AML Compliance Checklist: Your Essential Guide for 2026

Last Revised: January 7, 2026At a Glance

This checklist outlines the seven core elements of AML compliance for private fund managers in 2026, with practical steps to strengthen frameworks and streamline processes.

AML compliance is now a defining challenge for private fund managers. Regulators across Cayman, Luxembourg, the U.S., and the U.K. expect firms to apply consistent, risk-based standards — even as investor structures grow more complex and cross-border capital flows increase.

This checklist highlights the essential elements of a modern AML program in private markets: from investor due diligence and risk assessments to monitoring fund flows, maintaining records, and managing obligations across multiple domiciles. It is designed for compliance officers, operations teams, and senior managers who want a clear view of what regulators look for — and practical steps to strengthen their frameworks.

Private fund managers face rising AML expectations across global jurisdictions.

1. Investor Due Diligence: Why Does Thorough Onboarding Matter?

ℹ️ The gist:

Investor Due Diligence (IDD) is the foundation of AML compliance. It ensures managers understand who their investors are, the source of capital, and the risks involved. IDD typically includes:

- Identity verification for individuals and institutions (e.g., passports, corporate registration, regulatory licenses).

- Ultimate Beneficial Owner (UBO) checks for structures such as trusts or SPVs.

- Sanctions and PEP screening.

Ongoing monitoring of investor profiles, including updates to ownership, jurisdiction, and payment instructions.

A risk-based approach is essential. For example, an EU pension fund may require lighter checks than an opaque offshore vehicle. Thorough documentation also provides the audit trail regulators expect.

🧩 The challenges:

- Complex entity structures: A single investor relationship may involve multiple legal entities or feeder funds.

- Multi-jurisdictional requirements: Rules differ across domiciles (e.g., Cayman vs. Luxembourg vs. Delaware).

- Document collection delays: Institutional LPs often have slow internal processes.

- Incomplete ownership visibility: Some structures make UBO identification difficult.

- Manual workflows: Heavy reliance on email and spreadsheets creates inefficiencies and audit risks.

🔩 What you can do:

- Apply a tiered, risk-based approach to investor due diligence, adjusting depth of checks by risk level.

- Automate document collection and screening to reduce manual effort and onboarding timelines.

- Define clear escalation procedures for high-risk cases (e.g., review by MLRO before approval).

- Refresh investor records regularly in line with jurisdictional requirements (e.g., every 1–3 years).

- Tailor staff training so onboarding and compliance teams can spot red flags in fund-specific contexts, such as unusual subscription structures or sudden wire instruction changes.

2. How Do You Build an AML Risk Assessment Framework Across Fund Structures?

ℹ️ The gist:

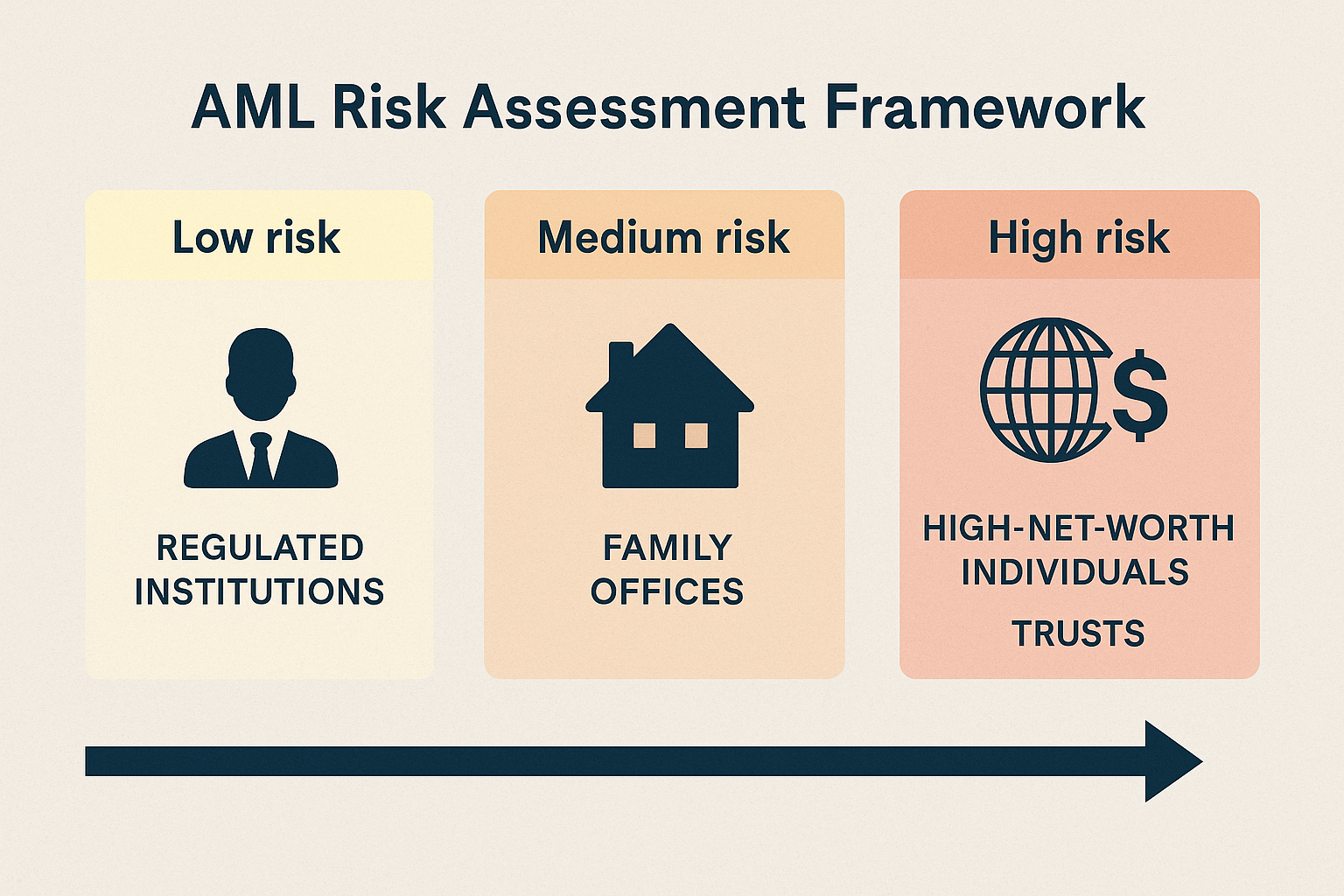

An AML Risk Assessment Framework helps managers identify and prioritize risks tied to money laundering or terrorist financing, and allocate resources accordingly.

A strong framework typically includes:

- Investor risk categorization.

- Geographic risk assessment.

- Fund structure risk analysis.

- Transaction risk assessment (capital calls, distributions, subscriptions).

- Documented methodology for scoring and review.

This not only guides resource allocation but also shows regulators and investors proactive risk management.

🧩 The challenges:

- Evolving risk landscape: Political instability, sanctions regimes, and regulatory changes require frequent reassessment.

- Fragmented data: Information is often scattered across administrators, internal teams, and legacy spreadsheets.

- Complex fund structures: Master-feeder arrangements, SPVs, and parallel funds add layers of complexity.

- Cross-team alignment: Compliance, operations, and investor relations must share risk insights for the framework to be effective.

🔩 What you can do:

- Review and refresh annually (or more often) to ensure the risk assessment reflects current investor base and global developments.

- Use both qualitative and quantitative inputs, such as investor type, jurisdiction, ownership transparency, and historical changes to investor profiles.

- Engage stakeholders across compliance, legal, ops, and investor relations so risk insights are embedded across the firm.

- Document methodologies clearly to provide an auditable trail for regulators and investors.

- Link the framework to enhanced due diligence procedures so higher-risk investors are escalated for deeper review before onboarding.

An AML Risk Assessment Framework helps managers prioritize resources and align with regulator expectations.

3. Transaction Monitoring in Private Markets: What Should You Look For?

ℹ️ The gist:

In private markets, transaction monitoring focuses on large fund-related flows, not retail-style activity. While visibility is more limited than in banking, it remains a critical control: in 2024, PwC reported that 30% of EMEA institutions rank transaction monitoring as a top AML investment priority.

The core goal is to ensure:

- Capital calls come only from verified accounts.

- Distributions go only to approved beneficiaries.

- Wire instruction changes are verified.

- Unusual patterns (e.g., third-party wires, unexpected jurisdictions) are flagged.

🧩 The challenges:

- Reliance on fund administrators — many day-to-day checks happen at the admin, but the GP/AIFM remains ultimately responsible.

- Manual processes — wire confirmations and approvals are often tracked in emails or spreadsheets, leaving audit gaps.

- Wire instruction risk — fraud attempts often involve last-minute account changes, which require enhanced verification.

- Data fragmentation — incomplete or inconsistent investor records make matching transactions harder.

🔩 What you can do:

- Define clear policies that payments must come from, and be returned to, the investor’s verified account.

- Automate anomaly detection for unusual jurisdictions, sudden changes to payment instructions, or irregular contribution timing.

- Coordinate closely with administrators, ensuring they escalate any anomalies promptly and document reviews.

- Maintain an auditable case log for all exceptions, reviews, and escalations, so both internal audit and regulators see a clear trail.

- Test the process regularly with real-life scenarios (e.g., an investor requesting to fund from a third-party account) to ensure your escalation chain works.

4. How Should a SAR/STR Escalation Process Be Structured?

ℹ️ The gist:

SARs/STRs are rare in private markets, but regulators still expect firms to have a process. Triggers may include third-party wires, sanctions hits, or unexplained requests to change distribution instructions.

A documented framework should include:

- Defined escalation chain to the MLRO.

- Consistent documentation of suspicions and outcomes.

- Confidential handling to avoid tipping-off.

- Audit-ready records of reviews.

🧩 The challenges:

- Low frequency, high uncertainty: Staff may hesitate on whether a case meets the threshold for filing.

- Jurisdictional variation: Cayman, Luxembourg, the UK, and the U.S. all have different requirements.

- Limited resources: Smaller firms often lack experienced AML investigators, relying on administrators for first-line review.

- Reputational sensitivity: Mishandled escalations can strain investor relationships.

🔩 What you can do:

- Maintain a tiered escalation process, ensuring the MLRO makes the final decision.

- Use standardized templates and logs to record suspicions and outcomes, creating a defensible audit trail.

- Provide periodic training so staff understand private-markets-specific red flags (e.g., midstream wire changes, opaque trust structures).

- Review past cases annually to refine thresholds and improve consistency.

Even in private markets, firms must have a clear process for handling suspicious activity escalations.

5. How Should AML Training Programs Be Tailored for Different Teams?

ℹ️ The gist:

A recent study by Ocorian found that 73% of alternative fund managers reported rising AML risks over the past two years, and more than 70% have faced AML fines or sanctions during that time — underscoring the importance of well-trained staff. Regulators also require documented AML training, but the real challenge is tailoring content for IR, Operations, Deal Teams, and Compliance so each group understands the risks most relevant to them.

🧩 The challenges:

- Different needs across teams: Deal teams don’t need the same depth of training as compliance, but they still need to recognize reputational and counterparty risks.

- Low exposure to issues: Because red flags arise infrequently, staff may forget escalation steps over time.

- Multi-jurisdiction requirements: Cayman, Luxembourg, and UK regulators each set their own expectations for training scope and frequency.

🔩 What you can do:

- Use scenario-based learning that reflects real fund risks (e.g., third-party wires, opaque structures).

- Incorporate case studies to make training tangible rather than theoretical.

- Deliver short, regular refreshers instead of relying on one annual session.

- Maintain attendance logs and evidence of comprehension, which regulators will request during inspections.

6. How Should Firms Approach AML Record Keeping and Audit Trails?

ℹ️ The gist:

Recordkeeping and auditability are core to AML compliance. Regulators expect firms to provide complete documentation covering due diligence, capital flows, risk assessments, and approvals. The challenge is ensuring records are consistently stored, secure, and retrievable.

🧩 The challenges:

- Data fragmentation: Documents are often scattered across administrators, internal servers, and shared drives.

- Manual processes: Reliance on PDFs and email chains leads to version control issues.

- Regulator expectations: During inspections, managers are often asked to produce documents within days — or hours.

- Audit pressure: Weak organization undermines credibility with both investors and regulators.

🔩 What you can do:

- Centralize AML records in a structured repository accessible to compliance and operations.

- Establish naming conventions and templates for consistent filing across funds and teams.

- Enforce role-based access controls to protect sensitive data.

- Test retrieval under realistic timelines, simulating regulator or auditor requests.

- Conduct periodic quality reviews to confirm files are complete and consistent.

Strong recordkeeping and auditability are central to satisfying AML regulatory inspections.

7. How Can Firms Manage Multi-Jurisdictional AML Compliance Across Fund Domiciles?

ℹ️ The gist:

Private fund managers often operate across Cayman, Luxembourg, Delaware, Ireland, the U.K., and more. Each jurisdiction sets its own AML rules. The challenge is ensuring consistency without duplication.

🧩 The challenges:

- Conflicting obligations: Some domiciles require ongoing investor due diligence refreshes every 1–3 years, while others don’t.

- Divergent filing requirements: STR/SAR obligations exist in Cayman, Luxembourg, and the U.K., but differ in scope and thresholds.

- Training frequency variations: Some regulators expect annual refreshers; others allow more flexibility.

- Investor expectations: European LPs often demand higher standards than U.S. LPs, leading to tension over what the “baseline” should be.

- Operational inconsistency: Different teams, offices, or administrators may interpret local AML rules differently, creating compliance gaps.

🔩 What you can do:

- Map AML requirements across jurisdictions to identify overlaps and differences.

- Apply the “highest common standard” where feasible — simplifying operations and ensuring no jurisdiction is under-served.

- Centralize policies and procedures so all teams and administrators operate from the same playbook.

- Automate jurisdiction-specific workflows — e.g., refresh cycles, retention clocks, reporting thresholds — to reduce manual tracking.

- Engage local counsel periodically to stay aligned with regulatory changes in each domicile.

The Bottom Line: Raising the Bar on AML in Private Markets

AML compliance in private markets means navigating complex fund structures, cross-border capital flows, and diverse investor profiles – often under the oversight of multiple regulators. From onboarding and risk assessments to training, recordkeeping, and escalation, every part of the framework demands precision and efficiency.

In July 2025, FinCEN announced its intention to delay the effective date of its rule requiring private fund managers and advisers to implement AML programs, moving it from January 1, 2026 to January 1, 2028. While the timeline has shifted, the direction hasn’t: the rule will ultimately bring private market firms under Bank Secrecy Act oversight, with the SEC expected to take on examination authority once implementation begins. (Goodwin Law, 2024).

Manual processes, spreadsheets, and email trails can’t keep up with today’s expectations. Firms that succeed will be those that combine sound governance with tools that reduce friction, improve auditability, and free compliance teams for higher-value oversight.

Platforms like Blackbird are built with these needs in mind — automating workflows such as investor due diligence, sanctions/PEP screening, ongoing monitoring, and multi-jurisdictional recordkeeping. By centralizing and streamlining, firms can meet regulator expectations faster, with fewer errors, and without adding unnecessary headcount.

If you’d like to learn more about how Blackbird can support your compliance framework, we invite you to explore our product page or connect with our team for a demo.

About the Author

Linoy Doron is a Content Strategist at Blackbird, where she translates complex fintech and compliance topics into clear, actionable insights. With a strong background in technology, SaaS, and UX, she crafts narratives that connect product value to the real needs of asset managers in the private market.