Compliance Automation: Cut Costs & Boost Efficiency

Last Revised: May 6, 2025The New Frontier of Regulatory Management

The regulatory landscape is in constant flux, presenting businesses with a complex and ever-changing set of rules. Keeping up with these shifts is critical for success, but traditional manual compliance methods often fall short. This is where compliance automation steps in, changing regulatory management from a potential problem into a strategic opportunity. Instead of reacting to compliance issues after they occur, businesses can proactively address risks and optimize their operations.

Shifting From Reactive to Proactive Compliance

Manual compliance processes are frequently slow, prone to errors, and require significant resources. They can leave companies open to penalties and damage their reputation. Compliance automation, on the other hand, allows for ongoing monitoring and real-time alerts, which means potential problems can be identified and fixed proactively. This shift from reactive problem-solving to proactive management is vital in today’s rapidly changing business world.

For instance, consider a financial institution manually verifying customer identities. This method is not only time-consuming but also vulnerable to human error. Automated Know Your Customer (KYC) solutions like Blackbird can streamline this process, resulting in faster and more accurate compliance checks.

The Rise of Compliance Automation

The need for effective compliance solutions is reflected in the substantial expansion of the compliance automation tools market. Between 2019 and 2023, the market grew at a Compound Annual Growth Rate (CAGR) of 12.9%, reaching USD 2,521.7 million. This expansion is expected to persist, with projections indicating the market will reach USD 13,402.2 million by 2034. This underscores the escalating need for simplified compliance management solutions across various sectors. For a deeper dive into these statistics, check out this report: Future Market Insights Report on Compliance Automation Tools

Embracing Automation for a Competitive Edge

Progressive companies are adopting compliance automation not simply as a requirement but as a strategic tool. By automating tedious tasks, they free up essential resources that can be focused on core business operations. Furthermore, strong compliance programs can bolster stakeholder trust and elevate a company’s standing in the market. This shift is no longer optional; it’s becoming a necessity for organizations that want to flourish in an increasingly regulated environment. Compliance automation is no longer merely about checking boxes; it’s about creating a resilient and adaptable business ready for the challenges ahead.

Breaking Down The Tech Behind Compliance Automation

Beyond simple rule checks, compliance automation represents a sophisticated blend of technologies working together. These tools go beyond simply automating tasks; they predict and mitigate potential compliance issues. This proactive approach relies heavily on technologies like Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP).

The Power Trio: AI, ML, And NLP

AI powers the analytical engine of compliance automation. It sifts through massive datasets, identifying patterns and anomalies that might indicate a compliance breach. This is where Machine Learning (ML) comes in. ML algorithms allow the system to learn from past data, improving its ability to predict future risks.

This means that instead of simply reacting to existing problems, the system can proactively identify and address potential issues before they escalate. Natural Language Processing (NLP) allows systems to understand and interpret complex regulatory texts, contracts, and communications. This ensures accurate and up-to-the-minute compliance with legal requirements.

For example, imagine a bank using compliance automation to detect fraudulent transactions. AI algorithms analyze transaction data, flagging suspicious activities. ML helps refine these algorithms by learning from past fraud patterns. NLP can then process customer communications related to these transactions, providing further context for investigation.

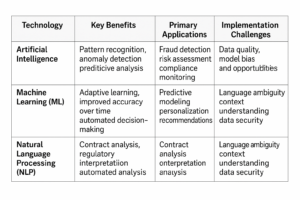

To better understand the technologies driving this shift towards automated compliance, let’s examine a comparison of their key benefits, applications, and implementation challenges.

Key Technologies Driving Compliance Automation

This table highlights how each technology contributes to a robust compliance automation solution. While AI provides the overarching analytical framework, ML refines the accuracy and efficiency of the system over time. NLP adds a critical layer of understanding, allowing the system to interpret complex textual data in a meaningful way.

Cloud-Based Compliance: Accessibility And Scalability

Leading organizations are rapidly adopting cloud-based compliance platforms. The cloud provides flexibility and scalability that traditional on-premise solutions struggle to match. Cloud platforms allow businesses to scale their compliance efforts up or down as needed, paying only for the resources they use.

Additionally, cloud solutions offer accessibility from anywhere with an internet connection, improving collaboration and response times. This increased adoption is fueled by a recognized need for greater efficiency in compliance management. Recent years have seen a surge in technology adoption for this very purpose.

According to a compliance risk study by Accenture, 93% of respondents believe AI and cloud compliance tools can remove human error, automate tasks, and enhance efficiency. Further innovation is expected from technologies like blockchain and the Internet of Things, offering even more sophisticated monitoring and analysis. Learn more about these developing trends here: Compliance Statistics – Sprinto.

The Human Element: Oversight And Strategy

While technology drives compliance automation, human oversight remains crucial. Experts are needed to develop and refine compliance strategies, interpret complex regulations, and manage exceptions. The most successful compliance automation implementations strike a balance between technological capability and human expertise.

This ensures accurate, adaptable, and ethically sound compliance practices. This combination allows organizations to leverage the power of automation while retaining essential human judgment and control.

The Business Case for Compliance Automation

Compliance automation offers substantial benefits that extend far beyond simply checking the regulatory compliance boxes. It creates a strong business case focused on cost reduction, increased accuracy, and improved operational efficiency. This translates into a real and measurable return on investment (ROI) for organizations willing to adopt this technology.

Quantifying Cost Savings and Efficiency Gains

Automation significantly lessens the reliance on manual labor for compliance processes. This directly contributes to lower operational costs, freeing up important resources. Tasks such as data entry, generating reports, and document review can be automated, minimizing the need for large compliance teams. This allows businesses to redirect staff towards more strategic projects.

Furthermore, automation significantly mitigates the risk of costly errors inherent in manual processes. By prioritizing accuracy and consistency, compliance automation helps prevent fines, penalties, and damage to a company’s reputation. These cost savings can be substantial, especially for businesses operating in highly regulated sectors.

Time Savings and Resource Optimization

Compliance automation solutions like Blackbird significantly decrease the time spent on compliance tasks. Automated workflows and real-time monitoring eliminate delays and bottlenecks, accelerating processing times. This increased speed translates into a faster onboarding process for investors and clients, creating a distinct competitive advantage.

Automation also optimizes how resources are allocated by streamlining workflows and eliminating redundant tasks. This empowers compliance teams to concentrate on high-value activities like risk assessment and strategic planning rather than being burdened with tedious manual work.

Reduced Errors and Improved Accuracy

Human error is an unavoidable aspect of manual compliance processes. Automation reduces this risk by ensuring consistent application of rules and regulations. Automated systems can process large amounts of data more accurately than manual efforts, minimizing the likelihood of errors and omissions. This improved accuracy leads to more reliable compliance reporting and a more robust overall compliance posture.

Strengthened Market Position and Stakeholder Confidence

Solid compliance programs foster trust with stakeholders. By demonstrating a commitment to compliance through automation, businesses can bolster their reputation and improve their market standing. This instills confidence in investors, clients, and regulators, making the company a more desirable partner. Strong compliance is a key differentiator in the current business landscape.

For instance, financial institutions using automated Know Your Customer (KYC) and Anti-Money Laundering (AML) solutions can readily demonstrate their dedication to regulatory compliance, attracting more investors and clients. This cultivates a stronger market position and allows for sustainable growth. Compliance automation not only minimizes penalties but also opens doors to unexpected opportunities.

Competitive Advantage and Innovation

Automating compliance functions allows organizations to free up resources and concentrate on innovation and strategic initiatives. This enables businesses to create new products and services, explore new markets, and react to changing market conditions more efficiently. Compliance automation, therefore, becomes a crucial driver for growth and competitive differentiation.

By adopting compliance automation, businesses can go beyond simply meeting regulatory requirements and turn compliance into a strategic advantage. The realized cost savings, improved accuracy, and optimized resource allocation all contribute to a stronger financial performance, while the enhanced reputation and market position pave the way for sustained success.

Building Your Compliance Automation Roadmap

Implementing effective compliance automation takes more than just purchasing software. It requires a carefully planned strategy and a deep understanding of your organization’s specific needs and goals. This section offers a practical roadmap for creating a compliance automation strategy that delivers measurable results. It all begins with a thorough evaluation of your current compliance operations.

Assessing Your Current Compliance Landscape

The first step in building your roadmap is to understand where you stand. This involves a complete review of existing compliance processes. Pinpoint pain points, bottlenecks, and areas that could benefit from automation. Ask yourself these key questions: Where are manual processes causing delays or mistakes? Which compliance tasks are using up the most resources? What are the most significant compliance risks your organization faces?

For example, manually verifying investor identities for KYC (Know Your Customer) compliance can be slow and prone to errors. Automating this process with a solution like Blackbird can significantly improve both efficiency and accuracy. This initial assessment sets the stage for your entire automation strategy.

Identifying High-Impact Automation Opportunities

After you’ve identified your challenges, prioritize automation opportunities based on their potential impact. Concentrate on areas where automation can provide the greatest return on investment (ROI) in terms of cost savings, risk reduction, and efficiency gains. Think about which processes are the most repetitive, time-consuming, or susceptible to errors. These are usually the prime candidates for automation.

Also, look for ways to improve data management and reporting. Automated systems can bring together compliance data into a central location, simplifying tracking, analysis, and reporting on compliance performance. This streamlined access to information is essential for informed decision-making and demonstrating compliance to regulators.

Building Stakeholder Buy-In

Successful compliance automation requires organization-wide support. Communicate the benefits of automation to key stakeholders, including compliance officers, IT staff, and business leaders. Clearly explain how automation will improve efficiency, lower costs, and lessen risk. When everyone understands the vision, the implementation process goes much more smoothly.

Involve stakeholders in the planning and implementation phases. Their input is invaluable for making sure the automation solution you choose aligns with the organization’s broader goals. This collaborative approach fosters a sense of ownership and increases the chance of a successful outcome.

Avoiding Common Pitfalls

Many compliance automation initiatives fail because of insufficient planning and execution. One common mistake is trying to automate too much too quickly. It’s better to start with a pilot project focused on a specific compliance area. This approach allows you to test and refine your strategy before implementing it on a larger scale. Another pitfall is overlooking the human element. While technology is crucial, human oversight and expertise are still essential.

Remember that compliance automation is not a one-and-done solution. Regulations evolve, so your automation solution must adapt. Create a process for ongoing monitoring, review, and adjustments to ensure your compliance program remains effective in the long term.

To help visualize the implementation process, let’s look at a sample roadmap.

A Compliance Automation Implementation Roadmap can guide you through the different stages of implementation and provide a framework for success. This table outlines the key phases and activities required for effective compliance automation:

This roadmap helps ensure a structured and efficient approach to compliance automation, maximizing the chances of achieving your desired outcomes.

Establishing Meaningful Metrics

To measure the success of your compliance automation efforts, set clear metrics and Key Performance Indicators (KPIs). Some examples include:

- Reduced compliance costs: Track the decrease in expenses related to manual processes, fines, and penalties.

- Improved accuracy rates: Measure the reduction in errors and omissions in compliance reporting and other tasks.

- Time savings: Quantify the amount of time saved by automating manual processes, such as data entry and document review.

- Increased efficiency: Monitor how automation streamlines workflows and resource allocation.

Regularly reviewing these metrics provides valuable insights into the performance of your program and highlights areas for improvement. This data-driven approach ensures that your strategy is delivering on its promises.

Industry-Specific Compliance Automation Strategies

Compliance automation, while based on core principles, needs a customized approach for different industries. This exploration delves into how various sectors are using automation to address their specific regulatory hurdles. We’ll examine how financial services firms handle Anti-Money Laundering (AML) and Know Your Customer (KYC), how healthcare providers manage HIPAA, and how manufacturers approach regulatory reporting.

Financial Services: Navigating AML and KYC

Financial institutions are under intense pressure regarding AML and KYC regulations. Manually verifying customer identities and monitoring transactions for suspicious activity is not only labor-intensive, but also error-prone. Automation solutions, like Blackbird, provide a way to improve these processes.

Blackbird, for example, automates data collection, document verification, and risk classification, freeing up compliance teams to focus on more complex investigations. This boosts efficiency and improves accuracy, minimizing the risk of penalties and damage to reputation.

- Automated identity verification: Quickly and accurately confirms customer identities for smoother onboarding.

- Transaction monitoring: Flags suspicious activity in real-time, allowing for quick intervention.

- Risk scoring: Assigns risk levels to customers based on various data points to help prioritize investigations.

These automated features noticeably improve compliance efficiency and lessen the load on compliance teams.

Healthcare: Ensuring HIPAA Compliance

Healthcare organizations deal with the constant challenge of maintaining HIPAA compliance, which requires strict control over patient data. Automation has a critical role in ensuring data security, access control, and comprehensive audit trails.

- Automated data encryption: Protects sensitive patient data from unauthorized access.

- Access control management: Makes sure only authorized personnel can access specific data.

- Audit trail automation: Creates a thorough record of all data access and changes for simpler audits.

Automation empowers healthcare providers to reinforce data security and streamline compliance processes, minimizing the risk of data breaches and related fines.

Manufacturing: Streamlining Regulatory Reporting

Manufacturers must comply with numerous industry-specific regulations related to product safety, environmental protection, and labor practices. Compliance automation can significantly reduce the difficulties of regulatory reporting.

- Automated data collection: Collects necessary data for compliance reports from diverse sources.

- Report generation: Automatically produces compliance reports in the necessary format.

- Real-time monitoring: Tracks important metrics and warns manufacturers of potential compliance problems.

This automation helps manufacturers improve reporting accuracy, save time, and meet regulatory deadlines. By streamlining these processes, they can concentrate on core business activities.

Tailoring Automation to Your Industry

While these examples highlight specific uses within certain industries, the core concept is the same: pinpoint your specific challenges and tailor automation solutions to solve them. It’s essential to figure out which compliance functions offer the best potential for automation within your sector. Examining successful implementations by similar organizations will give you valuable insight for your own strategy. Compliance automation isn’t a universal solution, but rather a powerful tool adaptable to the particular needs of any industry.

Measuring Success: Beyond Checkbox Compliance

Successfully implementing compliance automation involves more than simply meeting minimum requirements. It’s about achieving measurable results that have a positive impact on your business. This means looking beyond basic compliance rates and focusing on metrics that truly demonstrate the value of your automation efforts. Tracking efficiency improvements, cost savings, and quantifying risk reduction reveals the real impact of compliance automation.

Key Performance Indicators (KPIs) for Compliance Automation

To effectively measure the success of your compliance automation program, establish clear Key Performance Indicators (KPIs). These metrics should go beyond simple compliance rates and delve into the operational efficiencies and cost savings that automation provides.

- Reduction in Compliance Costs: This KPI tracks the decrease in expenses associated with manual compliance processes. Think staffing, auditing, and, crucially, fines and penalties. This metric clearly demonstrates the direct financial benefits of automation.

- Improved Accuracy and Reduced Error Rates: Automation minimizes human error, resulting in more accurate compliance reporting and data management. Tracking the reduction in errors highlights the increased reliability of your processes.

- Time Savings and Efficiency Gains: Measure the time saved through automated workflows. This includes processes like data entry, document verification, and report generation. These gains illustrate how automation streamlines operations and frees up valuable employee time for strategic work.

- Resource Optimization: Automation facilitates better allocation of your team’s resources. Track how automation empowers your team to focus on higher-value activities, such as risk assessment and strategic planning, instead of tedious manual tasks.

- Faster Incident Response: Automation helps identify and address compliance issues more efficiently. Measure the time it takes to resolve incidents, showing how automation minimizes the impact of potential breaches.

- Improved Risk Management: While more challenging to quantify, assess how automation helps identify and mitigate compliance risks. Fewer incidents and improved control over compliance data indicate better overall risk management.

Building Real-Time Dashboards for Compliance Visibility

To effectively monitor these KPIs, build dashboards that provide real-time visibility into your compliance performance. These dashboards should present key data points in a clear, concise format, allowing you to quickly grasp your current compliance posture.

For example, visualize trends in compliance costs, error rates, and time savings. This allows you to identify areas where automation is performing well and areas that require attention. Real-time reporting allows for proactive adjustments and ensures your automation strategy remains effective in a changing regulatory landscape.

Benchmarking and Continuous Improvement

Benchmark your automation maturity against industry standards and your peers to uncover areas for growth. This helps you understand how your organization compares to competitors and top performers. Use this information to guide your compliance automation roadmap and set realistic goals for ongoing improvement.

Compliance is not a static target. Regulations evolve frequently. Establish a framework for continuous improvement to ensure your compliance automation program adapts to these changes. Regularly review your KPIs, assess your processes, and adjust your automation strategy as needed. This ongoing effort ensures your organization remains compliant and your automation initiative continues to deliver value.

Ready to transform your KYC and investor onboarding processes? Blackbird automates compliance workflows, reducing manual effort and accelerating due diligence.