior towards online grocery shopping.

- Salesforce’s acquisition of Tableau involved detailed commercial due diligence on the growing data visualization market and enterprise adoption trends.

Actionable Tips:

- Conduct confidential customer interviews to verify relationships: Gain firsthand insights into customer satisfaction and loyalty.

- Use third-party market research to validate internal projections: Ensure objectivity and credibility of market assessments.

- Analyze customer acquisition costs and lifetime value metrics: Understand the economics of customer acquisition and retention.

- Evaluate sales pipeline quality and conversion rates: Assess the effectiveness of the sales process.

- Assess product roadmap alignment with market trends: Ensure the target’s product development aligns with future market demands.

Why Market and Commercial Due Diligence Deserves its Place in the Checklist:

In today’s dynamic and competitive business environment, a thorough understanding of the market and commercial landscape is essential for any significant investment. This element of the due diligence checklist helps mitigate risks, identify opportunities, and ultimately ensures that the transaction aligns with the overall strategic objectives of the acquiring company. Ignoring this crucial step can lead to costly mistakes and missed opportunities. By employing established methodologies such as those popularized by Bain & Company, Porter, BCG, and Gartner, a robust and insightful market and commercial due diligence process can be implemented.

7. Environmental, Social, and Governance (ESG) Review

In today’s business landscape, a comprehensive due diligence checklist must include a thorough Environmental, Social, and Governance (ESG) review. This crucial step, increasingly vital for informed decision-making, goes beyond traditional financial analysis to evaluate the target company’s non-financial performance and potential risks. As part of your due diligence checklist, an ESG review provides a structured evaluation of the target company’s environmental impact, social responsibility practices, and governance structures. This assessment identifies ESG-related risks and opportunities, regulatory compliance issues, sustainability initiatives, and alignment with evolving stakeholder expectations and reporting requirements. Neglecting this aspect can expose your organization to significant financial, reputational, and legal risks.

How it Works:

An ESG review involves assessing the target company across three key pillars:

- Environmental: This encompasses the company’s environmental footprint, including its impact on climate change, pollution levels, resource depletion, waste management, and adherence to environmental regulations. Features include environmental compliance and risk assessment, carbon footprint and climate impact analysis, and supply chain environmental risk assessment.

- Social: This evaluates the company’s relationships with its employees, customers, suppliers, and the wider community. Key areas of focus include labor practices, human rights, community engagement, product safety, and data privacy. Features include social impact and community relations evaluation, labor practices and human rights assessment, and supply chain social risk assessment.

- Governance: This examines the company’s leadership structure, board composition, executive compensation, internal controls, and ethical practices. Features include corporate governance structure review, board diversity and independence evaluation, and ESG reporting and disclosure practices assessment.

When and Why to Use This Approach:

An ESG review should be conducted as an integral part of any due diligence checklist, particularly for mergers, acquisitions, investments, and partnerships. Its importance is amplified when dealing with companies operating in sectors with significant environmental or social impact, such as energy, mining, manufacturing, and consumer goods. Including this in your due diligence checklist provides several benefits:

Pros:

- Identifies potential environmental liabilities and compliance issues, mitigating future legal and financial risks.

- Assesses alignment with investor and stakeholder ESG expectations, enhancing investor confidence and attracting responsible investments.

- Highlights potential reputation risks or opportunities, enabling proactive management of brand image and stakeholder relationships.

- Evaluates preparedness for evolving ESG regulations, ensuring long-term compliance and minimizing future disruptions.

Cons:

- ESG standards and expectations continue to evolve rapidly, requiring ongoing monitoring and adaptation.

- Quantifying ESG risks and opportunities can be challenging, demanding sophisticated methodologies and expert judgment.

- Historical environmental liabilities may be difficult to assess fully, necessitating thorough investigation and potentially specialized expertise.

- ESG reporting practices vary widely across companies and regions, making comparability and benchmarking challenging.

Examples of Successful Implementation:

- Unilever’s acquisition of eco-friendly cleaning products company Seventh Generation included detailed ESG due diligence to verify its sustainability claims and practices. This allowed Unilever to confidently integrate Seventh Generation into its portfolio, minimizing reputational risk and capitalizing on the growing consumer demand for sustainable products.

- When BlackRock acquires companies, their ESG assessment includes climate risk analysis aligned with Task Force on Climate-related Financial Disclosures (TCFD) recommendations. This ensures that BlackRock’s investments are resilient to climate change risks and aligned with their long-term investment strategy.

Actionable Tips for Readers (Chief Compliance Officer, Head of Compliance, Compliance Director, CFO, Investor relations manager):

- Conduct environmental site assessments for physical facilities: This helps identify potential environmental hazards and liabilities.

- Review carbon emissions data and reduction strategies: Assess the target company’s commitment to climate action and its potential exposure to carbon pricing regulations.

- Assess supply chain for environmental and social risks: Ensure that the target company’s supply chain practices align with your organization’s ESG standards.

- Evaluate board diversity and independence: A diverse and independent board contributes to stronger governance and risk management.

- Compare ESG reporting against established frameworks like GRI or SASB: This provides a standardized benchmark for assessing the quality and completeness of the target company’s ESG disclosures.

Popularized By:

The increasing importance of ESG is driven by influential organizations such as BlackRock’s ESG integration approach, Global Reporting Initiative (GRI) standards, Sustainability Accounting Standards Board (SASB) framework, and the UN Principles for Responsible Investment (PRI).

By incorporating a robust ESG review into your due diligence checklist, you gain a more comprehensive understanding of the target company’s true value and potential risks, enabling more informed and sustainable investment decisions. This proactive approach not only safeguards your organization from potential liabilities but also positions you to capitalize on emerging opportunities in a rapidly changing business environment.

Due Diligence Checklist Comparison

Final Thoughts: Integrating Due Diligence into Your Investment Strategy

From scrutinizing financial documents and ensuring legal compliance to evaluating operational efficiency and ESG factors, a robust due diligence checklist is crucial for mitigating risk and maximizing investment returns. This article’s 7-point due diligence checklist—encompassing financial analysis, legal review, operational assessment, technology and IP evaluation, human resources and cultural assessment, market analysis, and ESG review—provides a comprehensive framework for informed decision-making. Mastering these areas allows you to identify potential red flags, uncover hidden opportunities, and ultimately, make more confident and strategic investment choices. For those specifically interested in multifamily investments, a more tailored due diligence checklist can be invaluable. Check out Homebase’s multifamily due diligence checklist for a more specialized approach.

Remember, due diligence is not a one-size-fits-all endeavor. Tailor your due diligence checklist based on the specific investment opportunity, your organization’s risk tolerance, and your overall investment goals. Leveraging tools that streamline the process, like automation and advanced analytics, can significantly enhance the efficiency and effectiveness of your efforts. A well-executed due diligence process empowers you to make data-driven decisions, optimize your portfolio, and achieve long-term financial success. Embrace the power of a comprehensive due diligence checklist, and transform your investment strategy from reactive to proactive.

Streamline your due diligence checklist and improve investment decision-making with Blackbird. Visit Blackbird to learn how its automated platform can enhance your due diligence process and drive superior results.