Compliance Risk Management: Strategic Frameworks for Success

Published: May 18, 2025Navigating the Modern Compliance Landscape

Today’s regulatory environment presents significant hurdles for businesses of all sizes. Compliance risk management is no longer a static checklist; it’s an ongoing process requiring constant attention and adjustment. This necessitates a shift from reactive measures to a proactive, strategic framework. Successfully managing compliance involves grasping the shifting regulatory landscape, understanding the true costs of non-compliance, and integrating compliance into essential business practices.

Understanding the Evolving Regulatory Environment

Regulations are constantly evolving and growing across diverse industries. This continuous change makes it difficult for businesses striving to maintain compliance. Understanding the current regulatory environment is fundamental. For example, when operating in India, review the legal guidelines for conducting employee background checks in India to ensure alignment with local laws.

Staying informed about upcoming regulatory changes is equally critical for effective compliance risk management. A 2023 Thomson Reuters Risk & Compliance Survey found that 61% of corporate risk and compliance professionals ranked staying abreast of upcoming regulatory and legislative changes as their top strategic priority. This highlights the need for proactive monitoring and adaptation in compliance programs. More detailed statistics on compliance can be found here. Companies must actively monitor regulatory updates and adjust their compliance programs accordingly.

The Real Costs of Non-Compliance

The costs of non-compliance extend beyond mere financial penalties. Reputational damage, erosion of customer trust, and operational interruptions can have serious long-term repercussions. Imagine a data breach stemming from inadequate security protocols. The company could face significant fines, and the loss of customer data could severely tarnish its reputation, leading to a decline in business.

This emphasizes why viewing compliance as an investment, not a cost, is vital. Effective compliance risk management is a crucial aspect of protecting and enhancing a company’s overall value.

Reframing Compliance as a Business Enabler

Progressive organizations are transforming their compliance functions from cost centers into valuable assets. By embedding compliance into daily operations and decision-making, these companies are not just mitigating risk; they’re building trust with customers, streamlining operations, and achieving a competitive advantage.

This integrated strategy allows businesses to anticipate and adapt to regulatory changes more readily, minimizing the risk of penalties and disruptions. Ultimately, a robust compliance risk management framework strengthens the organization, fostering long-term sustainability and success.

Building Your Compliance Risk Management Framework

A robust compliance risk management framework is essential for any organization aiming to operate ethically and resiliently. It’s not just a static checklist, but a dynamic system that adapts to the ever-changing regulatory environment. This proactive approach enables businesses to confidently navigate complex regulations and avoid costly penalties. But how can organizations build a truly effective framework?

Key Components of a Robust Framework

A successful compliance risk management framework consists of several interconnected parts, much like the foundation, walls, and roof of a house. Each element is vital to the structure’s overall strength and function.

To better illustrate these components, let’s take a look at the table below:

Table: Core Components of Compliance Risk Management

This table outlines the essential elements of a comprehensive compliance risk management framework and their respective functions within the overall system.

As the table shows, a well-rounded framework encompasses everything from establishing clear roles to responding effectively to incidents. Each component is crucial for maintaining a strong compliance posture. A robust framework also needs to address areas like software development risks. You can find a comprehensive guide on software development risk management for further insights.

Integrating Technology for Enhanced Compliance

Technology plays a crucial role in modern compliance. A 2025 global compliance survey by PwC found that 49% of respondents used technology to manage eleven or more compliance activities. This emphasizes the growing reliance on digital solutions for streamlining processes and boosting effectiveness. The survey also highlighted training (82%) and risk assessment (76%) as the most common compliance activities, underscoring the importance of employee education and proactive risk identification. You can find more detailed statistics here. Tools like automated monitoring systems, data analytics platforms, and compliance management software can greatly improve efficiency and accuracy.

Building a Culture of Compliance

Ultimately, the success of any framework depends on fostering a strong culture of compliance. This means creating a shared understanding of compliance requirements and encouraging everyone to take responsibility for upholding ethical and legal standards. Leadership must prioritize compliance and embed it into the organization’s values and decision-making. This proactive stance shifts compliance from a reactive burden to a proactive business advantage, ensuring long-term sustainability, building trust with stakeholders, and establishing a strong market reputation.

Transforming Compliance Through Technology

The compliance technology landscape offers a diverse range of solutions. However, finding the right fit for your organization requires careful consideration. Which technologies truly enhance compliance risk management? The key is aligning solutions like AI, automation, and specialized platforms with your specific requirements.

Evaluating Technology Solutions Beyond the Sales Pitch

Adopting new technology successfully means looking beyond the surface. Flashy demos are one thing, but practical application is quite another. Similar to evaluating a car purchase, focusing on core functionality is crucial. Consider factors like system integration, scalability, and long-term return on investment (ROI). This thoughtful approach ensures you maximize value and achieve lasting success.

The compliance risk management landscape is also evolving. A Drata 2025 report revealed that 91% of companies plan to adopt continuous compliance within five years. This contrasts with traditional point-in-time models, which 76% of companies find cumbersome. This modern approach has yielded improved business outcomes for three out of four organizations that have adopted it. Learn more about these compelling statistics here. This shift necessitates technology that supports real-time monitoring and automated reporting.

Integrating New Tools with Existing Systems

Seamless integration is a cornerstone of successful technology implementation. New tools should complement existing systems, not operate in isolation. Integrating with your CRM, document management systems, and other vital platforms is essential. This interconnectedness optimizes data flow, minimizes manual data entry, and eliminates redundant processes. A well-integrated KYC platform, for instance, can streamline client onboarding, boosting both speed and accuracy.

Measuring the True ROI of Technology Investments

Demonstrating the ROI of compliance technology can be complex, yet it’s essential for justifying expenses and future investments. The true value extends beyond simple cost savings. While automation reduces operational costs, it also strengthens risk management, minimizing the potential for costly penalties. Automated workflows also free up your team. This allows them to focus on higher-value work, such as proactive risk assessment and strategic planning. Quantifying these broader benefits showcases the real impact of your technology investments.

The Human Side of Technology Implementation

The human element is crucial in any technological transformation. Change management is essential for successful adoption. Provide comprehensive training and support. Ensure your team understands and embraces the new tools. Addressing their concerns and highlighting the technology’s benefits—how it simplifies work rather than replacing jobs—is key. A positive, supportive implementation approach maximizes technology benefits and cultivates a culture of compliance. This fosters a smoother transition, empowering employees to use the technology effectively.

Mastering Risk-Based Compliance Approaches

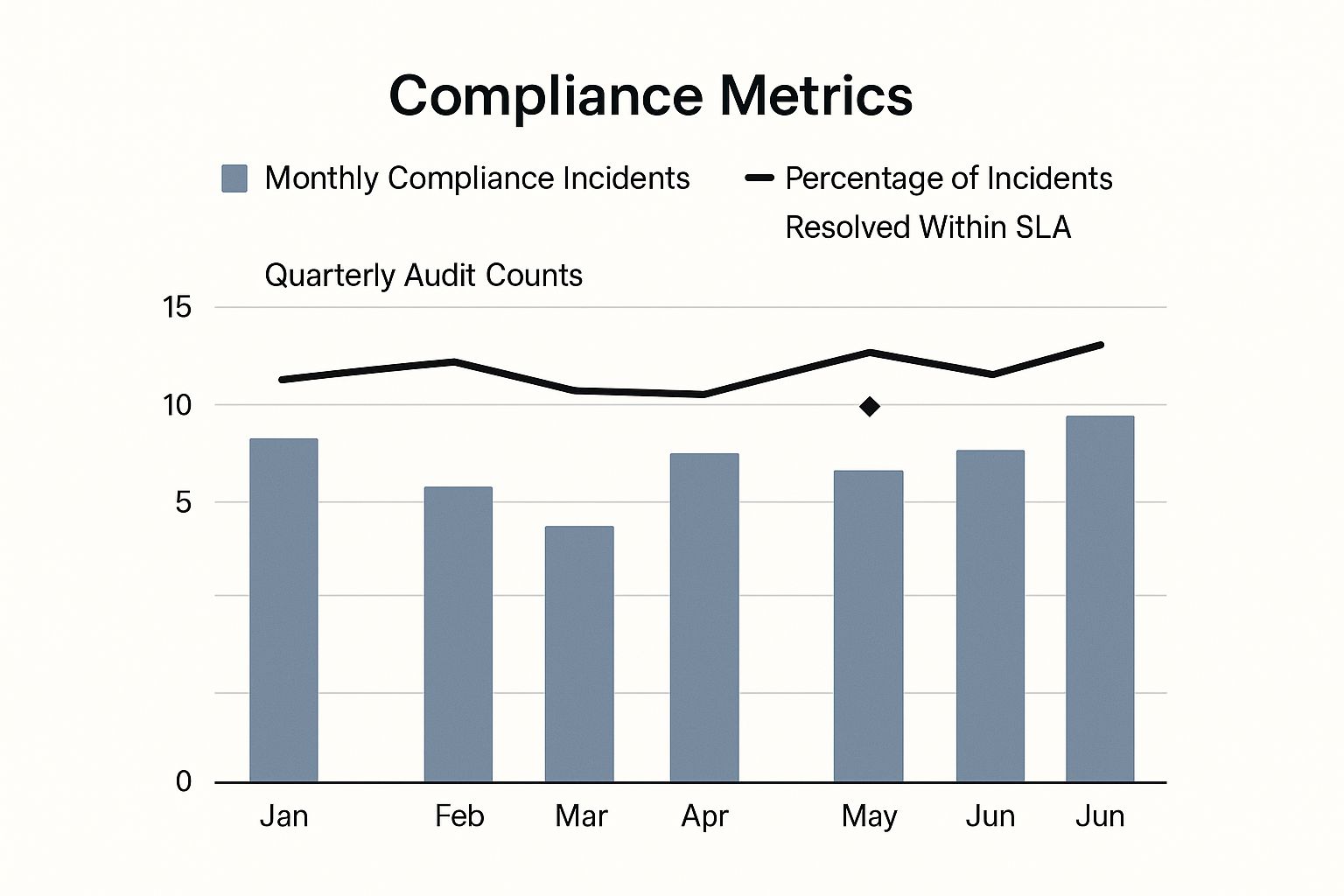

This infographic illustrates monthly compliance incidents from January to June 2024. It shows the percentage of incidents resolved within the service level agreement (SLA) and the number of quarterly audits. The data reveals a concerning trend. While compliance incidents vary from month to month, the percentage resolved within SLA has steadily declined, especially after a surge in incidents in March. This suggests a potential strain on resources or a need for improved processes to ensure timely resolution. The quarterly audit markers also highlight possible connections between audit frequency and incident occurrence.

Not all compliance risks are created equal. A one-size-fits-all approach to compliance risk management can be both inefficient and ineffective. Leading organizations recognize this and prioritize their compliance efforts based on the potential impact and likelihood of each risk. This approach is similar to a triage system in a hospital. It allows for strategic resource allocation, addressing the most critical threats first.

Quantifying Compliance Risks: A Practical Framework

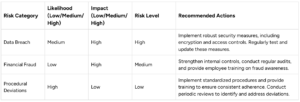

A practical framework for quantifying compliance risks is crucial for effective risk management. This involves identifying potential risks, assessing their likelihood, and evaluating their potential impact on the business. Think of it like this: what’s the risk of a house fire? The likelihood may be low, but the impact would be devastating. This justifies investing in preventative measures like smoke detectors and fire extinguishers.

In the same way, a low-likelihood but high-impact compliance risk, such as a data breach, warrants significant investment in preventative controls. This structured approach helps prioritize resources based on the risk profile.

Establishing Meaningful Tolerance Thresholds

After quantifying risks, organizations need to define their risk tolerance. This is the level of risk they are willing to accept. This involves establishing clear thresholds for different risk categories. For instance, a company may have a very low tolerance for risks related to financial fraud, but a higher tolerance for minor procedural deviations. Like setting a budget, tolerance thresholds provide clear boundaries and guide decision-making.

To help visualize and manage these risks, a Compliance Risk Assessment Matrix is invaluable. This table provides a framework for evaluating and prioritizing different compliance risks based on their likelihood and potential impact.

This matrix helps organizations identify high-risk areas requiring immediate attention and resources, while also managing lower-level risks effectively. This ensures a balanced and proactive approach to compliance.

Allocating Resources Where They Matter

With a clear understanding of risk quantification and tolerance thresholds, organizations can strategically allocate resources to the most critical areas. This ensures high-impact, high-likelihood risks receive the necessary attention and resources, while lower-priority risks are managed efficiently. This focused approach maximizes the effectiveness of compliance efforts.

Moving Beyond Checkbox Compliance

Risk-based compliance goes beyond simply ticking boxes. It promotes a proactive and strategic approach. Instead of merely reacting to compliance requirements, organizations actively identify, assess, and mitigate risks. This shift in mindset transforms compliance from a cost center into a strategic advantage.

Communicating Risk-Based Decisions

Communicating risk-based decisions to stakeholders, including regulators, is crucial. Transparency builds trust and demonstrates a mature and considered approach to compliance. Explaining the logic behind resource allocation and prioritization ensures everyone understands the strategy. Open communication fosters collaboration and strengthens the overall compliance posture.

Creating a Compliance Culture That Actually Works

A robust compliance risk management program hinges on a supportive organizational culture. It goes beyond mere policies and training. It’s about cultivating an environment where compliance is woven into the fabric of every employee’s thinking. This shift transforms compliance from a dreaded checklist into a shared responsibility, ultimately strengthening the organization. But how do successful organizations accomplish this?

Fostering a Culture of Shared Responsibility

A strong compliance culture operates like a well-oiled machine, with each component contributing to its smooth function. Every employee, from entry-level staff to the C-suite, understands their role in upholding compliance standards. This shared understanding encourages proactive risk management and minimizes the chance of violations. For instance, a clear grasp of data privacy policies equips employees to handle sensitive information properly, mitigating the risk of breaches.

Evidence-Based Approaches for Overcoming Resistance

Introducing new compliance initiatives can sometimes be met with resistance. Employees might perceive new procedures as inconvenient or redundant. To address this, organizations can use evidence-based strategies, demonstrating the real benefits of compliance. Showcasing case studies that illustrate how strong compliance practices prevent costly mistakes or reputational damage can effectively counter skepticism. Clearly explaining how new procedures enhance security and protect the organization’s interests can also ease concerns.

Designing Engaging Compliance Training

Traditional compliance training can be dull and ineffective. Engaging training programs, however, can reshape how employees view and interact with compliance. Consider interactive modules, gamified learning, or real-life scenarios. These approaches make training more enjoyable and memorable. Tailoring training to specific roles and responsibilities ensures relevance and maximizes its effect. This personalized approach reinforces the importance of compliance within each employee’s daily work.

Incentive Structures That Reinforce Compliance

Incentive structures can significantly motivate employees to embrace compliance. Recognizing and rewarding employees who consistently demonstrate strong compliance practices reinforces this positive behavior. This could involve formal awards, informal acknowledgment, or integrating compliance metrics into performance reviews. Rewarding teams with the fewest compliance incidents, for example, can encourage proactive risk management and a healthy dose of competition. This fosters a positive feedback loop where compliance is viewed not as a mere requirement but as a valued contribution.

Measuring Cultural Health Beyond Surveys

While surveys can provide valuable data, they shouldn’t be the only measure of cultural health. Organizations should look beyond surveys to other metrics. Analyzing the number of reported compliance incidents or the time it takes to resolve compliance issues can reveal deeper cultural trends. Observing how employees react to new compliance initiatives, their willingness to raise concerns, and their engagement in training programs can provide valuable qualitative information. This multifaceted approach offers a more comprehensive view of the organization’s compliance culture.

Identifying Early Warning Signs of Cultural Breakdown

Detecting cultural problems early is essential for effective intervention. An increase in compliance incidents, a decline in reported potential violations, or a disengaged workforce can all signal a weakening compliance culture. These warning signs alert organizations to underlying issues, allowing for prompt corrective action. Proactively addressing these issues prevents further decline and reaffirms the organization’s commitment to compliance.

Demonstrating the Competitive Advantages of a Strong Compliance Culture

A strong compliance culture isn’t just about avoiding penalties; it’s a competitive edge. It fosters trust with customers, investors, and partners, bolstering the organization’s reputation and attracting top-tier talent. Robust compliance practices also streamline operations, reduce inefficiencies, and minimize the risk of disruptions. This positive effect on the bottom line resonates with stakeholders and reinforces the value of a compliance-focused organization. By showcasing these tangible benefits, organizations can effectively demonstrate that strong compliance is not just a cost center, but a strategic investment in long-term success.

Proving Compliance Program Effectiveness

Demonstrating the value of a compliance program can be a real challenge. How do you quantify the success of something designed to prevent problems? This section dives into the complexities of measuring and communicating compliance effectiveness to different stakeholders. We’ll explore key metrics that go beyond simple activity tracking and focus on genuine risk reduction and tangible business impact.

Meaningful Metrics: Moving Beyond Activity Tracking

Effective compliance risk management involves more than just surface-level activity. Simply counting completed training modules or signed policy acknowledgements doesn’t demonstrate true compliance. Instead, consider focusing on metrics that reveal a genuine reduction in risk.

For instance, tracking near misses or prevented incidents offers tangible proof of your program’s preventative value. Another valuable metric is the time taken to detect and respond to compliance breaches. A shorter response time indicates a more effective and responsive compliance structure.

Developing Dashboards That Speak to Different Audiences

Different stakeholders have different priorities. Operations teams need to see the program’s daily impact, while the Board of Directors focuses on strategic value and overall risk. Creating specific dashboards that provide tailored insights for each group is essential.

An operations dashboard might highlight the efficiency of compliance workflows, for example. A board-level dashboard, however, should focus on overall risk reduction and alignment with strategic objectives.

Quantifying the Preventative Value of Compliance

One of the toughest tasks in compliance is showing the value of prevention. How do you measure something that didn’t happen? One effective strategy is calculating the potential cost of non-compliance.

Estimate the financial and reputational damage a prevented incident could have caused. This helps illustrate the tangible value of the compliance program. For instance, if your program prevented a data breach, calculate the potential costs of fines, legal fees, and reputational harm.

Highlighting the Positive Impact of Compliance

Compliance programs aren’t solely about preventing negative outcomes; they also contribute positively to business growth. A strong compliance framework builds trust with customers, investors, and regulators.

This increased trust can attract investment, improve customer loyalty, and strengthen market position. Highlighting these positive aspects shows that compliance is an asset, not just a cost center. Robust compliance programs can also streamline operations through standardized procedures, leading to greater productivity and cost savings.

Frameworks for Continuous Improvement

Effective compliance needs continuous improvement. Regularly review program performance, analyze metrics, and identify areas for enhancement. Create a feedback loop with stakeholders to gather input and address concerns.

Use performance data to inform future strategies and ensure your program adapts to changing risks and regulatory updates. Regular internal audits can identify vulnerabilities and offer improvements to bolster your compliance posture. This ongoing evaluation is vital for long-term success.