Ultimate Beneficial Ownership: Fundamentals & Global Landscape

Last Revised: February 12, 2026TD;LR

Let’s discuss ultimate beneficial ownership: for private market asset managers, identifying the individuals who ultimately control an investor or portfolio entity is a core KYC and AML requirement. Regulators increasingly expect firms to evidence not only who the UBO is but also how that conclusion was reached. This post provides a clear overview of UBO fundamentals and the global transparency landscape shaping these obligations.

Ultimate beneficial ownership: for private market firms, UBO identification is becoming increasingly complex.

What Does UBO Mean and Why is It Important?

An Ultimate Beneficial Owner (UBO) is the natural person who ultimately owns or controls a legal entity. This control can happen directly or through complex structures like trusts or nominee arrangements.

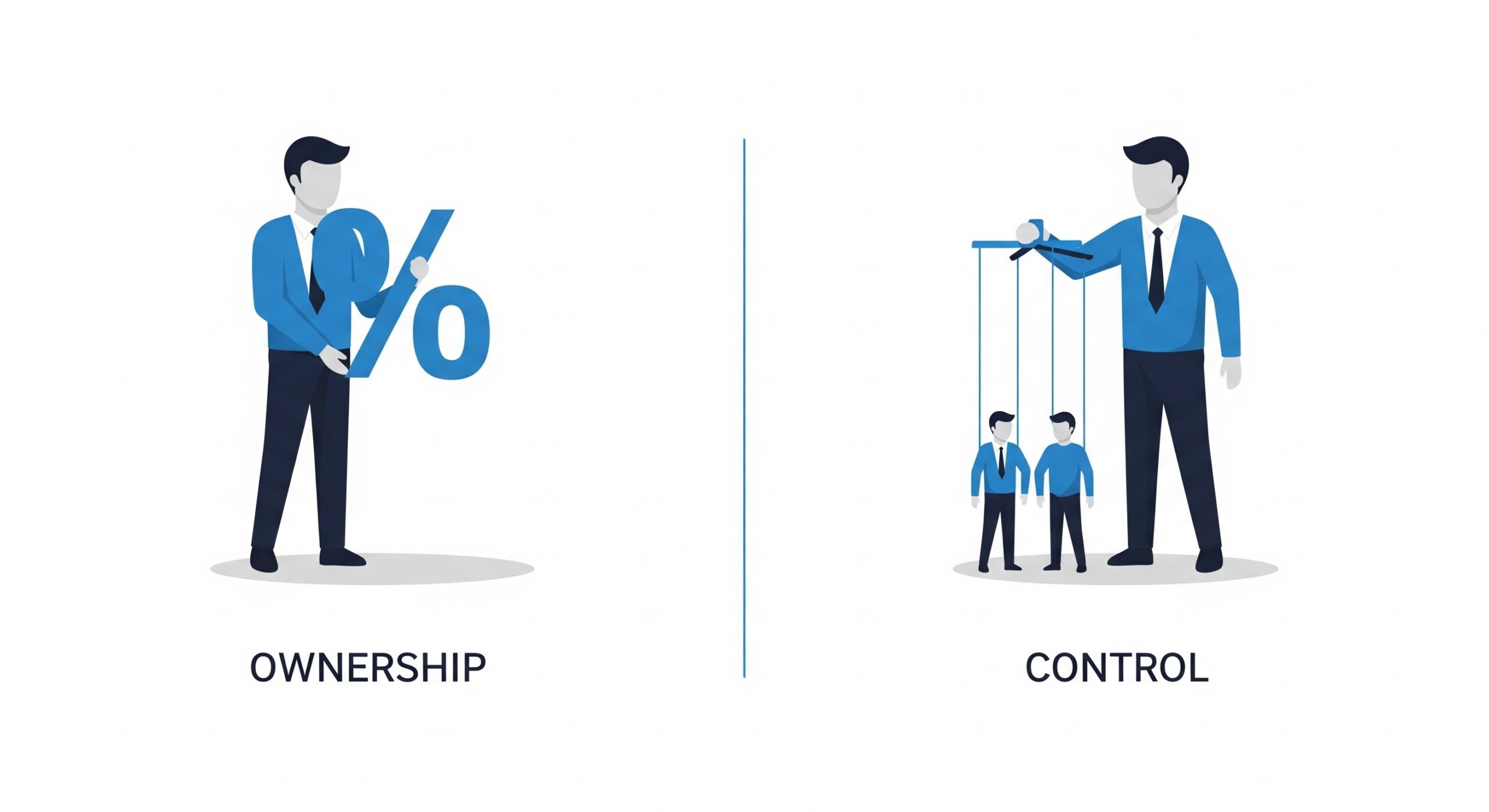

UBO identification typically rests on two concepts:

1. Ownership

A natural person holding a meaningful percentage of ownership interests. Many jurisdictions follow FATF’s 25% threshold as an initial indicator of significant ownership, though some apply lower thresholds or additional criteria for high-risk or complex entities.

2. Control

A natural person who exercises effective control regardless of shareholding. This may include individuals able to appoint or remove directors, exercise veto or supermajority rights, or influence decisions through shareholder agreements or trust powers.

This distinction between legal ownership and actual control is critical. In private markets, investor structures frequently involve SPVs, trusts, and offshore vehicles, so tracing control is often more informative than reviewing share registers alone.

When it comes to UBO identification, the distinction between legal ownership and actual control is critical.

Why Ultimate Beneficial Ownership Identification Matters

In private equity, venture capital, and hedge funds, UBO identification is essential for forming an accurate picture of who sits behind an investor entity. Institutional LPs often subscribe through multi-layered, cross-border vehicles administered by third parties, meaning initial documents rarely reveal the full structure. Clear UBO visibility helps firms identify risks that are not obvious at the entity level, such as political exposure, sanctions concerns, or control rights held by individuals who are not legal owners.

A credible UBO assessment also supports defensible onboarding decisions. Without it, teams cannot justify risk ratings, determine when enhanced due diligence is required, or explain escalation decisions during regulatory reviews. Supervisors increasingly expect firms to demonstrate how they mapped ownership, what evidence they relied on, and how they resolved ambiguity in complex structures.

UBO Meaning in the United States

Understanding UBO under the Corporate Transparency Act (CTA)

In the United States, the concept of the Ultimate Beneficial Owner (UBO) is primarily governed by the Financial Crimes Enforcement Network (FinCEN). While global standards vary, US compliance focuses on identifying individuals who exercise substantial control over a reporting company or own/control at least 25% of its ownership interests.

Key Criteria for US UBO Identification:

- Substantial Control: This includes senior officers (CEO, CFO, GC), individuals with authority over the appointment or removal of officers/directors, or key decision-makers regarding the entity’s finances and structure.

- The 25% Threshold: Any individual who, directly or indirectly, owns or controls 25% or more of the “ownership interests” of the entity.

- The “Look-Through” Approach: For complex private market structures — such as multi-layered PE funds or SPVs — firms must “look through” intermediate legal entities to identify the natural persons at the top of the chain.

FATF Standards and Their Influence

The Financial Action Task Force (FATF) sets the leading international standards for beneficial ownership transparency. While FATF recommendations are not binding, they shape national AML frameworks across major financial centers.

Key expectations include identifying and verifying beneficial owners, ensuring information is accurate and current, and applying enhanced due diligence to higher-risk customers. The familiar 25% ownership threshold is intended as a starting point — not a limit. FATF expects firms to look past simple percentages when structures, jurisdictions, or governance arrangements indicate hidden control.

Within the European Union, the new Anti-Money Laundering Authority (AMLA) will reinforce consistent supervision under the EU’s strengthened AML package. AMLA’s mandate is regional, operating within the broader FATF framework, but EU-based firms should expect more harmonized expectations around UBO data quality and verification.

The FATF sets the leading international standards for beneficial ownership transparency.

The Global UBO Transparency Landscape

UBO transparency rules vary significantly across jurisdictions. The European Union, United Kingdom, United States, and major financial hubs such as Singapore and the Cayman Islands all maintain beneficial ownership frameworks. However, accessibility, verification standards, and disclosure obligations differ widely. According to Kyckr, as of 2025, only one-third of EU member states maintain fully public access to their UBO registers, and open access to FinCEN UBO reporting has been severely restricted.

For private market firms onboarding cross-border investors, this lack of uniformity means UBO data often arrives in inconsistent formats and with varying levels of reliability. Independent verification remains essential, regardless of registry availability.

Why UBO Identification Is Getting Harder

The push for transparency is colliding with increasingly complex ownership structures. Compliance teams now encounter long chains of holding companies, trusts and foundations, nominee arrangements, and sovereign wealth or state-linked institutions with their own disclosure regimes. Each layer can obscure the natural person behind the entity.

As a result, UBO identification has evolved from a simple form-collection task into a structured investigative process. Teams must trace ownership through multiple layers, review control rights in governance documents, verify information across several registries, and reconcile conflicting or incomplete documentation. Cases with unclear information or limited cooperation require escalation. Manual processes struggle under this workload, particularly for managers handling large, diverse investor populations.

Compliance teams now face long ownership and control chains, with each layer obscuring the natural person behind the entity.

Verification Expectations Are Rising

Regulators now place increasing emphasis on verification, not just collection. A defensible approach documents how ownership was traced, defines evidence requirements for each entity type, integrates sanctions and PEP screening at the UBO level, and sets clear escalation paths for complex or higher-risk structures. It also specifies refresh cycles consistent with the entity’s risk rating. And penalties are getting harsher, too: according to Coredo, failure to update UBO data or verify ownership can now result in penalties of up to 10% of company annual turnover and automatic removal from commercial registers in the EU.

This shift directly affects audit readiness. Supervisors expect firms to show how they reached their conclusion, what sources they relied on, and how exceptions or ambiguities were resolved.

AI-driven platforms like Blackbird support this shift by centralizing investor documents, extracting ownership data, and orchestrating risk-based verification workflows. This reduces manual work and ensures consistency across jurisdictions and entity types.

The Bottom Line

UBO identification is central to risk assessment and regulatory compliance in private markets. As global transparency rules evolve and investor structures grow more complex, firms need clear frameworks and scalable verification processes to maintain control and audit readiness.

What are the practical challenges of identifying UBOs in complex structures, and how can compliance teams systematically break them down? To learn, check out the next article in this series: Breaking Down UBO Complexity: A Practical Guide for Compliance Teams.

Why Blackbird?

Blackbird offers an AI-first solution built for private market firms — streamlining KYC, AML, and Due Diligence in one platform. Our automation engine handles complex ownership structures, extracts UBO data from investor documents, and orchestrates risk-based verification workflows, enabling faster onboarding and stronger compliance without adding headcount.

Want to see it in action? Book a demo with our team.

For more insights (or fun KYC memes), follow us on LinkedIn.

About the Author

Linoy Doron is a Content Strategist at Blackbird, where she translates complex fintech and compliance topics into clear, actionable insights. With a strong background in technology, SaaS, and UX, she crafts narratives that connect product value to the real needs of asset managers in the private market.