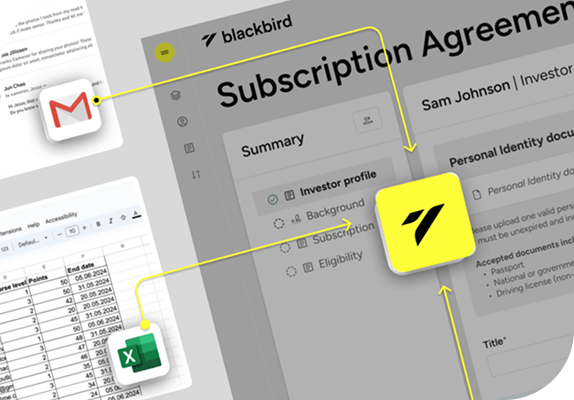

End-to-end automation with intelligent field mapping

Automatically extracts, validates, and organizes investor data, reducing manual input and ensuring accuracy across compliance workflows.

Seamless integration with your CRM and core systems

Syncs with your existing CRM, document management, and fund administration platforms for a streamlined workflow.

Granular audit trail and real-time status tracking

Captures every interaction at the question level, providing full transparency, version history, and audit readiness for regulatory compliance.

Built-in screening and live compliance reporting

Instantly runs investor data through integrated AML/KYC screening tools and generates up-to-date reports to flag risks and maintain compliance.

Ready to Streamline KYC

Compliance for Your Fund?

Enterprise-level security

Partner with Blackbird to streamline your compliance processes, enhance operational efficiency, and deliver exceptional value to your clients.