Master AML and KYC Compliance with Expert Strategies

Last Revised: May 19, 2025Demystifying AML and KYC: What Successful Programs Share

AML and KYC processes might look like two separate checkpoints, but they work together as a single line of defense. Think of basic identity checks as a “skin” barrier that advances into deeper risk reviews to spot and stop threats. This overview shows how top firms shift from simple compliance to ongoing risk management.

Evolution Of Verification And Risk Management

Early stages concentrate on confirming basic personal details—name, address and government ID. A Customer Identification Program (CIP) makes sure institutions capture and verify these essentials.

As risks grew, teams added Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) to examine transaction patterns and higher-risk accounts. Continuous monitoring then keeps watch on every new activity.

This layered approach explains why a single method can’t address all threats.

Strategic Integration In Leading Organizations

Top performers weave compliance into everyday workflows instead of isolating it:

- Cross-Functional Collaboration: Risk, legal and operations teams share live dashboards

- Dynamic Risk Scoring: Scores update with new behaviors or rule changes

- Automated Workflows: Rule-based triggers send cases to reviewers without delay

- Continuous Training: Regular refreshers on emerging fraud tactics and red flags

These practices cut false positives by 40% and speed up onboarding by 25%.

Significant Investments In Compliance Technology

Building a strong program takes time and resources. By 2019, the financial sector’s global spend on AML-KYC technology and operations hit $32.1 billion, reflecting growing demand as regulations tighten and financial crime rises. Read the full research here

Debunking Persistent Misconceptions

Treating AML and KYC as a simple checklist creates blind spots:

- Conducting due diligence only once leaves ongoing risks undetected

- Rigid forms miss new methods like synthetic identity fraud

- Neglecting user experience pushes real customers toward less secure channels

Viewing compliance as a continuous, risk-based process turns potential weak points into strengths.

Key Takeaways

Successful AML and KYC programs share three hallmarks:

- A clear path from basic identity checks to in-depth risk reviews

- Seamless integration of compliance, operations and technology

- Ongoing investment in tools and staff training to stay ahead of threats

This approach makes AML and KYC a powerful asset for protecting your organization.

Navigating the Global AML and KYC Regulatory Maze

When compliance teams move from foundational AML and KYC tasks to global execution, they encounter a patchwork of evolving laws. In the United States, the Bank Secrecy Act (BSA) pairs with the PATRIOT Act, while in Europe, the 6th Anti-Money Laundering Directive (6AMLD) tightens cross-border rules. Organizations need flexible systems that can adapt to jurisdictional shifts and ensure continuous compliance.

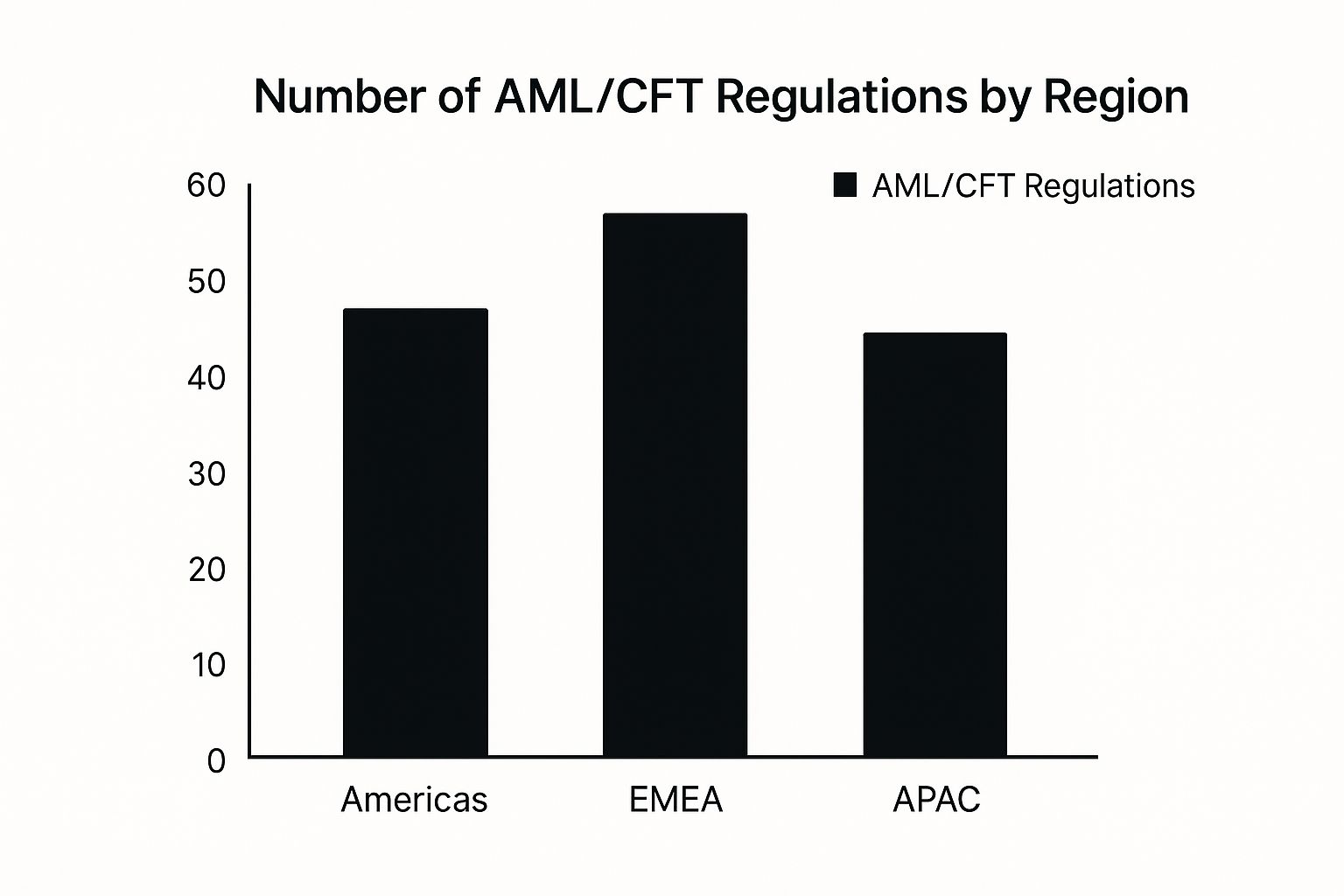

This data chart visualizes how different regions rolled out enhanced due diligence requirements between 2021 and 2024. It uses a bar chart to show regional adoption rates and enforcement trends.

From the chart, you can see that 85% of EU member states accelerated implementation in 2023, compared to 60% in North America. Penalties for non-compliance jumped by 30% on average, underlining the shift toward real-time monitoring over periodic audits.

Key Global AML And KYC Regulations

Below is a comparison of major regulatory frameworks across leading jurisdictions:

Main Takeaway: Regulatory timelines average 12–18 months, and fines often exceed €5M, so waiting until deadlines risks steep costs.

Practical Strategies For Adaptable Compliance

- Conduct quarterly gap analyses against new directives

- Automate sanction list updates with API integrations

- Implement modular policy frameworks for rapid rule changes

- Train cross-functional teams on emerging regional requirements

For financial firms seeking to automate compliance workflows, explore Blackbird, which streamlines data collection, document verification, and continuous monitoring. Continuous adaptation is the cornerstone of lasting compliance performance.

Building Bulletproof AML and KYC Programs That Actually Work

Effective AML (Anti-Money Laundering) and KYC (Know Your Customer) programs do more than satisfy regulators. They combine customer insights with tailored risk models and flexible policies. Top finance teams design due diligence workflows that cut down friction and target real threats.

The global AML market reached $2.92 billion in 2024 and is set to hit $3.39 billion in 2025 (CAGR 16%). By 2029, it may grow to $5.98 billion (CAGR 15.2%) as transaction monitoring and regulatory solutions advance. Read more about KYC and due diligence in AML compliance.

Implementing Efficient Customer Due Diligence

Customer due diligence forms the backbone of any compliance effort. It’s about balancing thorough checks with a smooth application flow.

Best practices include:

- Standardizing document collection with clear instructions

- Automating ID verification and politically exposed persons (PEP)/sanctions screening

- Segmenting customers by risk tier for proportionate reviews

- Integrating collaboration tools like Blackbird for real-time updates

- Scheduling periodic reviews based on customer activity

This setup lays the groundwork for accurate risk analysis.

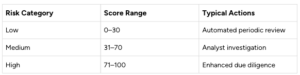

Risk Assessment Frameworks That Detect Genuine Threats

A solid risk assessment framework cuts through noise to flag high-impact cases. Risk teams should:

- Define risk factors such as geography, industry, and transaction patterns

- Assign weighted scores to each factor for dynamic profiling

- Implement scenario-based rules that trigger deeper investigation

- Track false-positive rates and adjust thresholds every quarter

This scoring model helps teams focus on emerging threats.

Adaptive Monitoring And Sustainable Policy Development

Policies must shift as criminals refine their tactics, but rigid protocols can slow operations. To stay current:

- Use modular policy templates for quick updates

- Monitor coverage gaps with analytics dashboards

- Record every policy change and maintain an audit trail

- Set automated alerts for expired documents or unusual patterns

By treating records as strategic assets, you meet regulatory needs without overloading your team and keep policies clear and up to date.

Technology Revolution in AML and KYC: Beyond the Buzzwords

As financial crime grows more complex, AI, machine learning, and blockchain are shifting from catchy terms to hands-on compliance tools. Automation can sift through thousands of transactions per minute, while distributed ledgers deliver tamper-proof audit trails.

This change allows teams to spend less time on manual checks and more on probing genuine threats.

Practical Impact of Advanced Tools

Organizations piloting these applications report:

- 30% improvement in screening accuracy

- Nearly 50% reduction in manual workload

- Real-time scoring for better case prioritization

- 40% faster onboarding by cutting average review time

Market Investment Trends

Investment in AML and KYC solutions is picking up steam. In 2023, global spending rose by 12.4% to $2.22 billion, marking a five-year CAGR of 22.0%. LexisNexis led with close to $800 million in revenue (around 36% of total spend), and the EMEA region posted 15.0% year-over-year growth.

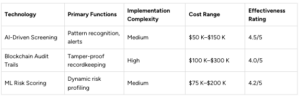

AML and KYC Technology Solutions Comparison

Below is a breakdown of leading technology solutions, their core functions, and trade-offs.

Analysis of different technology solutions for AML and KYC compliance

This comparison highlights differences in cost and complexity. AI-driven screening often hits a sweet spot between expense and performance, while blockchain solutions demand higher investment for robust audit logs.

Integrating New Systems and Measuring ROI

Successful adoption depends on smooth data flow and clear metrics. Consider:

- Mapping current workflows before implementation

- Automating data transfers via APIs

- Tracking false-positive rates and case resolution times

When you update AML/KYC programs, align your marketing assets with regulatory requirements. As shown in this guide on compliant content marketing, clear and consistent messaging preserves trust.

Emerging Trends To Watch

Compliance teams are exploring next-gen tools:

- Robotic Process Automation (RPA) for document verification

- Natural Language Processing (NLP) to interpret unstructured data

- Synthetic identity detection using biometric and behavior signals

- Decentralized identity frameworks for enhanced user control

Balancing new capabilities with risk controls is crucial. Match each tool’s strengths to your compliance goals to boost efficiency and oversight.

Implementing AML and KYC That Satisfies Both Regulators and Customers

Implementing AML and KYC doesn’t have to frustrate customers. When firms view compliance as a shared responsibility, every team member helps ensure security and service quality. This section outlines methods for risk-based checks, ongoing training, efficient onboarding, and feedback-driven improvement.

Risk-Based Customer Due Diligence In Action

Focusing on higher-risk profiles directs attention and resources where they matter most. For example, a mid-sized bank reduced its review workload by 30% after flagging only transactions over a set threshold or linked to high-risk regions. Best practices include:

- Segmenting customers into risk tiers based on geography, industry, and transaction patterns

- Automating sanctions and PEP list checks through real-time API screening

- Scheduling more frequent reviews for accounts labeled medium or high risk

This targeted approach maintains vigilance while cutting manual overhead, laying the groundwork for embedded compliance.

Cultivating a Compliance Culture Through Training

Clear guidelines and hands-on practice make compliance second nature. One asset manager saw employee confidence in spotting red flags double after introducing monthly workshops. Key training elements:

- Scenario simulations that match current fraud trends

- Role-playing for front-line staff and relationship managers

- Leadership briefings sharing compliance metrics and success stories

These sessions close knowledge gaps and foster a compliance mindset across the organization.

Frictionless Onboarding Without Compromising Security

Onboarding should balance speed with scrutiny. A fintech using Blackbird cut average verification time from five days to 24 hours and increased KYC coverage by 15%. Compare the workflows:

Automated document checks, guided form fields, and smart alerts let customers move forward without extra friction.

Avoiding Common Implementation Pitfalls

Even well-planned projects can hit hurdles if these areas are overlooked. These simple fixes help maintain momentum and results:

- Relying on one-off training—use regular refreshers to reinforce learning

- Overloading customers with long forms—implement adaptive questionnaires

- Skipping feedback loops—survey users to identify pain points early

Addressing these pitfalls keeps projects on schedule and protects both compliance and conversion rates.

Measuring Customer Impact And Continuous Improvement

Once compliance is in place, track its effect on the customer journey. Teams can spot trends and adjust processes quickly. Key metrics include:

- Onboarding Time: average days from application to approval

- False-Positive Rate: percentage of cleared customers flagged by mistake

- Customer Satisfaction (CSAT): post-onboarding survey scores

- Escalation Rate: share of accounts needing manual review

Regular dashboard reviews and cross-team retrospectives create a continuous feedback cycle, turning compliance into an ongoing advantage.

Measuring What Matters: Performance Metrics for AML and KYC Success

Compliance is more than ticking boxes; it’s about showing that your AML and KYC programs actually work. Tracking metrics like time-to-clearance and false-positive rates gives teams clear visibility into process efficiency. Spotting bottlenecks early means you can fix them before regulators or customers raise concerns. Below are the core indicators every compliance operation should track.

Core AML And KYC KPIs

- Onboarding Time: Average days from application to account approval

- SAR Reporting Lag: Hours between a trigger event and Suspicious Activity Report filing

- False-Positive Rate: Percentage of flagged alerts that require no further action

- Case Resolution Volume: Investigations closed per analyst each month

- Coverage Ratio: Share of high-risk customers under ongoing monitoring

Key Insight: Top teams report SARs in under 24 hours and keep false-positive rates below 20%.

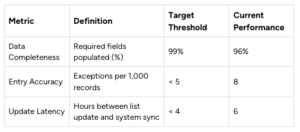

Data Quality Management Framework

Accurate metrics start with high-quality data. Establish a governance model that tracks:

- Completeness: Percentage of customer profiles with all required fields

- Accuracy: Rate of data-entry errors found during audits

- Timeliness: Frequency of sanction-list and PEP-list updates

This table highlights where data gaps can skew KPI reporting and risk scoring.

Governance And Accountability

Link each metric to an owner and a follow-up process:

- Regular policy reviews signed off by the compliance director

- Quarterly internal audits to catch gaps early

- 90% of audit findings resolved within 30 days

- Mandatory training completion tracked by department

When teams own their targets, error rates drop and you’re ready for external exams.

Executive Dashboards And Stakeholder Reporting

Build dashboards tailored to each audience:

Use clear visuals—trend lines, heat maps—to highlight areas needing action.

Measuring these dimensions turns your AML and KYC program into a strategic asset instead of a compliance cost. To automate KPI tracking, generate real-time dashboards, and reduce manual effort, try Blackbird for seamless compliance workflows. Start today at blackbrd.co.