Breaking Down UBO Complexity: A Practical Guide for Compliance Teams

Published: November 25, 2025TD;LR

UBO (Ultimate Beneficial Owner) identification is hardest when investor structures are multi-layered, cross-border, or opaque. This post outlines the key challenges and what compliance teams should do to tackle them.

After we’ve covered UBO fundamentals and the global transparency landscape, it’s time to break down the nuanced complexity of UBO identification.

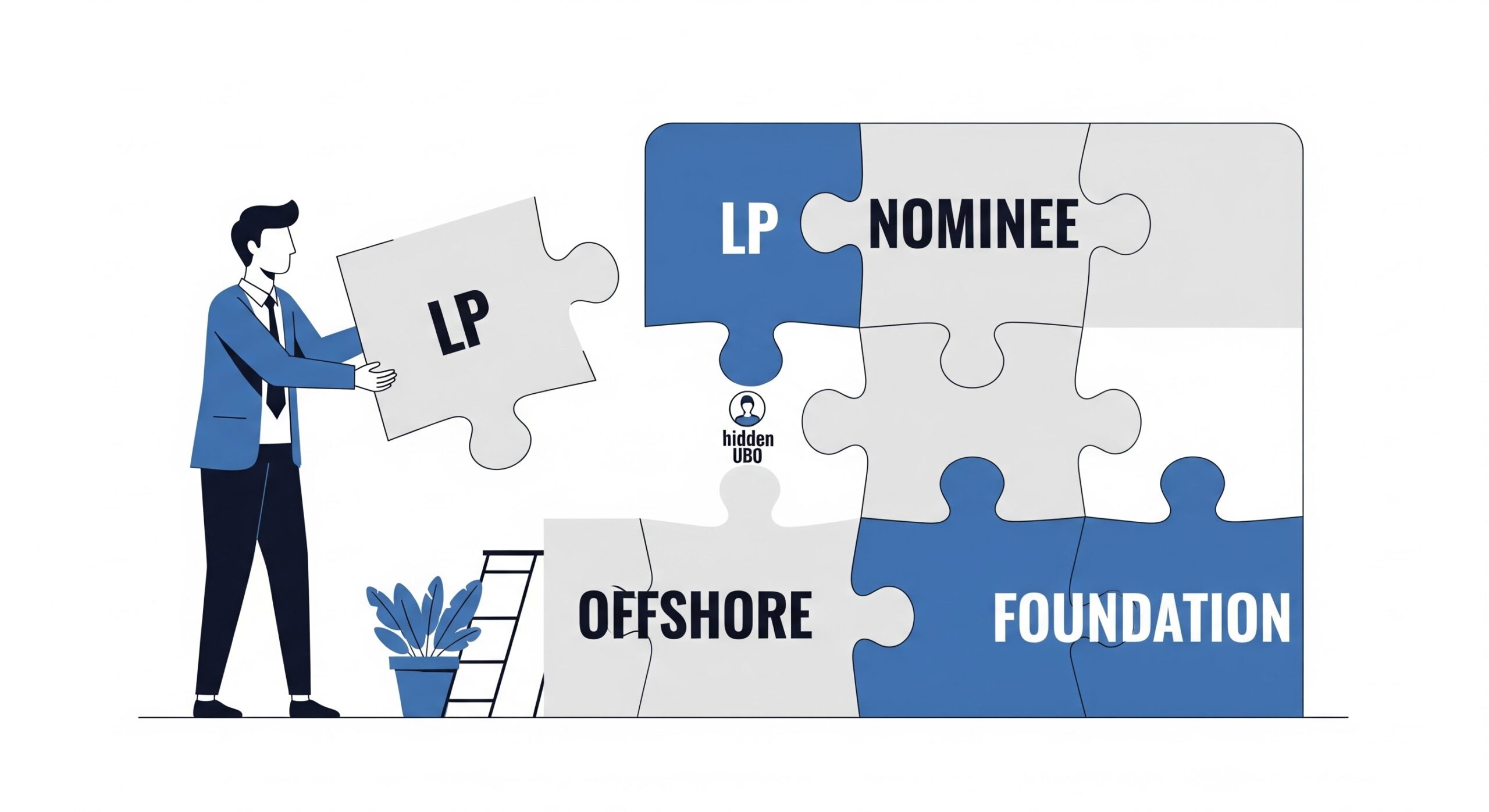

Identifying UBOs gets a lot more complex when private equity, venture capital, and hedge fund managers onboard institutional LPs. The main reason: these LPs invest through multi-layered, cross-border vehicles. Offshore entities, trusts, foundations, nominee arrangements, and sovereign-linked institutions can obscure the natural persons behind them. IOSCO reports that the global fund universe has nearly 100,000 vehicles, and these hold over USD 54.5 trillion in assets. This highlights how compliance teams face complex structures at such a large scale.

This post focuses on the practical challenges compliance teams encounter — and what compliance teams should do to address them.

Offshore entities, trusts, foundations, nominee arrangements, and sovereign-linked institutions can obscure the natural persons behind them.

1. Layered or Concealed Ownership Structures

Many investment vehicles use multi-jurisdictional chains, nominee directors, or trust arrangements. These methods create several layers of separation between the investing entity and the person in control. According to Harneys, the Cayman Islands alone hosts over 70% of the world’s offshore fund vehicles. This shows how often private-market managers face cross-border structures that make ownership tracing tricky. These layers can be intentional, but they still obscure who ultimately controls the entity.

What compliance teams should do: Approach these structures systematically rather than reactively. A steady tracing method helps compliance teams track each entity. It also prioritizes jurisdictions that are known for low transparency. Foundational documents, such as shareholder registers, certificates of incumbency, and trust deeds should be treated as the primary evidence. Compliance teams shouldn’t rely on ownership charts or summary letters from investors or administrators. They must check these against the actual documents.

Teams that manually extract data from dozens of documents often face accuracy issues. That’s why many firms now use automation: it helps them pull out names, percentages, and control indicators from documents quickly and accurately.

2. Red Flags Signaling Possible Concealment

Certain patterns frequently indicate that a structure may be designed to obscure beneficial ownership. These include complex entities with no clear business purpose, as well as the repeated use of nominee directors in unrelated companies. Additionally, there can be incomplete or heavily redacted documents, and inconsistencies between the information investors provide and what appears in corporate registries.

What compliance teams should do: Escalate cases where red flags materially impact the ability to confirm the natural person behind the entity. This typically involves requesting missing documents, seeking clarification from the investor or their service provider, or verifying details independently through available registries. Maintaining internal notes is essential. Documenting observed red flags, and how they were addressed, forms the audit trail regulators expect when reviewing cases that required additional scrutiny.

Compliance teams should escalate cases where red flags materially impact the ability to confirm the natural person behind the entity.

3. Trusts, Sovereign Wealth Funds, and Other Complex Scenarios

Trusts, foundations, sovereign wealth funds (SWFs), and state-linked entities require different handling compared to standard holding companies. Discretionary trusts, for example, may not have fixed beneficiaries, and trustees or protectors may hold meaningful control. Foundations may have beneficiaries who are not visible through typical company documentation. SWFs and government-affiliated entities often have unique governance structures or statutory exemptions. These can impact what information they disclose.

What compliance teams should do: Apply risk-based depth when reviewing these structures. For trusts, this may include requesting the trust deed, understanding the role of any protector, and identifying individuals with control powers rather than relying on shareholding. For sovereign wealth funds and other state-linked entities, teams may need to assess political exposure and governance oversight. They also need to decide if a full look-through to natural persons is necessary. In many cases, these entities are subject to statutory or regulatory oversight, meaning firms can apply a different verification approach — focusing on governance controls and institutional due diligence rather than tracing individual UBOs.

4. Cross-Border Verification Limits

Cross-border structures introduce practical obstacles that slow UBO identification. Registry access varies widely: some jurisdictions offer fully searchable public databases, others provide limited extracts, and some require paid agents or local intermediaries. Documents often arrive in different formats or languages, with varying levels of formality and reliability. Jurisdictional definitions of “beneficial owner” may also conflict with a firm’s internal standard.

What compliance teams should do: Maintain a single internal definition of UBO and apply it consistently across all investors. Maintaining a list of high-friction jurisdictions helps teams know when enhanced scrutiny or additional documentation will be needed. Centralizing document storage and verification notes stops teams in different offices from doing the same work. It also lowers the risk of inconsistent conclusions. Technology that standardizes formats, extracts key ownership data, and logs verification steps can further reduce friction and improve auditability.

Some jurisdictions offer open public registries, others provide limited extracts, and some require paid agents or local intermediaries.

5. Non-Cooperative or Slow-Responding Entities

Some investors delay sending the needed documents, or provide incomplete or heavily redacted materials. Others shift the responsibility of verification to their administrators. Corporate service providers may take weeks to respond, especially when multiple upstream entities are involved.

What compliance teams should do: Rely on predefined escalation paths rather than ad-hoc negotiations. These frameworks typically outline what should be requested first, when to escalate internally, when to involve the MLRO or senior compliance, and when to pause or decline onboarding altogether. Setting clear documentation requirements upfront helps manage expectations and reduces back-and-forth. For cases where teams proceed without full clarity, a clear justification — explaining what was missing, what was attempted, and why the risk was accepted — is essential for audit readiness.

The Bottom Line: UBO Challenges Are on the Rise, But Structure and Technology Are Here to Help

Identifying UBOs gets tough when private market structures are complex, layered, and cross-border. Almost half of institutional LPs plan to boost their investment in alternative assets (SS&C Intralinks LP Survey, 2024). So, the number of complicated ownership structures needing UBO tracing will likely increase. By applying structured workflows, risk-based depth, and disciplined escalation practices, compliance teams can navigate the opacity that comes with institutional LPs and offshore vehicles. Technology plays an increasingly important role in reducing manual effort and ensuring consistency across teams and jurisdictions.

The third and final post in the UBO series (final for now, that is) will explore how firms can use technology to build scalable, defensible UBO processes; and how automation is reshaping the operational model for investor onboarding.

About Blackbird

Blackbird offers an AI-first solution tailored to private market firms — covering KYC, AML, and Due Diligence in one seamless platform. Our built-in automation accelerates ownership tracing, UBO verification, and broader onboarding workflows, without the added headcount.

Want to see it in action? Book a demo with our team.

For more insights (or fun KYC memes), follow us on LinkedIn.

About the Author

Linoy Doron is a Content Strategist at Blackbird, where she translates complex fintech and compliance topics into clear, actionable insights. With a strong background in technology, SaaS, and UX, she crafts narratives that connect product value to the real needs of asset managers in the private market.